Category: News

Сhanges in transfer pricing and notifications of controlled transactions

Dear colleagues,

A year earlier we have informed you of major changes in transfer pricing effective from 01.01.2024 (link). We kindly remind you the main aspects and inform of the recent innovations:

1. Withholding tax on services of foreign related parties

We kindly remind you that withholding tax of 15% shall on mandatory basis be withheld from services of foreign related parties – residents of the country with which the DTT has been suspended.

On April 7, the Ministry of Finance officially updated the list of countries with relevant information of current DTTs, in particular, the information on the termination of the DTT with the UK on its initiative was added, in which regard a separate information message was also published.

For transactions with companies from countries with continuing DTTs, it is necessary to study the terms of the international agreement.

2. New format for notification of controlled transactions

On December 28, 2024, the Federal Tax Service issued the Order No. ED-7-13/1088@ “On approval of the form, procedure for filling out and format for submitting a notification of controlled transactions in electronic form” dated December 02, 2024, and on March 13, 2025, the Tax Service issued clarifications (Letter of the Federal Tax Service of Russia dated March 13, 2025 No. ShYu-4- 13/2827@* (ШЮ-4-13/2827@) on ensuring the proper application of the Letter of the Federal Tax Service of Russia dated May 25, 2022 No. ShYu-4-13/6384@* (ШЮ-4-13/6384@).

One of the key points is that for transactions proceeded after January 01, 2024, the taxpayer is to specify in the notification of controlled transactions (and in the documentation submitted at the request of the Federal Tax Service of Russia or in accordance with the paragraph 8 of the Article 105.15 of the Code) the applied transfer pricing method (as provided for in the Chapter 14.3 of the Code or a combination thereof) used to justify the market price level in the controlled transaction.

The changes also imply the disclosure of more information about controlled transactions, including prices in transaction chains (applicable to previous purchase / subsequent sale) for certain categories of transactions (for instance, exchange goods).

We kindly remind that for transactions proceeded in 2024, the notification in the new format is to be submitted not later than on May 20, 2025.

Non-submission by a tax payer to the tax authority within the prescribed time limits a notification of controlled transactions proceeded within one calendar year, or submission by a taxpayer to the tax authority of a notification of controlled transactions including unreliable information, shall entail a fine of RUB 100,000. Non-submission by a taxpayer to submit documentation regarding a specific transaction (group of similar transactions) within the prescribed time limits shall entail a fine of RUB 500,000.

3. Verification of transactions with a foreign “unrelated” counterparty

We kindly remind that since January 1, 2024, transactions with “unrelated” companies registered in countries in the offshore zones list may be automatically classified as controlled transactions for transfer pricing purposes (since July 1, 2023, the list of offshore zones was expanded to 91 jurisdictions by the Order of the Ministry of Finance of Russia dated June 05, 2023 N 86n and includes, for example, the countries of the European Union, Great Britain, Japan, the USA).

Regardless of the actual interdependence of the parties, the transaction will be recognized as controlled transaction if the income for the calendar year exceeds the limit of RUB 120 million.

Exceptions are being made for transactions, where one of the counterparties is a resident or a tax resident of a foreign state with which the Russian Federation has a DTT, the effect of which was suspended by the Decree of the President of the Russian Federation, when:

-

transactions were concluded before March 1, 2022,

-

the procedure for determining prices and (or) pricing methods (formulas) applied in such

transactions remain unchanged after March 1, 2022,

-

transactions are not recognized as controlled transactions in accordance with the criteria in

effect as of March 1, 2022.

4. Updated list of countries which tax authorities conduct an automatic exchange of information

On December 20, 2024, the Federal Tax Service published an Order No. ED-7-17/915@ dated October 30, 2024 “On approval of the List of foreign states (territories) whose competent authorities automatically exchange country-by-country reporting”.

We kindly remind that the effective order of the Federal Tax Service of Russia dated December 20, 2022 No. ED-7-17/1226@ became void with the adoption of the above-mentioned document.

The current version specifies 45 countries and 10 territories with which automatic exchange is carried out, which is amended compared to the previous list in terms of the exclusion from this list of a number of “unfriendly” European countries, which have ceased to carry out automatic exchange of country-by-country reporting with the Federal Tax Service of the Russian Federation (for example, Germany, France, Luxembourg, Italy, Spain, Greece and other countries).

We kindly remind that subsidiaries – residents of the Russian Federation, which parent companies are registered in jurisdictions with which automatic exchange has ceased, may have to submit a country-by-country reporting upon request from the tax authorities.

Non-submission a country-by-country reporting within the within the prescribed time limits either submission of a country-by-country reporting including unreliable information entails a fine of RUB 100,000 for periods before 01.01.2024 and a fine of RUB 1,000,000 for periods starting from 2024 (the fine may be applied to one calendar year).

We have been working with transfer pricing for many years and are engaged in preparing documentation for our clients.

We will gladly support you in the process of preparing documentation and answer questions that arise in connection with the changes specified.

Your contacts on this topic:

Elena Kameneva

Olga Kireeva

Other news

12.05.2025

Online seminar 11/12/2024: Features of liquidation of companies with foreign participation: latest changes and practice

02.04.2025

Online seminar 13.12.2024: Doing Business in Russia – Practical Experience in New Circumstances

27.03.2025

swilar has won the Russian Business Guide. PEOPLE OF THE YEAR award

On March 26, for the seventh time in a row, the international magazine RBG, with the support of the Chamber of Commerce and Industry of the Russian Federation, held an award ceremony for the winners of the award.

swilar has won the Russian Business Guide. PEOPLE OF THE YEAR award

On March 26, for the seventh time in a row, the international magazine RBG, with the support of the Chamber of Commerce and Industry of the Russian Federation, held an award ceremony for the winners of the “Russian Business Guide. PEOPLE OF THE YEAR” award. Over the years of its existence, the award has gained wide popularity and support among the business community, becoming a significant award for domestic business, and has made an important contribution to the popularization and support of the business community. The status of the award is recognized both in Russia and abroad.

The award winners are not just successful entrepreneurs, public figures and opinion leaders, but also true innovators who make a significant contribution to the development of business and the economy of Russia.

The swilar Group of Companies was recognized as the winner in the nomination “Best HR and Outsourcing Services Provider”.

The managing partner of SVILAR, Daria Pogodina, highlighted the specifics of work in this area in an article in the latest issue of RGB:

“We see that in the conditions of general turbulence, company management wants and must focus on solving operational business problems and at the same time is forced to develop new strategies or make adjustments to the plans being implemented. Of course, this leaves its mark on the expectations of companies towards their business partners: not just to work out tasks or, in the case of, for example, accounting outsourcing, to reflect documents, but to proactively point out certain nuances and offer solution options. This fits perfectly into our concept of support, and this is precisely why, according to reviews, our clients value us. Of course, one of the most important areas of the past year was the constant monitoring of the situation with international payments and the search for the best solutions for clients. Performing, among other things, the functions of the treasury, we monitor and analyze the situation in this area with special attention.” We invite you to read the full article at the link.

We thank the organizers of the award for the high assessment of our work!

Other news

12.05.2025

Online seminar 11/12/2024: Features of liquidation of companies with foreign participation: latest changes and practice

02.04.2025

Online seminar 13.12.2024: Doing Business in Russia – Practical Experience in New Circumstances

Cryptocurrency as a payment method

Darya Pogodina wrote an article for the Russian-Turkish Dialogue Association, which examines current issues of doing business between Russia and Turkey. The article covers key aspects of economic relations, legal issues, as well as the specifics of interaction in the field of international payments and taxation. Particular attention is paid to strategic areas for developing cooperation and potential risks that companies face when entering the Turkish market.

Other news

12.05.2025

Online seminar 11/12/2024: Features of liquidation of companies with foreign participation: latest changes and practice

02.04.2025

Online seminar 13.12.2024: Doing Business in Russia – Practical Experience in New Circumstances

Situation with cross-border payments as of March 2025

Darya Pogodina gave a report in Lipetsk on the topic “The situation with cross-border payments as of March 2025”. During her speech, the speaker presented up-to-date information on the current state of cross-border settlements, including changes in the regulation of foreign exchange transactions and documentation requirements. Particular attention was paid to changes in international payment practices and the adaptation of businesses to new conditions. The report aroused interest among participants engaged in foreign economic activity.

Other news

12.05.2025

Online seminar 11/12/2024: Features of liquidation of companies with foreign participation: latest changes and practice

02.04.2025

Online seminar 13.12.2024: Doing Business in Russia – Practical Experience in New Circumstances

Сhanges to corporate legislation: holding of meetings in companies

Dear Sirs or Mesdames,

we would like to inform you about the changes in the field of corporate law which will be important in the nearest time.

From March 01, 2025, significant new developments made by the Federal Law dated August 08, 2024 No. 287-FZ will come into force. A number of changes relates to limited liability companies (LLC).

So, the rules of holding general meetings of LLC participants have been amended, the related terminology has been changed. New rules will be applied, namely, while holding the annual meetings of participants according to the results of the year 2024.

Main changes are as follows:

The expression “general meeting” has been changed to “adoption of a resolution by the general meeting” or “meeting or absentee voting for adoption of a resolution by the general meeting”.

The meeting chairman will be elected only if the company does not have a Board of Directors (Supervisory Board). If it exists, the Chairman of such Board of Directors will take chair.

The forms of the general meeting will be as follows:

- a meeting, possible with remote participation;

- absentee voting, incl. by e-bulletins;

- a meeting combined with absentee voting.

In case of remote participation:

- participation will be executed using electronic/technical communications;

- a possibility is established to attend a meeting at the place of its holding or to hold a meeting without determining a place of holding;

- a possibility is established to make an online-broadcasting with access for the registered persons (upon a participant’s demand the company is obliged to provide access to the broadcasting recording).

Additionally, the rules of holding meetings combined with absentee voting have been fixed. Such meetings may be held in the cases stipulated by the company’s articles of association or by a unanimous resolution of all the company participants. Approval of annual reports and accounting (financial) statements is admitted at such meetings.

A separate article has been introduced dedicated to drafting and contents of the minutes of an LLC general meeting. It also stipulates that signing of the minutes by the secretary of the meeting will not be required.

Furthermore, a procedure was established in relation to adopting resolutions by the Board of Directors (the supervisory authority which is formed when it is stipulated by the articles of association). This authority may adopt resolutions at meetings (including those with remote participation) or by means of absentee voting. Similarly to meetings of company’s participants, meetings of the Board of Directors will be held with the possibility of personal attendance at the place of their holding as well as without determining such place.

The quorum when adopting Board resolutions will be not less than 1/2 of the number of Board members (if the greater number is not stipulated by the articles of association). The meeting may be combined with absentee voting.

The minutes according to the results of the meeting or the absentee voting will be prepared not later than 3 calendar days after the meeting or the end of document acceptance from the Board members (in case of absentee voting).

We will be happy to answer your questions arising in connection with the specified changes.

Your contacts on this topic:

Maria Matrosova

Nadezhda Maskaeva

Other news

12.05.2025

Online seminar 11/12/2024: Features of liquidation of companies with foreign participation: latest changes and practice

29.04.2025

Сhanges in transfer pricing and notifications of controlled transactions

SWISS & RUSSIAN VIEWS AND PERSPECTIVES BY ACADEMIA AND BUSINESS

Darya Pogodina spoke at the conference “Swiss & Russian Views and Perspectives by Academia and Business” with a report on the topic “Practical Experience in Intercultural Communication with German-Speaking Countries”. As part of the presentation, the speaker shared practical observations and cases from professional interaction with partners from Germany, Austria and Switzerland. The issues of differences in business culture, communication models were touched upon, and recommendations were given on how to effectively build cooperation in an intercultural environment. The report aroused keen interest among participants from the academic and business environment.

Other news

12.05.2025

Online seminar 11/12/2024: Features of liquidation of companies with foreign participation: latest changes and practice

02.04.2025

Online seminar 13.12.2024: Doing Business in Russia – Practical Experience in New Circumstances

Review of FSBU 4/2023 “Accounting (financial) statements”

Elena Kameneva spoke at the meeting of the Accounting Working Group of the AHC with a report on the topic “Review of FSBU 4/2023 “Accounting (financial) statements””. During the speech, the speaker analyzed in detail the main provisions of the new standard, which came into force in 2023, and its impact on the procedure for preparing and submitting financial statements. The report included an analysis of key changes, features of the standard’s application for Russian companies, as well as practical recommendations for implementing the new approach in accounting practice. The seminar aroused interest among specialists in the field of accounting and finance.

Other news

12.05.2025

Online seminar 11/12/2024: Features of liquidation of companies with foreign participation: latest changes and practice

02.04.2025

Online seminar 13.12.2024: Doing Business in Russia – Practical Experience in New Circumstances

International Settlements in Cryptocurrency in 2024. Recent Changes and Practice

Darya Pogodina spoke at a meeting of the Accounting Working Group of the AHC with a report on the topic “International Settlements in Cryptocurrency in 2024. Recent Changes and Practice.” The speaker covered current changes in the regulation of cryptocurrency transactions, including new requirements for cross-border payments and legal aspects of using cryptocurrencies for international settlements. During the speech, recommendations were given for compliance with the law, and practical cases were considered demonstrating the successful use of cryptocurrencies in international business practice. The report aroused keen interest among accountants and specialists working with innovative financial instruments.

Other news

27.03.2025

swilar has won the Russian Business Guide. PEOPLE OF THE YEAR award

On March 26, for the seventh time in a row, the international magazine RBG, with the support of the Chamber of Commerce and Industry of the Russian Federation, held an award ceremony for the winners of the award.

An article on the legalization of the legal status of cryptocurrency: how will this help businesses?

Especially for the November RBG (Russian Business Guide) magazine, swilar CEO Daria Pogodina and swilar Controlling Department Specialist Natalia Samonova discussed the current topic of cryptocurrency.

Другие новости

12.05.2025

Online seminar 11/12/2024: Features of liquidation of companies with foreign participation: latest changes and practice

02.04.2025

Online seminar 13.12.2024: Doing Business in Russia – Practical Experience in New Circumstances

Account of a Russian LLC abroad

In the context of ongoing difficulties with international payments, many companies have found it necessary to open an account in a foreign bank.

However, it is important to remember that opening a bank account in another jurisdiction imposes a number of additional obligations on the company, including the submission of necessary reports and notifications.

In our review, we will look at how not to violate the law in this situation and how to avoid penalties.

Let’s take a step-by-step look at what a company has to do to comply correctly with all requirements.

1. Notify the Federal Tax Service of Russia.

It is necessary to notify the Federal Tax Service in the following cases:

- opening a bank account outside the Russian Federation;

- closing such an account;

- changing the account details.

All Russian organizations are required to submit the corresponding notification. (Part 2, Part 8 of Art. 12 of the Law No. 173-FZ). The notification should be sent to the tax authority at the location of the organization in the form approved by the Order of the Federal Tax Service of Russia dated 26.04.2024 N SD-7-14/349@, within one month from the date of opening (closing) an account or changing the details, respectively (Part 2 of Art. 12 of the Currency Control Law).

Two forms have been approved: one is for opening and closing an account (Appendix N1), the other is for changing the details of this account (Appendix N2).

The notification can be submitted to the tax authority on paper (in person, through a representative, by registered mail) or in electronic form via telecommunication channels (TCC) or through the taxpayer’s personal account (PA).

When making the first transfer to a bank account abroad, the organization needs to provide the Russian bank with a notification on opening this account with a tax inspector’s note on its acceptance (Part 4 of Art. 12 of the Currency Control Law).

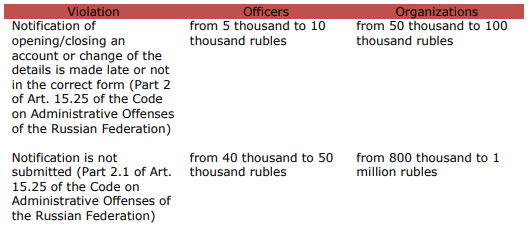

Failure to submit a notification about account or violation of the terms or procedure for submitting it may result in a penalty being imposed on the organization.

Their amounts are established in the Art. 15.25 of the Code on Administrative Offenses of the Russian Federation.

2. Report to the Federal Tax Service on flow of funds.

If a legal entity (resident of the Russian Federation) has foreign accounts, it has to submit a cash flow statement to the tax authority quarterly within 30 days after the end of the reporting quarter, attaching supporting documents: statements or other documents issued by the bank (Decree of the Government of the Russian Federation dated 28.12.2005 N 819 (as amended on 22.05.2024)).

If the documents are drawn up in a foreign language, the organization has to attach a translation into Russian, duly certified in accordance with the legislation of the Russian Federation (cl. 7 of the Rules for the Submission of Reports by Residents – Legal Entities).

The translation can be carried out by an employee of an organization or an organization engaged in translation activities, since the methods of translation are not limited by the law.

If necessary, at the request of the tax authorities, translation into Russian, notarized in accordance with the requirements of the legislation of the Russian Federation, shall be provided.

3. Comply with the currency legislation, in particular, carry out only legal currency transactions.

Contracts with non-residents, the amount of obligations for which exceeds the established threshold, namely, import contracts from 3 million rubles and export contracts from 10 million rubles, must be registered by an authorized bank of the Russian Federation.

The bank will assign a unique number to the contract (cl. 4.2, 5.5 of the Bank of Russia Instruction dated 16.08.2017 N 181-I (as amended on 09.01.2024).

When crediting export proceeds to an account abroad, it is necessary to provide to the authorized bank a certificate of currency transactions for settlements through an account abroad under accounting contracts, as well as provide a bank statement.

The term for providing a certificate of currency transactions for settlements through an account abroad is within 30 working days after the last day of the month in which such transactions were carried out.

4. Is it necessary to repatriate currency?

At present, the obligation to repatriate currency has only been retained for some companies.

From 16.10.2023 to 30.04.2025 inclusive, certain Russian exporters specified in the List approved by the Decree of the President of the Russian Federation dated 11.10.2023 No. 771, are required to credit to their accounts in authorized banks and sell proceeds in foreign currency on the domestic currency market of the Russian Federation within the established period and in the established amounts (cl. 1, 5 of the Decree of the Government of the Russian Federation dated 12.10.2023 No. 1681 “On measures for the implementation of the Decree of the President of the Russian Federation dated October 11, 2023 No. 771”).

The closed list consists of 43 groups of companies belonging to the sectors of the fuel and energy complex, ferrous and non-ferrous metallurgy, chemical and forestry industries, and grain farming. Exporters are notified of their inclusion in the list within 3 days by the Ministry of Economic Development of Russia.

For companies that are not on the closed list, the amount of foreign currency earnings subject to mandatory sale is currently 0%.

Therefore, if the organization is subject to the cancellation of repatriation, the terms for transferring export proceeds from the organization’s account opened abroad to a Russian bank are not established by regulation, i.e. such funds may remain on account abroad and these funds can be used, for example, for settlement of import or other contracts.

Contacts:

Natalia Safiulina

Nadezhda Kolomnikova

Other news

12.05.2025

Online seminar 11/12/2024: Features of liquidation of companies with foreign participation: latest changes and practice

29.04.2025