Category: Payments and banks

Cryptocurrency as a payment method

Daria Pogodina wrote an article for the Russian-Turkish Dialogue Association which reviews current issues of doing business between Russia and Turkey. The article covers key aspects of economic relations, legal issues, as well as the specifics of interaction in the field of international payments and taxation. Particular attention is paid to strategic areas for developing cooperation and potential risks that companies face when entering the Turkish market.

Situation with cross-border payments as of March 2025

Daria Pogodina presented a report on the topic “The situation with cross-border payments as of March 2025” in Lipetsk. During her speech Daria presented up-to-date information on the current state of cross-border settlements, including changes in the regulation of foreign exchange transactions and documentation requirements. Particular attention was paid to changes in international payment practices and the adaptation of businesses to new conditions. The report aroused interest among participants engaged in foreign economic activity.

Topics 2025: Practical Experience and Recommendations for Business Operations in Changing Conditions

PROGRAM

1. Current situation with international payments — overview and practical recommendations. Cryptocurrency payments — new opportunities for business?

Daria Pogodina — Managing Partner, swilar

2. Possibilities of transfers within the framework of foreign economic activity in rubles and yuan

Vasily Lukyanenko — Head of Department, JSC OTP Bank, Corporate Business Directorate

3. What to consider when working with personnel

Elena Balashova — Managing Partner, Balashova Legal Consultants

4. Liability insurance as an important element of risk management. Risks of directors and managers

Nikolay Artamonov — Underwriter for financial risks, JSC IC Turikum

5. Audit checklist — main errors identified by auditors in accounting and tax accounting based on the results of 2024 in the context of constant changes. Preparation for the annual audit

Olga Grigorieva – General Director of Sterngoff Audit LLC

6. Logistics and customs risks when importing to the Russian Federation. Latest practice: routes, customs control, inclusion of agent fees, dividends

Anna Dashicheva – Commercial Director of Polar Group LLC

Online seminar 13.12.2024: Doing Business in Russia – Practical Experience in New Circumstances

PROGRAM

Detailed reviews and Q&A session with experienced experts on the following topics

1. Doing business in Russia

Legal, tax, HR and migration issues. Basics.

2. Overview on bank transaction with Russia

SWIFT, currency exchange and other.

3. Practical experience of foreign companies in Russia

FAQ in the regular business processes.

International settlements in cryptocurrency in 2024. Recent changes and practice

Daria Pogodina spoke at the meeting of the Accounting Working Group of the Russian-German Chamber of Commerce with a report on the topic “International Settlements in Cryptocurrency in 2024. Recent Changes and Practice.” The speaker covered current changes in the regulation of cryptocurrency transactions, including new requirements for cross-border payments and legal aspects of using cryptocurrencies for international settlements. During the speech, recommendations were given for compliance with the law, and practical cases were considered demonstrating the successful use of cryptocurrencies in international business practice. The report aroused keen interest among accountants and specialists working with innovative financial instruments.

An article on the legalization of the legal status of cryptocurrency: how will this help businesses?

Especially for the November RBG (Russian Business Guide) magazine, swilar CEO Daria Pogodina and swilar Controlling Department Specialist Natalia Samonova discussed the current topic of cryptocurrency.

Account of a Russian LLC abroad

In the context of ongoing difficulties with international payments, many companies have found it necessary to open an account in a foreign bank.

However, it is important to remember that opening a bank account in another jurisdiction imposes a number of additional obligations on the company, including the submission of necessary reports and notifications.

In our review, we will look at how not to violate the law in this situation and how to avoid penalties.

Let’s take a step-by-step look at what a company has to do to comply correctly with all requirements.

1. Notify the Federal Tax Service of Russia.

It is necessary to notify the Federal Tax Service in the following cases:

- opening a bank account outside the Russian Federation;

- closing such an account;

- changing the account details.

All Russian organizations are required to submit the corresponding notification. (Part 2, Part 8 of Art. 12 of the Law No. 173-FZ). The notification should be sent to the tax authority at the location of the organization in the form approved by the Order of the Federal Tax Service of Russia dated 26.04.2024 N SD-7-14/349@, within one month from the date of opening (closing) an account or changing the details, respectively (Part 2 of Art. 12 of the Currency Control Law).

Two forms have been approved: one is for opening and closing an account (Appendix N1), the other is for changing the details of this account (Appendix N2).

The notification can be submitted to the tax authority on paper (in person, through a representative, by registered mail) or in electronic form via telecommunication channels (TCC) or through the taxpayer’s personal account (PA).

When making the first transfer to a bank account abroad, the organization needs to provide the Russian bank with a notification on opening this account with a tax inspector’s note on its acceptance (Part 4 of Art. 12 of the Currency Control Law).

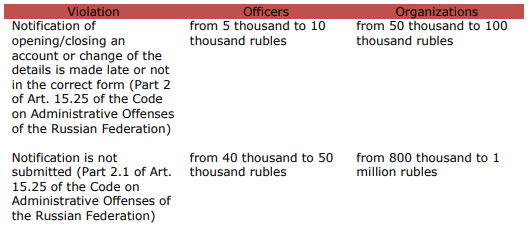

Failure to submit a notification about account or violation of the terms or procedure for submitting it may result in a penalty being imposed on the organization.

Their amounts are established in the Art. 15.25 of the Code on Administrative Offenses of the Russian Federation.

2. Report to the Federal Tax Service on flow of funds.

If a legal entity (resident of the Russian Federation) has foreign accounts, it has to submit a cash flow statement to the tax authority quarterly within 30 days after the end of the reporting quarter, attaching supporting documents: statements or other documents issued by the bank (Decree of the Government of the Russian Federation dated 28.12.2005 N 819 (as amended on 22.05.2024)).

If the documents are drawn up in a foreign language, the organization has to attach a translation into Russian, duly certified in accordance with the legislation of the Russian Federation (cl. 7 of the Rules for the Submission of Reports by Residents – Legal Entities).

The translation can be carried out by an employee of an organization or an organization engaged in translation activities, since the methods of translation are not limited by the law.

If necessary, at the request of the tax authorities, translation into Russian, notarized in accordance with the requirements of the legislation of the Russian Federation, shall be provided.

3. Comply with the currency legislation, in particular, carry out only legal currency transactions.

Contracts with non-residents, the amount of obligations for which exceeds the established threshold, namely, import contracts from 3 million rubles and export contracts from 10 million rubles, must be registered by an authorized bank of the Russian Federation.

The bank will assign a unique number to the contract (cl. 4.2, 5.5 of the Bank of Russia Instruction dated 16.08.2017 N 181-I (as amended on 09.01.2024).

When crediting export proceeds to an account abroad, it is necessary to provide to the authorized bank a certificate of currency transactions for settlements through an account abroad under accounting contracts, as well as provide a bank statement.

The term for providing a certificate of currency transactions for settlements through an account abroad is within 30 working days after the last day of the month in which such transactions were carried out.

4. Is it necessary to repatriate currency?

At present, the obligation to repatriate currency has only been retained for some companies.

From 16.10.2023 to 30.04.2025 inclusive, certain Russian exporters specified in the List approved by the Decree of the President of the Russian Federation dated 11.10.2023 No. 771, are required to credit to their accounts in authorized banks and sell proceeds in foreign currency on the domestic currency market of the Russian Federation within the established period and in the established amounts (cl. 1, 5 of the Decree of the Government of the Russian Federation dated 12.10.2023 No. 1681 “On measures for the implementation of the Decree of the President of the Russian Federation dated October 11, 2023 No. 771”).

The closed list consists of 43 groups of companies belonging to the sectors of the fuel and energy complex, ferrous and non-ferrous metallurgy, chemical and forestry industries, and grain farming. Exporters are notified of their inclusion in the list within 3 days by the Ministry of Economic Development of Russia.

For companies that are not on the closed list, the amount of foreign currency earnings subject to mandatory sale is currently 0%.

Therefore, if the organization is subject to the cancellation of repatriation, the terms for transferring export proceeds from the organization’s account opened abroad to a Russian bank are not established by regulation, i.e. such funds may remain on account abroad and these funds can be used, for example, for settlement of import or other contracts.

Contacts:

Natalia Safiulina

Nadezhda Kolomnikova

Other news

04.06.2025

Speech at the meeting of the Russian-German Chamber of Commerce and Industry

26.05.2025

Important! Increase of fines for violations in the field of personal data processing

Online seminar 11/12/2024: Features of liquidation of companies with foreign participation: latest changes and practice

PROGRAM

1. Features of liquidation of foreign subsidiaries in 2024-2025.

Daria Pogodina, Managing Partner of swilar

2. Liquidation audit – features of the procedure.

Olga Grigorieva, General Director of Sterngoff Audit

3. Closing representative offices and branches of foreign companies – what to consider?

Daria Pogodina, Managing Partner of swilar

4. Features of termination of employment relations with employees during company liquidation.

Elena Balashova, Managing Partner of Balashova Legal Consultants

5. Planning the budget and financing of the company during the liquidation period.

Natalia Samonova, Head of Controlling Projects of swilar

6. Business valuation in Russia for the purpose of submission to the Government Commission.

Alexey Sitnikov, Director, Swiss Appraisal

Association Russian-Turkish Dialogue. Legalization of the legal status of cryptocurrency

The article by Daria Pogodina examines current changes in the legislation of Russia and Turkey concerning cryptocurrencies, as well as the process of their legalization and integration into the financial system of both countries. The author analyzes legal and regulatory barriers, and provides recommendations for businesses interested in using cryptocurrencies in their activities. The article focuses on the possible risks and benefits of using cryptocurrencies in international settlements.

Russian-German Chamber of Commerce

Daria Pogodina spoke at the event organized by the Russian-German Chamber of Commerce, presented an up-to-date overview of restrictions and requirements affecting cross-border settlements and also covered practical aspects of interaction with banks, currency control and approvals with the government commission. The report aroused great interest among participants conducting foreign economic activity with partners in the EU and other jurisdictions.