Author: Mark

Online seminar 13.12.2024: Doing Business in Russia – Practical Experience in New Circumstances

PROGRAM

Detailed reviews and Q&A session with experienced experts on the following topics

1. Doing business in Russia

Legal, tax, HR and migration issues. Basics.

2. Overview on bank transaction with Russia

SWIFT, currency exchange and other.

3. Practical experience of foreign companies in Russia

FAQ in the regular business processes.

Account of a Russian LLC abroad

In the context of ongoing difficulties with international payments, many companies have found it necessary to open an account in a foreign bank.

However, it is important to remember that opening a bank account in another jurisdiction imposes a number of additional obligations on the company, including the submission of necessary reports and notifications.

In our review, we will look at how not to violate the law in this situation and how to avoid penalties.

Let’s take a step-by-step look at what a company has to do to comply correctly with all requirements.

1. Notify the Federal Tax Service of Russia.

It is necessary to notify the Federal Tax Service in the following cases:

- opening a bank account outside the Russian Federation;

- closing such an account;

- changing the account details.

All Russian organizations are required to submit the corresponding notification. (Part 2, Part 8 of Art. 12 of the Law No. 173-FZ). The notification should be sent to the tax authority at the location of the organization in the form approved by the Order of the Federal Tax Service of Russia dated 26.04.2024 N SD-7-14/349@, within one month from the date of opening (closing) an account or changing the details, respectively (Part 2 of Art. 12 of the Currency Control Law).

Two forms have been approved: one is for opening and closing an account (Appendix N1), the other is for changing the details of this account (Appendix N2).

The notification can be submitted to the tax authority on paper (in person, through a representative, by registered mail) or in electronic form via telecommunication channels (TCC) or through the taxpayer’s personal account (PA).

When making the first transfer to a bank account abroad, the organization needs to provide the Russian bank with a notification on opening this account with a tax inspector’s note on its acceptance (Part 4 of Art. 12 of the Currency Control Law).

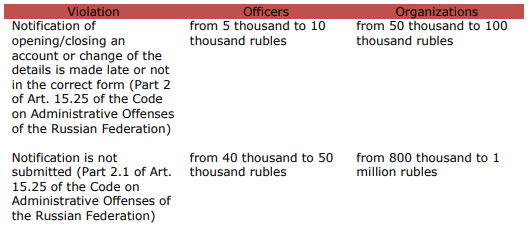

Failure to submit a notification about account or violation of the terms or procedure for submitting it may result in a penalty being imposed on the organization.

Their amounts are established in the Art. 15.25 of the Code on Administrative Offenses of the Russian Federation.

2. Report to the Federal Tax Service on flow of funds.

If a legal entity (resident of the Russian Federation) has foreign accounts, it has to submit a cash flow statement to the tax authority quarterly within 30 days after the end of the reporting quarter, attaching supporting documents: statements or other documents issued by the bank (Decree of the Government of the Russian Federation dated 28.12.2005 N 819 (as amended on 22.05.2024)).

If the documents are drawn up in a foreign language, the organization has to attach a translation into Russian, duly certified in accordance with the legislation of the Russian Federation (cl. 7 of the Rules for the Submission of Reports by Residents – Legal Entities).

The translation can be carried out by an employee of an organization or an organization engaged in translation activities, since the methods of translation are not limited by the law.

If necessary, at the request of the tax authorities, translation into Russian, notarized in accordance with the requirements of the legislation of the Russian Federation, shall be provided.

3. Comply with the currency legislation, in particular, carry out only legal currency transactions.

Contracts with non-residents, the amount of obligations for which exceeds the established threshold, namely, import contracts from 3 million rubles and export contracts from 10 million rubles, must be registered by an authorized bank of the Russian Federation.

The bank will assign a unique number to the contract (cl. 4.2, 5.5 of the Bank of Russia Instruction dated 16.08.2017 N 181-I (as amended on 09.01.2024).

When crediting export proceeds to an account abroad, it is necessary to provide to the authorized bank a certificate of currency transactions for settlements through an account abroad under accounting contracts, as well as provide a bank statement.

The term for providing a certificate of currency transactions for settlements through an account abroad is within 30 working days after the last day of the month in which such transactions were carried out.

4. Is it necessary to repatriate currency?

At present, the obligation to repatriate currency has only been retained for some companies.

From 16.10.2023 to 30.04.2025 inclusive, certain Russian exporters specified in the List approved by the Decree of the President of the Russian Federation dated 11.10.2023 No. 771, are required to credit to their accounts in authorized banks and sell proceeds in foreign currency on the domestic currency market of the Russian Federation within the established period and in the established amounts (cl. 1, 5 of the Decree of the Government of the Russian Federation dated 12.10.2023 No. 1681 “On measures for the implementation of the Decree of the President of the Russian Federation dated October 11, 2023 No. 771”).

The closed list consists of 43 groups of companies belonging to the sectors of the fuel and energy complex, ferrous and non-ferrous metallurgy, chemical and forestry industries, and grain farming. Exporters are notified of their inclusion in the list within 3 days by the Ministry of Economic Development of Russia.

For companies that are not on the closed list, the amount of foreign currency earnings subject to mandatory sale is currently 0%.

Therefore, if the organization is subject to the cancellation of repatriation, the terms for transferring export proceeds from the organization’s account opened abroad to a Russian bank are not established by regulation, i.e. such funds may remain on account abroad and these funds can be used, for example, for settlement of import or other contracts.

Contacts:

Natalia Safiulina

Nadezhda Kolomnikova

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025

Dear colleagues, Please accept our sincere congratulations on the upcoming New Year and Christmas!

Changes in regulating transactions with persons from unfriendly countries

At this moment, for companies with Western participation, coordination of transactions with the subcommittee of the Government Commission for Control of Foreign Investments in the Russian Federation remains of great relevance. The subcommittee has the right to make decisions on the issuance by the Government Commission of permits for residents of the Russian Federation to carry out transactions with foreign persons from unfriendly countries, as well as currency transactions.

We would like to remind you that unfriendly countries, in accordance with the order of the Government of the Russian Federation dated 05.03.2022 No. 430-р, include, among others, Australia, Great Britain, Canada, the Republic of Korea, the USA, Ukraine, Switzerland, Japan and all member states of the European Union.

In particular, in the Decree of the President of the Russian Federation dated 08.09.2022 No. 618 restrictions were established for the execution of transactions that directly and/or indirectly entail the establishment, change or termination of the rights of ownership, use and/or disposal of shares in the authorized capital of limited liability companies or other rights that make it possible to determine the conditions for management of such companies. First of all, these are transactions for disposal of shares in the authorized capital of limited liability companies, which have become relevant due to the desire of a number of Western companies to temporarily or permanently leave the Russian market due to the political situation.

Such transactions can only be carried out on the basis of permits issued by the Government Commission for Control of Foreign Investments in the Russian Federation, which, if necessary, contain the conditions for carrying out these transactions. The procedure and criteria for issuing permits are constantly updated with a tendency to become stricter, which is aimed at complicating the exit of Western businesses from the Russian market and maintaining their presence in the Russian Federation.

In addition to the requirements for documents that must be drawn up and submitted for approval, from the end of 2022, in order to alienate the share of an “unfriendly” participant of a limited liability company, it is necessary to pay a voluntary contribution to the budget of the Russian Federation (see our previous review on changes in this area), as well as to carry out the transaction with a mandatory discount.

At the end of October 2024, the Ministry of Finance of Russia published an updated regulation (Extract from the minutes of the meeting of the subcommittee of the Government Commission for Control of Foreign Investments in the Russian Federation dated 15.10.2024 No. 268/1). The new procedure includes the following:

- The amount of the voluntary contribution to be paid to the budget when Russian companies are disposed of by “unfriendly” participants has increased. Now it is 35% of the market value of the asset based on the results of its independent assessment (previously it was necessary to pay 15%).

An installment plan was introduced for payment of the contribution. 25% of the asset value must now be transferred to the Russian Federation budget within a month from the date of the transaction, 5% within a year, and another 5% within two years from that date. - In addition, the size of the mandatory discount to the market value of the asset upon alienation of an LLC has been changed. Now it must be a minimum of 60%, whereas previously the company could be sold for 50% of its market value.

Also, if the market value of the alienated assets is more than 50 billion rubles, the consent of the President of the Russian Federation will be required to complete the transaction.

The new conditions should apply both to future applications for approval of transactions, and to those already submitted, but not considered by the Government Commission.

Other news includes amendments to the Decree of the President of the Russian Federation dated 04.05.2022 No. 254 regarding the payment of profit of Russian resident companies to their foreign participants.

Let us remind you that in order to pay “unfriendly” participants profit in an amount exceeding 10 million rubles per calendar month or the equivalent of this amount in foreign currency, it is necessary to follow the procedure established by the Decree of the President of the Russian Federation dated 05.03.2022 No. 95. This procedure involves opening a special account of type “C” in a Russian credit institution in the name of a foreign creditor, through which the corresponding settlements are made. At the same time, the Ministry of Finance of the Russian Federation was given the authority to determine a different procedure for payment of residents’ profits to foreign creditors, which meant the need to obtain permissions from the Ministry of Finance for this procedure.

From 09.09.2024, the authority to issue permits for the payment of dividends by Russian companies to persons from unfriendly countries was granted to the Government Commission for Control of Foreign Investments in the Russian Federation. Such permits may contain conditions for the payment of profits.

The Government of the Russian Federation will additionally develop and approve the procedure for issuing such permits by the Government Commission. After the adoption of the changes, the procedure and terms for approving the payment of dividends may become milder.

We will keep you updated on the news of the relevant regulation, and are also ready to provide legal support when interacting with authorized bodies on issues of approving transactions and paying dividends to “unfriendly” foreign persons.

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025

Dear colleagues, Please accept our sincere congratulations on the upcoming New Year and Christmas!

Federal accounting standard FSBU 4/2023 “accounting (financial) statements

The new Federal Accounting Standard FSBU 4/2023 “Accounting (Financial) Statements” is mandatory for use starting with the accounting statements for 2025 in all commercial organizations in the real sector.

The standard regulates the composition and content of information, the composition of appendices to the balance sheet and the statement of financial results, the composition of appendices to the balance sheet and the statement on the proper use of funds, the composition of interim financial statements, sample forms of financial statements and the conditions for the reliability of financial statements.

The composition of the annual and interim financial statements in accordance with the cl. 5 and 6 of FSBU 4/2023 of a commercial organization includes a balance sheet, a statement of financial results and appendices thereto. The appendices to the balance sheet and the statement of financial results consist of a statement of changes in equity, a statement of cash flows, and notes to the balance sheet and the statement of financial results.

Balance sheet

An idea of the financial position of an economic entity as of the reporting date is provided by the disclosure in the balance sheet of at least the following indicators: intangible assets; fixed assets; investment property; deferred tax assets; financial investments; inventory; long-term assets for sale; value-added tax on acquired assets; accounts receivable; cash and cash equivalents; equity (for commercial organizations)/targeted financing (for non-profit organizations); borrowed funds; accounts payable; deferred tax liabilities; provisions (cl. 9 of the FSBU 4/2023).

In addition to the indicators given in the cl. 9 of the Standard, other indicators may be disclosed considering materiality (for example, indicators of goodwill; intangible exploration assets; tangible exploration assets; capital investments in intangible asset objects; capital investments in non-current assets; rights to use the assets investment in a lease; underbillings; lease liabilities (cl. 10 of the FSBU 4/2023).

Statement of financial results

The statement of financial results should give an idea of the financial results of the activities of an economic entity for the reporting period. The statement of financial results discloses information about all income and expenses of an economic entity (cl. 25 of the FSBU 4/2023).

One of the main changes in the statement of financial results is the indicator of profit (loss) from discontinued operations (less the related corporate income tax). It is disclosed separately from profit (loss) from continuing operations before taxation.

Cl. 28 of FSBU 4/2023 determines the procedure for offset between indicators of other income and other expenses. An offset between these indicators is made if they are related to one (for example, the result from the disposal of non-current assets, the result from the disposal of a capital investment object) or several similar facts of economic life (in particular, exchange rate differences, the result of revaluation of non-current assets included in the income or expenses of the reporting period, the result of impairment of non-current assets and recovery of impairment included in the expenses or income of the reporting period). An exception is when the separate presentation of such income and expenses can affect the decisions of users of financial statements or such presentation is provided for by other standards.

Clause 29 of FSBU 4/2023 contains a list of income and (or) expenses that, taking into account materiality, are disclosed in the statement of financial results or notes. This list includes indicators of income and (or) expenses for the reporting period related to the impairment of inventories and reversal of impairment, impairment of non-current assets and reversal of impairment, revaluation and disposal of non-current assets, settlement of litigation and write-off of provisions.

According to the cl. 30 of FSBU 4/2023, the notes disclose information on the composition of expenses for ordinary activities recognized in the statement of financial results (taking into account changes in the balances of work in progress and finished goods). The information is presented in the context of the relevant elements.

Statement of changes in equity

The sample report presents the result of changes in equity for the reporting period, and not separately the increase and decrease in capital, as in the form.

All changes are reflected in one table, including information on the impact on each component of equity of adjustments to the reflection of the consequences of changes in accounting policies and the correction of significant errors in accounting.

The accumulated revaluation of non-current assets is allocated as an independent component of capital.

Statement of cash flows

In the sample report, a separate line singles out cash flow receipts from current operations in the form of interest on accounts receivable from customers. Apart from that, the composition of the information in the sample corresponds to the composition of the information in the form of the cash flow statement, approved by the Order of the Ministry of Finance of Russia dated 02.07.2010 No. 66n.

Notes

The notes disclose information that is necessary for users of financial statements to make economic decisions, but is not disclosed in the balance sheet, statement of financial results, statement on the planned use of funds, statement of changes in equity, or statement of cash flows (cl. 40 of the FSBU 4/2023).

Cl. 46 of FSBU 4/2023 specifies the list of information disclosed in the Notes.

We will be happy to answer your questions regarding FSBU 4/2023.

Contacts:

Eugenia Chernova

Olga Kireyeva

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025

Dear colleagues, Please accept our sincere congratulations on the upcoming New Year and Christmas!

Changes in corporate legislation from 01.09.2024

We hereby inform you that Federal Law No. 287-FZ of August 08, 2024 introduced a number of important changes affecting both limited liability companies (OOO) and joint-stock companies (AO). The changes come into effect at different times. In this message, we would like to talk about changes in relation to OOO that will be in effect from September 01, 2024.

From this date, the resolution on the election (appointment) of the sole executive body of the OOO – for example, the general director – will need to be necessarily certified by a notary. Also, when registering such changes in the Unified State Register of Legal Entities, a notary will be the applicant.

Thus, the procedure for changing the general director in an OOO has been significantly changed. Previously, participants could make such a resolution without a notary (if an alternative procedure was stipulated in the articles of association), and then the new director would sign the application for registration himself. Now the participants or their representatives will be required to be present at the Russian notary to make a resolution (with the issuance of the appropriate certificate), after which the notary will sign an application sent by him to the registration authority.

For foreign participants in Russian OOO, such changes mean the presence of two options:

- arrival in the Russian Federation and visiting a Russian notary to make a resolution on changing the director of a controlled Russian company;

- issuance of a power of attorney to Russian representatives for carrying out such actions (please note that the power of attorney must be properly legalized and translated into Russian).

At the moment, we are awaiting clarification regarding whether notarization will be mandatory for participants to make resolutions on extending the powers of the general directors of OOO, as well as the beginning of the liquidation of controlled companies.

With regard to the liquidation of an OOO, from September 01, it is legislatively confirmed that the notary submits to the Federal Tax Service (FTS) a notification about the formation of a liquidation commission/appointment of a liquidator. Such a notification is usually sent simultaneously with the message that the legal entity is entering into the process of liquidation. The notification shall be submitted to the Federal Tax Service by the notary who certified the liquidator’s signature on it, no later than the end of the working day on which the notification was signed.

According to another change, from September 01, the list of information on shares in the authorized capital of OOO, which is contained in the Unified State Register of Legal Entities, is being expanded. The Register will contain information about the arrest of the share imposed by the court or enforcement officer. So far, the Unified State Register of Legal Entities includes information on the size, nominal value of shares and shareholders.

In the future, we will inform you about other significant changes to corporate legislation introduced by Federal Law No. 287-FZ dated August 08, 2024.

We will be happy to answer your questions and, if necessary, support you in the preparation, signing and submission of relevant documents to the authorized bodies.

Contacts:

Maria Matrossowa

Nadezhda Maskaeva

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025

Dear colleagues, Please accept our sincere congratulations on the upcoming New Year and Christmas!

Counterparty verification in CIS countries: Kazakhstan

We would like to draw your attention to the screening possibilities of foreign counterparties in the Republic of Kazakhstan.

To reduce risks and check the reliability, solvency and security of your foreign counterparty, you should take the following steps:

- Legal check;

- Financial check;

- Check valid licences, if applicable;

- Check other factors such as publicly available information / business reputation: customer reviews, relationships with partners or contractors.

As part of the legal review of an LLP (Limited Liability Partnership or “TOO”), which acts as a separate legal entity based on its own Charter, you should request the following legal documents:

- Charter;

- Memorandum of Association (however, the counterparty may refuse to provide this as the provisions may be confidential);

- Resolution/protocol on the appointment of the directors;

- State registration certificate – certificate of registration. What to check: Consistency of the information in the certificate with other incorporation documents;

- Business Identification Number (BIN) – a unique number created for a legal entity (branch and representative office) and self-employed persons;

- Registration number of the VAT payer’s certificate.

Also pay attention to the company’s legal address for local authorities. It must be specified in the Charter and other documents when registering the LLP and can be either a commercial premises or a private address (e.g. the founder’s flat).

There are following risk factors:

- “mass registration address”;

- mismatch between the legal and actual addresses (when submitting to the tax office), which is especially relevant for VAT payer counterparties.

The charter capital of an LLP must be at least 100 times the monthly calculate on index (MCI) at the time of submitting the formation documents for state registration. Fr om January 1, 2024, the MCI will be 3,692 tenge, i.e. the minimum capital must be 369,700 tenge (approx. RUB 73,000). The charter capital must be fully paid within one year from the date of registration. For small companies (up to 100 employees, income up to 300,000 MCI/year) there is no minimum capital (it can therefore be 0 tenge).

The executive body can be collective (directorate) or individual (director). An LLP can have several directors who act independently of each other (but only natural persons).

In addition, we would like to draw your attention to the official regime of “suspension of activity” in the Republic of Kazakhstan (the official analogue of “sleep mode” in the Russian Federation). During suspension, a company cannot conduct any profitable activities, but it is not liquidated and can be reinstated. Information on companies whose activities have been suspended can be obtained from the website of the State Revenue Committee of the Ministry of Finance of the Republic of Kazakhstan (SRC).

Further, in case the signatory of the contract is a director acting on the basis of the Charter, you should check the following aspects:

- Timeliness of the authorization (the data in the decision / protocol of appointment should coincide with the data in the state registers);

- Duration of the authorization;

- Existence of possible restrictions (e.g. transactions above a certain amount may require the approval of the participants, this may be specified in the Charter);

- Delimitation of powers if there are several directors.

If the signatory of the contract is acting on the basis of a power of attorney, be sure to request and scrutinize it for:

- The authority of the person issuing the power of attorney. If it is not signed by a director, but by another person based on the power of attorney with the right of overriding power of attorney, you should also request and check the original power of attorney;

- Description of the powers of the person acting on the basis of the power of attorney.

Wh ere to get data (open sources):

- Portal of the Bureau of National Statistics of the Agency for Strategic Planning and Reforms of the Republic Kazakhstan (RK).

Here you can find basic information about the company.

- Portal of the State Revenue Committee of the Ministry of Finance of the RK (www.kgd.gov.kz).

Here you can find:

- Details on suspension / non-suspension of activities;

- Information on the absence (presence) of tax arrears;

- Total amount of taxes paid;

- Presence of the counterparty in the List of unreliable taxpayers;

- Information about being / not being in the process of liquidation.

Here you can find the availability of open and past court cases.

- Public procurement portal.

Here you can see if the counterparty is on the list of unfair participants in public procurement.

- Portal of the Electronic Government of the Republic of Kazakhstan Egov.kz.

Here you can find:

- Information about the registered legal entity as of a given date;

- Details of the latest amendments to the constituent documents;

- Information about participation of the legal entity in other legal entities;

- Information on the presence of branches and representative offices of the legal entity;

- Information on the category of the subject of entrepreneurship;

- Data on encumbrances (seizure) on the legal entity’s share;

- Information on recognition of the legal entity as an inactive legal entity or involvement of its participants in inactive legal entities.

Unfortunately, as in many other jurisdictions, to obtain full data from public official sources, in most cases verification or authorization may be required, which requires a local phone number or IIN / BIN (analogue to the Russian TIN). In this regard, it may be necessary to engage a local partner to carry out a full-fledged verification.

For bigger or more significant deals, of course, the financial condition of the counterparty should be checked. For this purpose, it is necessary to request and analyze financial and tax statements for the last reporting periods:

- Balance sheet,

- Profit and Loss Statement,

- Cash flow statement.

Analyzing the financial statements will help to understand how successful and sustainable the company is, and to identify problems / risk factors.

We would also advise you to look at:

- review of financial ratios,

- analysis of current assets and total debt,

- profit and loss analysis,

- and get information about the bank details of the counterparty in advance – not all banks in Kazakhstan accept and send payments to Russia or do so with restrictions on the type of currency / banks from the Russian Federation.

We will be happy to answer your questions and, if necessary, carry out a counterparty check at your request.

Contacts:

Maria Matrossowa

Nadezhda Maskaeva

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025

Dear colleagues, Please accept our sincere congratulations on the upcoming New Year and Christmas!

Review article “International payment practices in the current environment”

Exclusively for the Russian Business Guide magazine, Daria Pogodina, Managing Director of swilar presented a review article “International payment practices in the current environment”.

You can read the article online in Russian or English, or download two-language article in pdf-format by clicking the “Download en” button below the message.

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025

Dear colleagues, Please accept our sincere congratulations on the upcoming New Year and Christmas!

New in the rules for issuing permits by the government commission

We bring to your attention a review of the latest changes in the procedure for transactions with shares of OOOs with participants from unfriendly countries.

We would like to remind you that any transactions or groups of transactions with securities of Russian legal entities and/or shares constituting the share capital of Russian legal entities require obtaining permits from the Government Commission and performing a number of procedures (obtaining an independent assessment, establishing KPIs, etc.).

On 23.01.2024, Decree of the Government of the Russian Federation dated 22.01.2024 No. 40 “On amendments to the Decree of the Government of the Russian Federation dated 06.03.2022 No. 295” (hereinafter – the “Decree No. 40”) was published, which contains some clarifications of the procedure.

Decree No. 40 established the need to comply with certain previously formulated conditions for obtaining permits (see Extract from the decision of the subcommission dated 07.07.2023 No. 171/5) and made some additions.

In particular, it is now established at the regulatory level (clause 5 (1) of the Rules approved by the Decree of the Government of the Russian Federation dated 06.03.2022 No. 295, hereinafter – the “Rules”) that the following information must be additionally included in the application for a permit:

- report on an independent assessment of the market value of the relevant securities of Russian legal entities and/or shares constituting the share capital of Russian legal entities.

This assessment must be carried out by an appraiser engaged in private practice and included in the list of appraisers (appraisal organizations) recommended by the subcommission to carry out such an assessment, or by an appraiser who has entered into an employment contract with a legal entity included in such a list (paragraph 3 of clause 1 of Decree No. 40). The right to determine the specified list is granted to the subcommission (clause 8 of Decree No. 40).

- key performance indicators and their target values for buyers, proposed as conditions for the implementation of transactions or a group of transactions.

Decree No. 40 also details the procedure for monitoring the achievement of key performance indicators.

In particular, Decree No. 40 clarifies who will monitor the implementation of the set KPIs (performance indicators). Monitoring of achievement of indicators and their target values will be carried out by:

- federal executive authorities (in each case, the authority will be determined depending on the scope of activity of the legal entity or party to the transaction), and (or)

- the Central Bank of the Russian Federation,

on the basis of documents confirming the achievement of these indicators and their target values, submitted within the time limits established in the decisions of the subcommission (clause 8 of Decree No. 40).

Please note that, in accordance with the clause 5 (2) of the Rules, the requirement to include additional information in the application in the form of an independent assessment report, as well as KPIs, does not apply to transactions and operations:

- between persons included in the same group of persons in accordance with competition law,

- between persons associated with unfriendly countries.

Additionally, you can read our previously published reviews on the topic: on the procedure for issuing permits for transactions with shares in the share capital of OOOs, on the conditions for obtaining permits for transactions with shares in OOOs, as well as on changes to these conditions.

We will be happy to answer your questions!

Contacts:

Maria Matrossowa

Yulia Belokon

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025

Dear colleagues, Please accept our sincere congratulations on the upcoming New Year and Christmas!

Submission of information about members of a foreign organization

Please note that all representative offices and branches of foreign companies are required to submit information about the members and beneficiaries of their parent structures to the tax authority by 28.03.2024.

According to the clause 3.2 of the article 23 of the Tax Code of the Russian Federation, foreign organizations (FO), as well as foreign structures without formation of a legal entity (FSWFLE), are obliged annually no later than March 28:

- to submit information about the members of such a FO (for FSWFLE – information about its founders, beneficiaries and managers) as of December 31 of the year preceding the year of submission of the specified information to the tax authority at the place of their registration, as well as

- to disclose the procedure for indirect participation (if any) of an individual or public company in the event that the share of their direct and/or indirect participation in the FO (FSWFLE) exceeds 5%.

This obligation does not apply to foreign companies that are registered with the Russian tax authorities only because of the provision of services in electronic form, as well as to subsidiaries (OOO) with foreign participation.

The form of communication about the members of a FO (for a FSWFLE – about its founders, beneficiaries and managers), the format of its submission in electronic form, as well as the procedure for filling in the form are approved by the Order of the Federal Tax Service of Russia dated 01.12.2021 No. ED-7-13/1046@.

Wrongful failure to submit (untimely submission) by a foreign organization (foreign structure without formation of a legal entity) of the above information to the tax authority entails a fine of 50,000 RUB (clause 2.1 of the article 129.1 of the Tax Code of the Russian Federation).

You can find information previously published by us on this topic here.

We will be happy to answer your questions and offer our assistance in creating the report.

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025

Dear colleagues, Please accept our sincere congratulations on the upcoming New Year and Christmas!

Review article “CHANGES IN 2024: Double Taxation Agreements (DTAs), Transfer Pricing, Offshoring and other news”

Exclusively for the Russian Business Guide magazine, Daria Pogodina, Managing Director of swilar presented a review article “CHANGES IN 2024: Double Taxation Agreements (DTAs), Transfer Pricing, Offshoring and other news” providing detailed step-by-step analysis of the changes and their consequences.

You can read the article online in Russian or English, or download two-language article in pdf-format by clicking the “Download ru” button below the message.

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025