Category: International relations and sanctions

Current topics and features of work for foreign companies in the Russian Federation in changing conditions

Daria Pogodina spoke at the event “Current Topics and Features of Work for Foreign Companies in the Russian Federation in Changing Conditions” with a report on the topic “Suspension of Provisions of Agreements on Avoidance of Double Taxation and Expansion of the List of Offshore Zones: Changes, Concessions, Comments”. The speaker analyzed the key changes in international tax interactions, spoke about the legal and tax consequences for foreign structures operating in Russia, and discussed possible adaptation measures. The report was especially relevant for companies with a cross-border structure and foreign capital.

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025

Dear colleagues, Please accept our sincere congratulations on the upcoming New Year and Christmas!

Doing Business in Russia – Practical Experience in New Conditions. Joint webinar with AGROS EXPO

Daria Pogodina spoke at a joint webinar with AGROS EXPO, and in her report shared relevant information on legal and tax aspects of foreign and international companies operating in Russia, as well as practical solutions applied in the changing regulatory environment. Particular attention was paid to compliance issues, adaptation of corporate procedures, and interaction with government agencies. The webinar arose great interest among participants in the agro-industrial sector.

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025

Dear colleagues, Please accept our sincere congratulations on the upcoming New Year and Christmas!

Daria Pogodina and Eugenia Chernova gave presentations in Lipetsk

PROGRAMM

Suspension of Double Taxation Agreement and expansion of offshore list. Changes. Mitigation?

Comments. Consequences.

Daria Pogodina

Changes in transfer pricing since 01.01.24

Eugenia Chernova

ABOUT THE EVENT

Daria Pogodina spoke in Higher School of Economics with the report “Practical experience in Intercultural Communication with German speaking countries”. The speaker presented real cases and practical observations from business interactions with partners from Germany, Austria and Switzerland. The peculiarities of business etiquette, differences in approaches to communication and management, as well as tips on building an effective dialogue in an intercultural environment were discussed. The report aroused keen interest among students and professors.

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025

Dear colleagues, Please accept our sincere congratulations on the upcoming New Year and Christmas!

Practical experience in intercultural communication with German speaking countries

Daria Pogodina spoke at the HSE on the topic of “Practical experience in Intercultural Communication with German speaking countries”. The speaker shared real cases and practical observations from business interactions with partners from Germany, Austria and Switzerland. The features of business etiquette, differences in approaches to communication and management were considered, and advice was given on how to build an effective dialogue in an intercultural environment. The talk aroused keen interest among students and teachers.

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025

Dear colleagues, Please accept our sincere congratulations on the upcoming New Year and Christmas!

Important! Сhanges in transfer pricing from 01.01.2024

On 28.11.2023 a so called “Big Tax Law” Federal Law No. 539-FZ of 27.11.2023 was published, which makes revolutionary changes in transfer pricing already fr om 01.01.2024.

We have compiled a detailed overview of the planned changes.

What will be changed:

- A 15% withholding tax has been introduced on intragroup services provided by foreign related parties;

- The list of related parties will expand;

- More transactions will be recognized as controlled;

- The amount of additional tax charges will increase;

- Penalties for failure to comply with transfer pricing rules will increase;

- The list of information submitted in transfer pricing reporting will be expanded;

- New “safe” intervals for interest rates.

Below we will consider each of these significant changes separately.

1. Withholding tax on services of foreign related parties

According to the new rules, a withholding tax of 15% will obligatory be withheld from the services of foreign related parties with residence in a country with which the DTT has been suspended.

For transactions with other countries, it is necessary to read the terms of the DTT agreement.

2. Expansion of the list of related parties

The list of related parties will be added to:

- the related party and its controlled foreign company (CFC)

- CFC’s of the same related parties, «sister’s» CFC

- foreign structures without the formation of a legal entity registered in an offshore jurisdiction (or if at least one of the participants in such a structure is registered in an offshore jurisdiction)

3. Expansion of the definition of a controlled transaction

Transactions, one of the parties to which is a person whose place of registration (place of residence, place of tax residence) is a so-called offshore jurisdiction, are considered controlled.

Since the list of offshore jurisdictions was expanded from 01.07.2023, all international transactions with these jurisdictions, even with independent partners, will be considered controlled from 01.01.2024.

Reporting on such transactions must be submitted after exceeding the threshold of 120 million rubles per year.

At the same time, transactions will not be recognized as controlled if the following conditions are met:

- transactions were concluded before March 1, 2022

- the procedure for determining prices and (or) pricing methods (formulas) used in such transactions did not change after March 1, 2022,

- transactions are not recognized as controlled in accordance with transfer pricing legislation as of March 1, 2022.

4. Possible additional tax charges

When a tax audit is carried out and it is discovered that prices other than market prices have been used for a controlled transaction, the tax base will be adjusted to the median value (and not to the maximum-minimum value of the corridor, as it was previously).

If tax authorities make a transfer pricing adjustment to the tax base in the Russian Federation for foreign trade transactions, these adjustments will be qualified as hidden dividends from sources in the Russian Federation (the so-called “secondary adjustment”), and will be subject to withholding tax at a rate of 15% (in addition to the penalty).

If the taxpayer independently carries out a transfer pricing adjustment before the start of control measures and the corresponding funds are transferred by a foreign partner to an account in a Russian bank, this transfer pricing adjustment would not qualified as hidden dividends.

Thus, the total possible amount of additional tax charges can be up to 35% of the price adjustment amount:

20% additional profit tax + 15% withholding tax

5. New levels of penalties

For non-payment or incomplete payment of tax as a result of the application of prices that do not correspond to market prices:

- in relation to foreign trade transactions – 100% of the amount of unpaid tax on the profit of the foreign counterparty, equal to the amount of the transfer pricing adjustment (but not less than 500 000 rubles)

- in relation to domestic Russian transactions – 40% of the amount of unpaid tax (but not less than 30 000 rubles)

For failure to submit within the prescribed period or provision of a notification of controlled transactions containing misinformation – 100 000 rubles

For failure to submit documents within the prescribed period – documentation regarding a specific transaction (group of transactions), notification about participation in an international group of companies (for each fact of violation) – 500 000 rubles.

For failure to submit within the prescribed period or provision of documents containing misinformation – country report, global documentation, local documentation, accounting (financial) statements of a member of an international group of companies (for each fact of violation) – 1 000 000 rubles.

6. More information to submission to tax authority

Expanded information required to be submitted to the Federal Tax Service from 01.01.2024

Notification of controlled transactions

(compulsory annually no later than 20.05.)

· terms of the transaction (details are established only for goods transactions)

· methods and sources of information used in the transfer pricing (previously not required to be disclosed)

· value creation chain for transactions in the field of foreign trade in raw materials (according to the list of the Ministry of Industry and Trade, clauses 5-6 of Article 105.14 of the Tax Code of the Russian Federation) only with related parties.

Documentation on transfer pricing

(upon request of the Federal Tax Service within 30 days)

· information on income and expenses, number of employees, amount of profit (loss), value of fixed assets and intangible assets of a foreign counterparty that is a party to a controlled transaction (including the attachment of relevant supporting documents)

· description of the terms of the transaction

· financial statements of a foreign counterparty.

The refusal of an independent counterparty to provide the requested information must be reported to the Federal Tax Service of Russia.

In transactions with related counterparties, the taxpayer does not have the right to refer to a refusal to disclose information.

Disclosure of information will require the taxpayer to collect a significant amount of additional information, as well as its systematization and storage in the accounting system.

7. New “safe” interest intervals for loans

From 01.01.2024, the lower lim it of the basic “safe” intervals for loan transactions is reduced:

- for loans in RUB: min – 10% of the key rate of the Central Bank of the Russian Federation (but not less than 2%), max -150% of the key rate of the Central Bank of the Russian Federation;

- for loans in CHF and JPY: min – 1%, max – corresponding rate plus 5%;

- for loans in EUR, CNY, GBP and other currencies: min – 1%, max – corresponding rate plus 7%.

The first reporting period under the amended rules is 2024, notification of controlled transactions must be submitted before 20.05.2025, but an audit of contracts that are subject to changes and possible adjustments to international transactions must be carried out now.

There are many changes in transfer pricing, and the risks of additional charges for transfer pricing are increasing.

High-quality documentation remains a tool for protecting the taxpayer’s position regarding approaches and methods for justifying market prices

We have been working with transfer pricing and preparing documentation for our clients for many years.

We will gladly support you in preparing a reasoned tax position.

Contacts:

Eugenia Chernova

Olga Kireyeva

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025

Dear colleagues, Please accept our sincere congratulations on the upcoming New Year and Christmas!

MTPP Workshop

PROGRAM

Implications for Transfer Pricing

Eugeniya Chernova

“Suspension of DTT and expansion of the list of offshore jurisdictions. Changes. Mitigation?

Comments. Consequences.”

Daria Pogodina

ABOUT THE SEMINAR

During her speech, Eugenia Chernova highlighted how changes in tax regulation and the international situation affected the practice of transfer pricing in Russian and transnational companies. Particular attention was paid to new documentation requirements, changes in approaches to comparability analysis and increased control by tax authorities. The report was accompanied by examples from practice and caused an active discussion.

Daria Pogodina, within the framework of the topic, analyzed the current changes in the regulation of transactions with foreign related parties, the expansion of the list of offshore jurisdictions and their impact on taxation and the corporate structure of business. Comments were given on current regulatory documents, as well as recommendations for reducing risks and adapting to new conditions. The report generated increased interest among specialists in the field of international taxation.

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025

Dear colleagues, Please accept our sincere congratulations on the upcoming New Year and Christmas!

Expansion of the list of offshores. Softening. Comments. Consequences

Eugenia Chernova spoke on the topic “Expansion of the list of offshore jurisdictions. Mitigation. Comments. Consequences.” The speaker analyzed in detail the latest changes in the list of offshore jurisdictions, possible tax and legal consequences for Russian companies, as well as measures aimed at mitigating new restrictions. The report aroused the interest of participants working with foreign structures and international settlements.

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025

Dear colleagues, Please accept our sincere congratulations on the upcoming New Year and Christmas!

Extension of the list of offshore zones – What to expect?

Since Russia has been closely interacting with China in various fields over the past decades, many Russian representatives of small and medium-sized businesses are beginning to actively cooperate with Chinese partners. Russian businessmen who are not aware of the peculiarities of the Chinese mentality may encounter serious difficulties when signing contracts with Asian partners.

In this review we would like to draw your attention to the important features of concluding contracts between partners from Russia and China, which will help you to avoid a number of mistakes:

1. The only official language in China is Chinese. Thus, it is advisable to sign the text of the contract not in Russian and English, but in Russian and Chinese (the official languages of Russia and China).

If the Chinese partners do not insist on this, this can only mean that they do not intend to register the contract with the Chinese government authorities.

2. The name of a Chinese company registered in China can only be in Chinese, and the English name of the company is not legally valid to the full extent Chinese, as well as Russian, courts do not consider claims if the documents do not indicate the real (registered) company names.

3. It is necessary to check the registration of the Chinese company by requesting from the partner a certificate of registration of a legal entity, and also make sure that its representative has the appropriate authority.

It should be kept in mind that only the legal representative of the company has the right to sign a contract without a power of attorney. This may not always be the CEO of the company. The legal representative must be indicated in the certificate of registration of a legal entity.

If someone else signs the contract on the Chinese side, they are required to present a power of attorney. Therefore, when concluding a contract with a Chinese company, it is worth asking the future partner for a power of attorney confirming the authority of the signatory.

4. It is important to check the registration (legal status) of the Chinese seal.

Each Chinese company generally has one main seal, which is strictly controlled. However, to support various types of activities, companies often produce additional types of seals, including “contract seals.” Having produced such seals, Chinese companies often do not amend the registration documents accordingly or otherwise register their legal status.

In this regard, it is recommended to check whether the Chinese partner’s seal is registered by requesting a certificate from the State Commerce and Industry Administration of the government at the place of registration of the Chinese company. It is quite easy to obtain such a certificate, and falsifying it is dangerous for a Chinese partner.

5. To protect yourself, it is recommended to check the company’s website. The site must have a Chinese version, otherwise there is a high chance of encountering scammers. You should check the domain name registration date and ownership.

6. In order to avoid difficulties with the recognition and enforcement of decisions of Russian courts in China, it is recommended to introduce an arbitration clause and include in it one of the well-known institutional arbitration centers in China, for example, the China International Economic and Trade Arbitration Commission (CIETAC), the Beijing Arbitration Commission (BAC), etc.

On the one hand, this will require additional costs for contacting Chinese lawyers or Russian specialists with experience in representing the interests of parties in Chinese arbitration. On the other hand, this will simplify the issue of recognition and enforcement of the decision under the New York Convention of 1958.

If the Chinese partners do not want to resolve the dispute in arbitration due to the high cost of the procedure, then, in order to avoid difficulties with the recognition and execution of decisions of Russian courts in China, it is better to establish a clause for those disputes, for which this is possible, regarding their resolution in a Chinese state court, since Russian courts readily recognize decisions of Chinese courts.

Contacts:

Eugenia Chernova

Olga Kireyeva

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025

Dear colleagues, Please accept our sincere congratulations on the upcoming New Year and Christmas!

International payments and account opening difficulties

An increasing number of Russian banks are now suspending the opening of accounts for new customers, restricting the opening of new foreign currency accounts for existing customers, introducing commissions for keeping foreign currency in accounts, and imposing limits on foreign currency transfers or ceasing to make such transfers abroad altogether.

We continuously monitor the situation with local banks, keep track of updates on the conditions with foreign currency international transfers with European and CIS countries, and maintain a consolidated analytical register, including for banks in Russia that are in the TOP-100 of current Russian financial sector rankings.

We also provide additional comprehensive account opening support to our clients, namely:

- full communication with the bank;

- clarification of the requirements for the package of documents to be submitted for account opening;

- preparation and verification of the set of documents required for account opening/provision of information on the documents required for account opening;

- completion of all required applications and forms;

- control over the opening of bank accounts;

- preparation of the documents for granting access to the online bank and connecting authorized signatories and non-signatories to the online bank.

Should you have any difficulties with international payments, account opening or other related issues, we will be happy to provide you with more detailed information upon request and offer our support.

Contacts:

Maria Matrossowa

Yulia Belokon

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025

Dear colleagues, Please accept our sincere congratulations on the upcoming New Year and Christmas!

Business Abroad: What Notifications Need to Be Filed?

In this review, we have summarized the rules governing the required notifications and reports that must be filed in the Russian Federation if you have (or are acquiring) a share in a foreign organization.

When creating/acquiring a share in a foreign organization: notification

When a share in a foreign organization arises (or changes), regardless of the size of the share, an individual who is a tax resident of the Russian Federation must file a notification of participation in foreign organizations (on the establishment of foreign structures without forming a legal entity).

This notification must be filed no later than three months from the date of the emergence (change in share) of participation in a foreign organization.

Failure by a taxpayer to submit a notification of participation in foreign organizations to the tax authority within the prescribed period or submission of a notification of participation in foreign organizations containing inaccurate information entails a fine of 50,000 rubles for each foreign organization.

What is considered a controlled foreign organization (CFO)?

A controlled foreign company is a legal entity or a structure without the formation of a legal entity, the place of tax residence of which is a jurisdiction other than the Russian Federation, controlled by a legal entity or an individual who is a tax resident of the Russian Federation.

When creating / acquiring a share in a CFC (controlled foreign organization)

When a share in the CFC arises (changes) the individual must submit a notification of controlled foreign companies to the tax authority at the place of registration during the reporting year, but no later than April 30 of the year following the reporting year. The deadlines for sending an annual notification of a CFC to the Federal Tax Service for individuals are set out in Article 25.14 of the Tax Code of the Russian Federation.

The notification form is set out in legislation.

In addition to the notification form itself, it is necessary to collect a package of documents on the controlled foreign company and its participant. Typically, this list includes:

1. Certificate of registration of the organization and an extract from the trade register;

2. Certificate of the state – tax registrar;

3. Financial statements of the CFC, prepared in accordance with the personal law of such a company for the financial year. In case of its absence, it is necessary to submit other documents that confirm the profit or loss of the company;

4. Auditor’s report on the financial statements of the CFC, if the audit is mandatory or the company voluntarily conducted an audit;

5. Copy of the passport of the CFC participant;

6. Notarized power of attorney in case of notification by a third party.

If the original documents are attached not in Russian, a notarized translation is required.

Calculation of the tax base for the CFC

The minimum amount of CFC profit that can be used as a taxable base is 10 million rubles, CFC profit below this amount is not taxed in the Russian Federation and is not subject to declaration.

If the profit of a controlled foreign company exceeds 10 million rubles, it is used as a tax base for calculating income tax and is filled in the 3-NDFL declaration (Sheet B) for individuals. Information on each CFC is submitted separately, the data is not summarized. Declarations must be submitted to the Federal Tax Service as part of the normal procedure for filing declarations along with other sheets of the document.

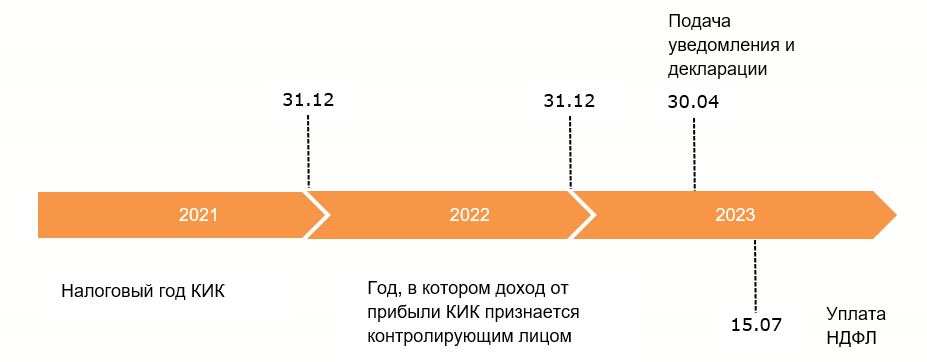

Particular attention should be paid to determining the date of receipt of profit from the CFC by the controlling person – December 31 of the year following the tax year of the foreign organization. The dates of receipt of profit and reporting on it are clearly presented in the diagram:

The profit (loss) of a CFC is the amount of profit (loss) of this company, determined in one of the following ways:

1. According to its financial statements prepared in accordance with the laws of the jurisdiction in which the company is registered, for the financial year;

2. According to the rules established by Chapter 25 of the Tax Code of the Russian Federation (in the event of failure to meet the conditions for determining the profit (loss) of a CFC based on its financial statements, as well as at the choice of the taxpayer – the controlling person).

In order to determine the profit (loss) of a CFC, the unconsolidated financial statements of such a company, prepared in accordance with the standard established by the personal law of such a company, are used. If the personal law of a CFC does not establish a standard for preparing financial statements, the profit (loss) of such a CFC is determined based on the financial statements prepared in accordance with International Financial Reporting Standards or other internationally recognized standards for preparing financial statements.

For tax purposes, the following are deducted from the profit of a CFC:

Distributed dividends (have already been taxed at source);

Dividends paid from Russian organizations (have already been taxed at the time of payment in the Russian Federation);

Losses from previous years (which can be offset against taxable profit regardless of the position of the CFC jurisdiction on this matter);

Distributed profit of a foreign person without forming a legal entity.

Exemption from taxation of profit of a controlled foreign company

The profit of a CFC is exempt from taxation in the Russian Federation if at least one of the following conditions is met with respect to such a CFC:

1. A CFC is a non-profit organization that, in accordance with its own law, does not distribute the profit (income) received between shareholders (participants, founders) or other persons;

2. A CFC is formed in accordance with the legislation of a member state of the Eurasian Economic Union and has a permanent location in this state;

3. The effective tax rate on income (profit) for this CFC based on the results of the period for which, in accordance with the personal law of such an organization, financial statements for the financial year are prepared, is at least 75% of the weighted average tax rate for corporate income tax;

4. The CFC is one of the following companies:

an active foreign company;

an active foreign holding company;

an active foreign subholding company;

and others that are less commonly applicable.

Carry-forward of a CFC loss

If, according to the financial statements of the CFC prepared in accordance with its personal law for the financial year, a loss is determined, the said loss may be carried forward to future periods without restrictions and taken into account when determining the CFC profit.

A CFC loss may not be carried forward to future periods if the taxpayer – the controlling person has not submitted a notification of the CFC for the period for which the said loss was incurred.

Fines for failure to provide notification of CFC

More information on the FTS website.

Contacts

Evgeniya Chernova

Olga Kireeva

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025