Category: News

FAS 27/2021 – postponement of the due date for the requirement to store accounting documents

In our message No. 6/2021 dated 06/11/2021, we informed about the planned changes in the workflow regulations, which could have a significant impact on the work of companies that use ERP systems hosted on servers located outside the territory of the Russian Federation.

On December, 24th 2021 the Ministry of Finance of Russia issued information message No. IS-Uchet-35 on the adoption of Order No. 224n dated 23.12.2021, according to which the due date for the requirement to store accounting documents on the territory of the Russian Federation, according to the Federal Accounting Standard FAS 27/2021, is postponed from January, 1st 2021 to January, 1st 2024.

The amendments were adopted in order to provide conditions for the organizations for proper preparation to store accounting documents in the Russian Federation, by postponing the due date of paragraph 25 of FAS 27/2021 from January 1st , 2022 to January 1st, 2024.

It is noted that the due date of the beginning of whole FAS 27/2021 standard remain in force, with the exception of paragraph 25 of FAS 27/2021 on the storage of accounting documents, data contained in such documents, and the placement of databases on the territory of the Russian Federation, which is subject to mandatory application from January 1st, 2024.

Information message No. 6/2021 with a detailed review of FAS 27/2021 can be found found at the following link.

We will be glad to answer your questions!

Contacts:

Eugenia Chernova

Olga Kireyeva

Natalia Safiulina

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025

Dear colleagues, Please accept our sincere congratulations on the upcoming New Year and Christmas!

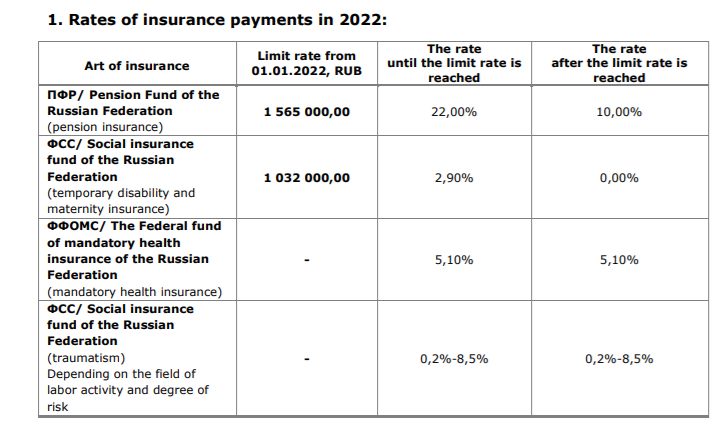

The rate limit for insurance payments in 2022

Оn January 1, 2022, the Resolution of the Government of the Russian Federation №1951 dd. 16.11.2021 comes into force. It concerns increasing the rate limit for insurance payments in cases of temporary disability and maternity, and also mandatory pension insurance:

- The rate limit for social insurance, in cases of temporary disability and maternity, for each individual does not exceed 1,032,000 rubles on a cumulative basis starting fr om the 1 January 2022;

- The rate limit for mandatory pension insurance does not exceed 1,565,000 rubles on a cumulative basis starting from the 1 January 2022 for each individual.

The payments for health care insurance and social payments in case of injuries will have to be made on the basis of all the taxable incomes irrespective of their amount. There will be no lim it for them, as before.

The limits and regulations for calculating insurance payments given above will be valid in 2022 for all companies, except for those with the status of SMEs.

2. Social contributions for SMEs in 2022:

We remind you that in accordance with the Federal Law of 01.04.2020 № 102-FZ dated April 1, 2020, the total amount of insurance payments for SME to state extrabudgetary funds in respect of payments to individuals, in excess of the minimum monthly wage, is reduced to 15%.

This reduced rate for SME applies irrespective of the maximum amount of payments to an individual (see above). At the same time, a part of payments less than or equal to the minimum monthly wage (determined at the end of each calendar month) is taxable at the general insurance contribution rate of 30%.

The value of the minimum monthly wage is set simultaneously on the entire territory of the Russian Federation by the federal law and is subject to annual indexation.

The minimum wage is established at the rate of 13 890 rubles for 2022 (Federal law N 406-FZ dated 06.12.2021).

Please note! Reduced tariff of insurance payments for SME from 01.01.2021 is determined for unlimited term (Item 17, clause 1, Art. 427 of the Tax Code, as amended from 01.01.2021).

We will be happy to answer your questions!

Contacts:

Natalia Safiulina

Ekaterina Babenko

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025

Dear colleagues, Please accept our sincere congratulations on the upcoming New Year and Christmas!

FAS 6/2020 “Fixed Assets” from 01.01.2022

We would like to draw your attention to the fact that starting fr om January 1, 2022 a new standard for accounting for fixed assets (hereinafter referred to as FA) is mandatory for usage – FAS 6/2020.

The corresponding changes were made by the Order of the Ministry of Finance N204n dated September 17, 2020. Before transition to the new standard, we recommend that you do the following:

• Establish a limit on the cost of fixed assets to allocate the cost of an asset to the FA or the low-value FA category;

• Conduct an inventory of fixed assets and other assets that, in accordance with FAS 6/2020, could be classified as fixed assets based on the new cost limit;

• Make appropriate changes to the accounting policy of the Company;

• Determine the useful life period of the FA and the terms of the annual testing of it for relevance;

• Sel ect the method of subsequent accounting of the FA (after initial recognition), at initial or revalued cost;

• Determine the liquidation value (hereinafter referred to as LV) of fixed assets on the balance sheet of the enterprise. and the timing of the annual LV assessment;

• For the method of assessing fixed assets at a revalued cost, establish the frequency of revaluation of fixed assets for each group of revalued fixed assets;

• Reflect changes in the organization’s balance sheet as of 01.01.2022 using incoming adjustments;

• Disclose relevant information in the accounting (financial) statements of the company.

What does this mean in practice?

According to the new standard, an organization has the right to independently set a cost limit for classifying an object as a fixed asset, in the contrast to the previously existing limit of 40,000 rubles.

With an increase in the limit (if, for example, an organization decides to set it at the level of 100,000 rubles in order to make it equal to the FA limit in tax accounting), some fixed assets may no longer meet the accounting FA lim it criteria and will need to be reclassified as low-value FA, writing off the net book value of the period as an expense (clause 5 of FAS 6 / 2020), while it will be still necessary to keep inventory and off-balance sheet records of such objects.

The standard introduces the concept of residual value – the amount that an entity would receive if an item were disposed of (including tangible assets remaining after disposal), less the estimated disposal costs at the time of disposal. A LV of the particular can be equal to zero if at the end of the UL no more benefits are expected fr om the disposal of the object, if receipts are expected, but they are not material, or if it is impossible to determine how much will be received upon disposal of an asset (paragraph 31 of FAS 6/2020).

The liquidation value of fixed assets should be systematically (at least, at the end of each year) analyzed for changes and, if necessary, adjusted (clause 37 of FAS 6/2020).

Also, the innovation of the standard – the accrual of depreciation on fixed assets is not suspended (including in cases of downtime or temporary break in the use of fixed assets), except for the case when the residual value of an item of fixed assets becomes equal to or exceeds its book value (hereinafter BV). If subsequently the residual value of such an item of fixed assets becomes less than its book value, depreciation is resumed on it (paragraph 30 of FAS 6/2020).

What should be done?

According to paragraphs 48-49 of FAS 6/2020, the consequences of a change in accounting policy associated with the beginning of the application of the new standard should be reflected retrospectively – as if the specified standard had always been applied.

It is necessary to recalculate and adjust the balance sheet statement in the part of fixed assets as of 01.01.2022, in case there was no early application of the standard, and also determine the BV – the initial asset cost less accumulated depreciation. The initial cost should be calculated according to the previously existing rules, and the accumulated depreciation – according to the norms of the new standard (clause 49).

Prospective application of the standard, without incoming adjustments at the beginning of the year, is possible only for organizations that are entitled to use simplified accounting methods, including simplified accounting (financial) statements (paragraph 51 of FAS 6/2020).

We will be happy to answer your questions!

Contacts:

Eugenia Chernova

Olga Kireyeva

Natalia Safiulina

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025

Dear colleagues, Please accept our sincere congratulations on the upcoming New Year and Christmas!

Changes in Migration Legislation

We would like to pay your attention to the fact that the changes specified in the Federal Law No. 274-FZ of July 01, 2021 “On the introduction of amendments to the Federal Law “On the legal status of foreign citizens in the Russian Federation” and the Federal law “On state fingerprint registration in the Russian Federation” shall become effective from December 29, 2021.

According to the Federal Law No. 274-FZ of July 01, 2021 foreign citizens who have arrived in the Russian Federation for working purposes (including highly qualified specialists) shall be subject to mandatory medical examination for substance abuse, infectious diseases that constitute a danger to the public, as well as HIV infection, to state fingerprint registration and photography within 30 calendar days from the date of arrival in the Russian Federation or from the date of receipt of work permission documents.

Besides, foreign citizens who have arrived in the Russian Federation for purposes other than work for a period exceeding 90 calendar days shall be subject to the abovementioned mandatory medical examination, mandatory state fingerprint registration and photography within 90 calendar days from the date of arrival in the Russian Federation.

State fingerprint registration and photography of foreign citizens will need to be completed once.

The medical examination must be repeated multiple times depending on period of validity of medical certificates. It is necessary to mention that in accordance with the clause 20 of the Ministry of Healthcare of the Russian Federation Order No. 1079нof November 19, 2021 that enters into force from March 01, 2022, medical certificates issued to foreign citizens will be in force within 3 months from their issuance. The Law specifies the procedure for repeated medical examination and submission deadline of its results to the territorial authority of the Ministry of Internal Affairs of the Russian Federation within 30 calendar days from the date of expiry of medical certificates. The results of the medical examination are to be submitted by a foreign employee in person or through the Russian unified portal of state and municipal services (Gosuslugi).

If a foreign citizen fails to comply with the above-mentioned mandatory procedures, the period of his residence is reduced and he will be obliged to leave the territory of the Russian Federation.

Contacts:

Maria Matrossowa

Project leader swilar OOO Project Manager of SWILAR LLC

maria.matrossowa@swilar.ru + 7 499 978 37 87 (ext. 308)Tatiana Ushakova

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025

Dear colleagues, Please accept our sincere congratulations on the upcoming New Year and Christmas!

The members of German-Russian Chamber of Commerce (AHK) in their own words: three questions to swilar

Comment of swilar Moscow General Director Daria Pogodina for the December issue of the Russian-German Chamber of Commerce briefing

– What does your company do?

– We provide the full range of administrative services for foreign business in Russia. Usually we start the interaction at the stage of management consultancy support in Europe, and then work with the structure in Russia in the format of, amongst other things, outsourcing of accounting, controlling and reporting.

– This year your company celebrates its 10th anniversary. How do you evaluate the path you’ve traveled?

– Over the past few years, we have been actively developing new areas: for example, we started working in SAP and other systems. However, despite the constant dynamics of development, we are particularly proud of the stability of the processes: many customers have been with us for all these years and have no plans to change this. For us, this is an important indicator and recognition of the quality of our work. Another great achievement is our close-knit team: thanks to the coordinated work of our employees our processes not only didn’t sag in the pandemic, but also reached a new level of automation and quality.

– What do you value most about AHK?

– We have been members of AHK practically since the company was founded, and we are proud to be part of such an active business community. The most valuable thing for us in AHK is networking, feeling of constant support and possibility to cooperate with the specialists of different fields.

Synopsis. AHK Briefing is a newsletter that includes an overview of key news in the Russian market.

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025

Dear colleagues, Please accept our sincere congratulations on the upcoming New Year and Christmas!

Transport tax for legal entities: Main changes in 2021

We remind you that starting from January 1, 2021 important changes concerning the transport tax came into force.

For your convenience, we have made an overview of the main changes and recommendations on their application.

From January 1, 2021 the obligation of organizations to provide tax returns on transport tax for 2020 and subsequent tax periods (clause 17 of Article 1 of the Federal Law № 63-FZ of 15.04.2019, Federal Tax Service Order of 04.09.2019 Nr. MMV-7-21/440) was canceled.

Also, from this date uniform deadlines and advance payments for payment of transport tax were introduced for all organizations:

- the tax is to be paid no later than March 1 of the year following the expired calendar year;

- advance payments, if they are introduced by the law of the Federal subject of the Russia, are to be paid not later than the last day of the month following the expired quarter.

Starting from 2021 organizations must calculate and pay transport tax on their own (clause 1, Article 362 of the Tax Code of the Russian Federation).

The total amount of tax is calculated for each transport vehicle as the multiplication of tax base and tax rate with the multiplying coefficient (clause 2, Article 362 of the Tax Code of the Russian Federation).

The rates are set by the Federal subjects of Russia within the limits specified in the Article 361 of the Tax Code of the Russian Federation.

Organizations that have the right to transport tax benefits must send to the tax authority an application for a tax benefit (Article 361.1 of the Tax Code of the Russian Federation). At the same time organizations are also entitled to submit documents confirming the right to this benefit with the application.

The form of an application for a tax benefit is prescribed by Order No. ММВ-7-21/377@ of the Federal Tax Service dd. July 25, 2019.

From 2022, taxpayers will submit to the tax authority an application for a tax benefit in the form as amended by Order of the Federal Tax Service of Russia No. ED-7-21/574@ of 18.06.2021.

The Tax Code does not set a deadline for filing an application.

An application for tax benefit shall be considered by the tax authority within 30 days from the date of its receipt. This period can be extended in case of necessity for the tax authority to request information confirming the taxpayer’s right to tax benefit from other authorities and persons who have such information. In this case, the taxpayer shall be notified of the extension of the deadline for review of the application.

After considering of the application, the tax authority shall send to the taxpayer:

- notification on granting tax benefit;

- notification of refusal with the explanation of the grounds for refusal.

In order to ensure the full payment of tax, from 2021 the tax authorities will send taxpayers messages about the amount of tax calculated by the tax authorities (paragraph 4 of Article 363, paragraph 5 of Article 363 of the Tax Code).

The tax will be calculated basing on the information available at the tax authority:

- from the authorities that register vehicles – the Traffic Police;

- according to the information about the declared tax benefits received from the owners of vehicles.

Deadlines for mailing tax notices:

- Six months from the date the tax payment deadline expired (e.g., the notification for 2020 must be received by the taxpayer no later than September 1, 2021);

- Two months from the date of receipt of information on the recalculation of the tax;

- One month from the date of receipt of information from the Unified State Register of Legal Entities (EGRUL) that the company is being liquidated.

Tax notification is sent to the taxpayer via telecommunications, personal account on the website of the tax office, or by regular post (if it is impossible to notify by other means).

However! Please note that the above-mentioned notification is informative in nature and is sent to the taxpayer after the expiration of the tax period and the deadline for tax payment, and, consequently, does not cancel the obligation of the taxpayer to calculate and pay the tax on his own in the accordance with the law requirements.

Shall the tax amount independently calculated and paid by the taxpayer not match the data specified in the tax notification, within ten working days from the date of receipt of the message about the calculated tax amount the organization (tax payer) can send to the tax inspection its explanations and documents confirming: the correctness of the calculation, completeness and timeliness of the tax payment, the validity of the use of lower tax rates, tax benefits or the existence of the grounds for tax exemption (paragraph 6 of Article 363 of the Tax Code).

The term for considering the application is one calendar month. Shall the term take longer, the tax authorities are obliged to notify the taxpayer.

According to the results of consideration the taxpayer will receive:

- A message on recalculation of the amount to be paid, considering the explanations, evidence and arguments provided;

- A demand for additional payment if the taxpayer’s explanations are not accepted by the Federal Tax Service.

Also, starting from 2021 taxpayers are obliged to send a report on the owned transport vehicles which are considered to be objects of taxation. This obligation applies in case of non-receipt of a message about the amount of transportation tax calculated by the tax authorities concerning objects of taxation for the whole period of their ownership (Letter of the Federal Tax Service of Russia of 29.10.2020 N BS-4-21/17770@).

A report must be sent to the tax authority by the 31 December of the year following the expired tax period with the attachment of documents confirming the state registration of vehicles.

Wrongful non-submission (untimely submission) of the report leads to the fine at the rate of 20% of the unpaid tax amount of the vehicle, the report about was not submitted (untimely submitted) (clause 3 of article 129.1 of the Tax Code of the Russian Federation).

The standards for filling in the report on the owned transport vehicles have been determined by the Order of the Federal Tax Service No. ED-7-21/124@ dated 25.02.20.

Sending the above-mentioned report is not required if organization sends an application for a tax exemption in relation to the relevant object of taxation.

If you have any questions, we will be happy to offer you additional information on this topic.

Contacts:

Natalia Safiulina

Ekaterina Babenko

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025

Dear colleagues, Please accept our sincere congratulations on the upcoming New Year and Christmas!

Inclusion of license fees in the customs value

Earlier, we provided you with an overview of the current situation with the liquidation of LLCs in Russia.

In addition to the previous review, we would like to further draw your attention to this year’s innovation: a simplified liquidation procedure.

A simplified liquidation procedure is available for SMEs (for the latest information on the status of SMEs, see here and here) and allows you to reduce the time and cost of the liquidation procedure, as well as reduce possible risks of improper liquidation (for example, restrictions on participation and management in new companies within three years).

However, not all SMEs are eligible for simplified liquidation by default. To do this, the company must comply with a list of certain additional criteria.

What conditions must be met to be eligible for simplified liquidation?

- All founders (members) of the company made a resolution to terminate activities unanimously.

- The company is included in the unified register of small and medium enterprises (SMEs).

- The company is not a VAT payer (it is on a simplified tax system) or is exempt fr om VAT.

- The company does not have debts to creditors, including debts to employees and the state budget.

- There are no marks in the Unified State Register of Legal Entities about the inaccuracy of data and about the initiation of bankruptcy proceedings.

- The company has no real estate and vehicles in the property.

- The organization is not in the process of liquidation, reorganization or in the process of forced exclusion from the Unified State Register of Legal Entities by decision of the Federal Tax Service.

How to implement simplified liquidation?

To start a simplified liquidation, you must submit an application to the tax service on form P19001. At the moment, the paper and electronic formats of this form have not yet been approved, at the current stage, you can familiarize yourself with the draft form.

In the application, the founders (members) of the company confirm that:

- All financial obligations to counterparties have been fulfilled.

- All payments due to dismissed employees have been made.

- No later than one business day before exclusion from the Unified State Register of Legal Entities, all taxes have been paid and final tax reporting has been provided.

The application can be submitted electronically (using an enhanced qualified electronic signature of each participant), directly to the tax service on paper (notarization of signatures will be required) or through a notary public.

What is the time lim it for simplified liquidation?

The tax service will check the application and within 5 business days will make a decision on the upcoming exclusion of the company from the Unified State Register of Legal Entities or refusal.

In case of a positive decision by the tax service, information about the upcoming exclusion of the company from the register will be published in the Unified State Register of Legal Entities and in the State Registration Bulletin.

Within 3 months from the date of publication in the bulletin, the creditors of the company will be able to send their objections, if any.

If there are no objections from creditors within 3 months, the liquidated company will be excluded from the register.

It is important to know:

The initial conditions for simplified liquidation must be met at the time of exclusion. If during this period the company accumulates debts or assets, or fails to submit reports, simplified liquidation will not take place.

Contacts:

Maria Matrossowa

Project leader swilar OOO Project Manager of SWILAR LLC

maria.matrossowa@swilar.ru + 7 499 978 37 87 (ext. 308)Tatiana Ushakova

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025

Dear colleagues, Please accept our sincere congratulations on the upcoming New Year and Christmas!

Obligation to enter information about corporate subscribers into the Unified Identification and Authentication System

From December 1, 2021, in accordance with amendments to the Federal Law “On Communications” No. 126-FZ dated July 7, 2003, corporate mobile communications will be provided to organizations and individual entrepreneurs only if there is data about the corporate communications user in the Unified Identification and Authentication System (ESIA).

If this requirement is not met, organizations will be disconnected from corporate communications services from December 1.

What is ESIA?

ESIA is a Russian information system used for authorization on the state portal “Gosuslugi”.

How is data entered into ESIA?

Data is entered into ESIA in three stages. The procedure is as follows:

The organization enters the following information about employees using corporate mobile communications in its personal account on the website of the operator providing corporate communications:

personal data of an individual (passport data);

subscriber number;

name of the organization / full name of the individual entrepreneur.

Employees who have access to the personal account of the corporate communications operator can also enter information about themselves.

The employee confirms the transfer of information through the personal account on the State Services portal, after which the information is sent to the mobile operator.

The mobile operator enters the data into the Unified Identification and Authentication System.

When should the information be provided?

Data on users of corporate mobile communications under contracts concluded before 01.06.2021 must be entered into the system no later than 30.11.2021. When starting to use corporate mobile communications from June 1, 2021, the information must be transferred to the operator before the start of services.

Corporate users using M2M (Machine to machine) SIM cards for ATMs, POS terminals, video surveillance systems, the deadline for submitting information, according to Government Resolution No. 844 of 05/31/2021, must provide information no later than September 1, 2021.

Your contacts on this topic:

Maria Matrosova

Tatyana Ushakova

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025

Dear colleagues, Please accept our sincere congratulations on the upcoming New Year and Christmas!

New: changes in the procedure for providing information about participants of foreign companies from 2021

In accordance with the Federal Law № 100-FZ of 20.04.2021 additional responsibilities for foreign companies, as well as foreign entities without incorporation, registered with the Russian tax authorities were added. This includes directly foreign companies, which have received Russian TIN for a bank account in Russian Federation, branches and representatives (hereinafter, – foreign organizations).

In particular, the law obliges foreign organizations, as well as foreign entities without incorporation to report the following information to the tax authorities at the place of their registration:

- Information about the participants of the foreign organization;

- Information on founders, beneficiaries and managers (for a foreign entity without incorporation);

- Information on participation (if any) of a natural person or company, if the share of their direct and (or) indirect participation in the foreign company exceeds 5%.

The above-mentioned information should be submitted to the tax authority annually not later than March 28, considering that the information should be formed in the tax authorities as of December 31 of the year preceding the year of its submission. Thus, the next report with information as of 2021 should be submitted not later than March 28, 2022. The form of this report will be approved additionally.

Previously p. 3.2 of Art. 23 of the Tax Code provided for the above obligation only for foreign organizations that had their own taxable immovable property in Russian Federation.

Failure to provide this information in accordance with p. 6. of Art. 1 of the Federal Law № 100-FZ of 20.04.2021 shall entail a penalty of 50 000 ruble. Please note that this obligation does not apply to foreign companies which are registered with the Russian tax authorities only due to the provision of services in electronic form, as well as subsidiaries (OOO) with foreign ownership.

Contacts:

Maria Matrossowa

Project leader swilar OOO Project Manager of SWILAR LLC

maria.matrossowa@swilar.ru + 7 499 978 37 87 (ext. 308)Tatiana Ushakova

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025

Dear colleagues, Please accept our sincere congratulations on the upcoming New Year and Christmas!

New rules for document management and storage in Russia from 01.01.2022: FAS 27/2021

We would like to introduce you to the new standard FAS 27/2021 “Documents and document flow in accounting”, approved by Order No. 62n (registered with the Ministry of Justice on 07.06.2021).

The standard introduces new concepts and legislative norms that significantly change the order of document flow and storage of companies’ documents (except for organizations in the public sector).

The new standard regulates such things as the procedure for signing documents, the date of documents, the language of documents, making corrections and other aspects mandatory for local accounting services in Russia after the introduction of the standard. For your convenience, we have prepared a consolidated overview of the main changes introduced by the new FAS (the overview is available in Russian at the link).

Special attention of foreign companies operating in Russia deserves paragraph 25 of the standard:

Storage of accounting documents

An economic entity must keep accounting documents as well as data contained in such documents and locate the databases of such data in the territory of the Russian Federation.

If the laws or regulations of the country – the place of business outside the Russian Federation – require storage of accounting documents in the territory of this country, such storage should be ensured.

The paragraph about the need to keep accounting registers in the Russian Federation raises the most questions from foreign companies.

Many international companies (especially those using SAP, Navision and other international accounting systems) often use servers outside the Russian Federation, which are shared by the group of companies, so the requirement to store registers within the country may entail significant structural changes.

At the moment, however, there is no direct indication in the standard (paragraph 25) as to whether the primary accounting registers should be stored in Russia or whether it will be sufficient to ensure the storage of a copy of the registers to meet the requirements of the new FAS.

In this connection, collective appeals by international business associations to the Ministry of Finance requesting the necessary clarifications are currently being prepared. We are closely monitoring the situation and will be happy to offer updates on this topic should further information become available.

We will be glad to answer your questions!

Contacts:

Eugenia Chernova

Natalia Safiulina

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025