Category: International relations and sanctions

Legal protection of trademarks in Russia: risks and consequences of non-use

Dear colleagues,

Over the past year, international brands that have reduced their presence or left the Russian market have been registering trademarks in the Russian Federation, which has been widely covered in the media. Having received many questions from companies about the regulation of brand protection in the current situation, we decided to describe in more detail the mechanism of trademark protection in Russia, the existing risks, opportunities and options.

National and international trademarks in Russia

Russia protects both trademarks registered under the Madrid system (international registrations) and national marks registered with the Federal Service for Intellectual Property (Rospatent).

Russia recognizes conventional priority (Article 1507 of the Civil Code of the Russian Federation, Article 4 of the Madrid Agreement), which means protection of rights to a trademark registered in any Paris Convention country.

However

- the introduction of the parallel import regime has partially limited this protection for certain categories of goods;

- legal protection of a trademark may be terminated early if the right holder does not use it for three consecutive years in respect of the goods concerned.

This provision is set forth in Article 1486 of the Civil Code of the Russian Federation and corresponds to clause “c” of Article 5 of the Paris Convention for the Protection of Industrial Property dated 20.03.1883.

How does it happen?

In accordance with clause 1 of Article 1486 of the Civil Code of the Russian Federation, legal protection of a trademark may be early terminated in respect of all or part of the goods for which it is registered, if the mark has not been used for three consecutive years.

An interested person who has reasons to believe that the right holder does not use the trademark shall have the right to send him a proposal for voluntary withdrawal of legal protection.

Such a proposal may contain a claim either to

- submit an application to the federal executive body in the field of intellectual property to waive the right to the trademark, or

- enter into an agreement on alienation of the exclusive right.

This proposal shall be sent not only to the right holder, but also to the address indicated in the State Register of Trademarks or the relevant international register.

It is important to note that it is possible to send such a proposal only after three years from the date of state registration of the trademark. If within two months after receipt of the proposal the right holder does not take the abovementioned actions, the interested party is entitled within the next thirty days to apply to the court with a claim for early termination of legal protection of the trademark due to its non-use.

At the same time, the legislation does not contain an exhaustive list of cases when a person may be recognized as an interested party. The court in each specific case assesses whether the claimant has a legitimate interest in terminating the legal protection of the unused trademark. Any person whose legitimate interests are affected by the existence of an unused registration may be acknowledged an interested party.

Of course, the trademarks of foreign companies that left the Russian market in 2022 face particularly high risks of early termination of protection.

Consequences of loss of legal protection

If a trademark loses legal protection, there is a potential risk that third parties may register it on their names.

In this case, there is a risk that products marked with the trademark of the former right holder will appear on the market, as control over the brand will be lost.

Restoration of rights will require significant time and financial expenses.

Current situation: risks

The current situation with the possible consequences of the loss of legal protection of a trademark remains controversial.

Early termination of protection creates prerequisites for re-registration of a brand or registration of a similar designation. However, despite the significant number of applications duplicating or imitating foreign marks, Rospatent often refuses to register identical or confusingly similar marks held by well-known companies.

Nevertheless, although the implementation of such brand interception is fraught with obstacles and at the moment the practice is ambiguous, and some examples of court practice already exist that are not in favor of the foreign right holder.

Current situation: court practice

A recent example of early termination of trademark protection is the ruling of the Intellectual Property Rights Court dated 30.10.2024 (case No. SIP-334/2024). The court satisfied the claim of LLC “R-Climat” against Telefonaktiebolaget LM Ericsson and terminated the legal protection of the company’s trademarks in respect of goods of the 11th class of International Classification of Goods and Services (equipment for ventilation, heating and air conditioning).

The reason was non-use of the marks for three years, which created an opportunity for their re-registration by other persons.

Another case in a similar situation is the case concerning registration of the trademark “Fantola” (No. 712275), owned by the Russian company “Drinks from Chernogolovka-Aqualife”. The Western right holder Coca-Cola tried to challenge Rospatent’s decision, claiming that the mark was confusingly similar to its brand.

Despite the authority’s initial rejection of the objections, the company appealed to the Intellectual Property Rights Court (IPRC). The court proceedings took an ambiguous turn: at first, the court recognized Rospatent’s actions as invalid, but eventually sent the case for a reconsideration which confirmed that the “Fantola” trademark could be used.

This case demonstrates the complexity of such disputes and the lack of unambiguous judicial practice in matters of trademark similarity.

What can be done?

In order to reduce risks for companies, especially those that have left the Russian market, it is possible to consider maintaining registration or renewing the use of a trademark directly with Rospatent.

If registration/renewal of individual marks (e.g. a series or a family of similar trademarks) is done with a certain periodicity every 3 years, the loss of an older trademark will not entail the loss of other similar trademarks for use in the Russian Federation.

Nevertheless, when deciding on the necessity of such a step it is important to evaluate the totality of factors and assess the degree of risk: the risk is highest if the right holder’s goods are not represented on the Russian market and are not available to Russian consumers for more than 3 years.

In this situation, formal registration of the trademark in the Russian Federation may not be sufficient, as the fact of use/non-use of the brand in the Russian Federation is of priority importance. Such trademarks should be actually used to show the good faith of the right holder.

Thus, it is important to assess the whole issue in a comprehensive manner, taking into account all factors in each individual case.

When considering all options, it is important to assess whether the following issues have been or will be resolved:

- Legal defense – whether there will be an opportunity to stop illegal use of the brand and counterfeit products.

- Right to sue – whether there will be the ability to recover compensation for infringement of exclusive rights.

- Preservation of market position – whether there will be protection against brand takeover and unfair competition.

- Flexibility to return the business – whether it will be possible to resume operations in the Russian Federation without losing trademark rights.

Conclusion

In the context of sanctions and changes in legislation, trademark rights holders need to actively monitor their use in Russia. Otherwise, there is a risk of losing rights, which may lead to serious commercial and reputational losses. Timely legal measures will allow you to retain control over your brand and avoid undesirable consequences.

We will be happy to assist you in solving this task and answer your questions.

Submit a request

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025

Dear colleagues, Please accept our sincere congratulations on the upcoming New Year and Christmas!

Situation with cross-border payments as of March 2025

Daria Pogodina presented a report on the topic “The situation with cross-border payments as of March 2025” in Lipetsk. During her speech Daria presented up-to-date information on the current state of cross-border settlements, including changes in the regulation of foreign exchange transactions and documentation requirements. Particular attention was paid to changes in international payment practices and the adaptation of businesses to new conditions. The report aroused interest among participants engaged in foreign economic activity.

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025

Dear colleagues, Please accept our sincere congratulations on the upcoming New Year and Christmas!

SWISS & RUSSIAN VIEWS AND PERSPECTIVES BY ACADEMIA AND BUSINESS

Daria Pogodina spoke at the conference “Swiss & Russian Views and Perspectives by Academia and Business” with the report on the topic “Practical Experience in Intercultural Communication with German-Speaking Countries”. As a part of the presentation, the speaker shared practical observations and cases from professional interaction with partners from Germany, Austria and Switzerland. The issues of differences in business culture, communication models were considered, and recommendations were given on how to build cooperation in an intercultural environment effectively. The report aroused keen interest among participants from the academic and business environment.

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025

Dear colleagues, Please accept our sincere congratulations on the upcoming New Year and Christmas!

International settlements in cryptocurrency in 2024. Recent changes and practice

Daria Pogodina spoke at the meeting of the Accounting Working Group of the Russian-German Chamber of Commerce with a report on the topic “International Settlements in Cryptocurrency in 2024. Recent Changes and Practice.” The speaker covered current changes in the regulation of cryptocurrency transactions, including new requirements for cross-border payments and legal aspects of using cryptocurrencies for international settlements. During the speech, recommendations were given for compliance with the law, and practical cases were considered demonstrating the successful use of cryptocurrencies in international business practice. The report aroused keen interest among accountants and specialists working with innovative financial instruments.

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025

Dear colleagues, Please accept our sincere congratulations on the upcoming New Year and Christmas!

Account of a Russian LLC abroad

In the context of ongoing difficulties with international payments, many companies have found it necessary to open an account in a foreign bank.

However, it is important to remember that opening a bank account in another jurisdiction imposes a number of additional obligations on the company, including the submission of necessary reports and notifications.

In our review, we will look at how not to violate the law in this situation and how to avoid penalties.

Let’s take a step-by-step look at what a company has to do to comply correctly with all requirements.

1. Notify the Federal Tax Service of Russia.

It is necessary to notify the Federal Tax Service in the following cases:

- opening a bank account outside the Russian Federation;

- closing such an account;

- changing the account details.

All Russian organizations are required to submit the corresponding notification. (Part 2, Part 8 of Art. 12 of the Law No. 173-FZ). The notification should be sent to the tax authority at the location of the organization in the form approved by the Order of the Federal Tax Service of Russia dated 26.04.2024 N SD-7-14/349@, within one month from the date of opening (closing) an account or changing the details, respectively (Part 2 of Art. 12 of the Currency Control Law).

Two forms have been approved: one is for opening and closing an account (Appendix N1), the other is for changing the details of this account (Appendix N2).

The notification can be submitted to the tax authority on paper (in person, through a representative, by registered mail) or in electronic form via telecommunication channels (TCC) or through the taxpayer’s personal account (PA).

When making the first transfer to a bank account abroad, the organization needs to provide the Russian bank with a notification on opening this account with a tax inspector’s note on its acceptance (Part 4 of Art. 12 of the Currency Control Law).

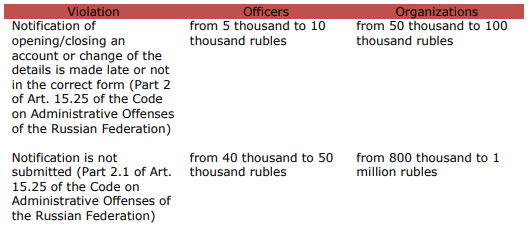

Failure to submit a notification about account or violation of the terms or procedure for submitting it may result in a penalty being imposed on the organization.

Their amounts are established in the Art. 15.25 of the Code on Administrative Offenses of the Russian Federation.

2. Report to the Federal Tax Service on flow of funds.

If a legal entity (resident of the Russian Federation) has foreign accounts, it has to submit a cash flow statement to the tax authority quarterly within 30 days after the end of the reporting quarter, attaching supporting documents: statements or other documents issued by the bank (Decree of the Government of the Russian Federation dated 28.12.2005 N 819 (as amended on 22.05.2024)).

If the documents are drawn up in a foreign language, the organization has to attach a translation into Russian, duly certified in accordance with the legislation of the Russian Federation (cl. 7 of the Rules for the Submission of Reports by Residents – Legal Entities).

The translation can be carried out by an employee of an organization or an organization engaged in translation activities, since the methods of translation are not limited by the law.

If necessary, at the request of the tax authorities, translation into Russian, notarized in accordance with the requirements of the legislation of the Russian Federation, shall be provided.

3. Comply with the currency legislation, in particular, carry out only legal currency transactions.

Contracts with non-residents, the amount of obligations for which exceeds the established threshold, namely, import contracts from 3 million rubles and export contracts from 10 million rubles, must be registered by an authorized bank of the Russian Federation.

The bank will assign a unique number to the contract (cl. 4.2, 5.5 of the Bank of Russia Instruction dated 16.08.2017 N 181-I (as amended on 09.01.2024).

When crediting export proceeds to an account abroad, it is necessary to provide to the authorized bank a certificate of currency transactions for settlements through an account abroad under accounting contracts, as well as provide a bank statement.

The term for providing a certificate of currency transactions for settlements through an account abroad is within 30 working days after the last day of the month in which such transactions were carried out.

4. Is it necessary to repatriate currency?

At present, the obligation to repatriate currency has only been retained for some companies.

From 16.10.2023 to 30.04.2025 inclusive, certain Russian exporters specified in the List approved by the Decree of the President of the Russian Federation dated 11.10.2023 No. 771, are required to credit to their accounts in authorized banks and sell proceeds in foreign currency on the domestic currency market of the Russian Federation within the established period and in the established amounts (cl. 1, 5 of the Decree of the Government of the Russian Federation dated 12.10.2023 No. 1681 “On measures for the implementation of the Decree of the President of the Russian Federation dated October 11, 2023 No. 771”).

The closed list consists of 43 groups of companies belonging to the sectors of the fuel and energy complex, ferrous and non-ferrous metallurgy, chemical and forestry industries, and grain farming. Exporters are notified of their inclusion in the list within 3 days by the Ministry of Economic Development of Russia.

For companies that are not on the closed list, the amount of foreign currency earnings subject to mandatory sale is currently 0%.

Therefore, if the organization is subject to the cancellation of repatriation, the terms for transferring export proceeds from the organization’s account opened abroad to a Russian bank are not established by regulation, i.e. such funds may remain on account abroad and these funds can be used, for example, for settlement of import or other contracts.

Contacts:

Natalia Safiulina

Nadezhda Kolomnikova

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025

Dear colleagues, Please accept our sincere congratulations on the upcoming New Year and Christmas!

Changes in regulating transactions with persons from unfriendly countries

At this moment, for companies with Western participation, coordination of transactions with the subcommittee of the Government Commission for Control of Foreign Investments in the Russian Federation remains of great relevance. The subcommittee has the right to make decisions on the issuance by the Government Commission of permits for residents of the Russian Federation to carry out transactions with foreign persons from unfriendly countries, as well as currency transactions.

We would like to remind you that unfriendly countries, in accordance with the order of the Government of the Russian Federation dated 05.03.2022 No. 430-р, include, among others, Australia, Great Britain, Canada, the Republic of Korea, the USA, Ukraine, Switzerland, Japan and all member states of the European Union.

In particular, in the Decree of the President of the Russian Federation dated 08.09.2022 No. 618 restrictions were established for the execution of transactions that directly and/or indirectly entail the establishment, change or termination of the rights of ownership, use and/or disposal of shares in the authorized capital of limited liability companies or other rights that make it possible to determine the conditions for management of such companies. First of all, these are transactions for disposal of shares in the authorized capital of limited liability companies, which have become relevant due to the desire of a number of Western companies to temporarily or permanently leave the Russian market due to the political situation.

Such transactions can only be carried out on the basis of permits issued by the Government Commission for Control of Foreign Investments in the Russian Federation, which, if necessary, contain the conditions for carrying out these transactions. The procedure and criteria for issuing permits are constantly updated with a tendency to become stricter, which is aimed at complicating the exit of Western businesses from the Russian market and maintaining their presence in the Russian Federation.

In addition to the requirements for documents that must be drawn up and submitted for approval, from the end of 2022, in order to alienate the share of an “unfriendly” participant of a limited liability company, it is necessary to pay a voluntary contribution to the budget of the Russian Federation (see our previous review on changes in this area), as well as to carry out the transaction with a mandatory discount.

At the end of October 2024, the Ministry of Finance of Russia published an updated regulation (Extract from the minutes of the meeting of the subcommittee of the Government Commission for Control of Foreign Investments in the Russian Federation dated 15.10.2024 No. 268/1). The new procedure includes the following:

- The amount of the voluntary contribution to be paid to the budget when Russian companies are disposed of by “unfriendly” participants has increased. Now it is 35% of the market value of the asset based on the results of its independent assessment (previously it was necessary to pay 15%).

An installment plan was introduced for payment of the contribution. 25% of the asset value must now be transferred to the Russian Federation budget within a month from the date of the transaction, 5% within a year, and another 5% within two years from that date. - In addition, the size of the mandatory discount to the market value of the asset upon alienation of an LLC has been changed. Now it must be a minimum of 60%, whereas previously the company could be sold for 50% of its market value.

Also, if the market value of the alienated assets is more than 50 billion rubles, the consent of the President of the Russian Federation will be required to complete the transaction.

The new conditions should apply both to future applications for approval of transactions, and to those already submitted, but not considered by the Government Commission.

Other news includes amendments to the Decree of the President of the Russian Federation dated 04.05.2022 No. 254 regarding the payment of profit of Russian resident companies to their foreign participants.

Let us remind you that in order to pay “unfriendly” participants profit in an amount exceeding 10 million rubles per calendar month or the equivalent of this amount in foreign currency, it is necessary to follow the procedure established by the Decree of the President of the Russian Federation dated 05.03.2022 No. 95. This procedure involves opening a special account of type “C” in a Russian credit institution in the name of a foreign creditor, through which the corresponding settlements are made. At the same time, the Ministry of Finance of the Russian Federation was given the authority to determine a different procedure for payment of residents’ profits to foreign creditors, which meant the need to obtain permissions from the Ministry of Finance for this procedure.

From 09.09.2024, the authority to issue permits for the payment of dividends by Russian companies to persons from unfriendly countries was granted to the Government Commission for Control of Foreign Investments in the Russian Federation. Such permits may contain conditions for the payment of profits.

The Government of the Russian Federation will additionally develop and approve the procedure for issuing such permits by the Government Commission. After the adoption of the changes, the procedure and terms for approving the payment of dividends may become milder.

We will keep you updated on the news of the relevant regulation, and are also ready to provide legal support when interacting with authorized bodies on issues of approving transactions and paying dividends to “unfriendly” foreign persons.

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025

Dear colleagues, Please accept our sincere congratulations on the upcoming New Year and Christmas!

Counterparty verification in the CIS countries: Kazakhstan

Daria Pogodina gave a presentation at the Moscow Chamber of Commerce and Industry on the topic of “Checking a Counterparty in the CIS Countries: Kazakhstan”. The speaker shared practical recommendations for checking the reliability of partners in the jurisdiction of Kazakhstan, highlighted available sources of information, features of corporate legislation and possible risks when working with local companies. The presentation was especially useful for participants conducting foreign economic activity in the CIS.

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025

Dear colleagues, Please accept our sincere congratulations on the upcoming New Year and Christmas!

Briefing “Central Asia market development: Kazakhstan” Almaty

Daria Pogodina made a presentation at the briefing in Almaty on the topic “How to check your counterparty in Kazakhstan from abroad?”. During her presentation Daria talked about key sources of information for checking the reliability of partners in Kazakhstan, legal aspects of access to data, typical risks and ways to minimize them. The presentation was aimed at international companies planning business cooperation in the region, and included practical advice on remote verification of counterparties.

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025

Dear colleagues, Please accept our sincere congratulations on the upcoming New Year and Christmas!

swilar at the Russian-German Chamber of Commerce Conference

On June 5, swilar spoke at the annual Conference for CFOs of the Tax and Financial Reporting Committee of the Russian-German Chamber of Commerce.

Daria Pogodina, CEO of swilar, spoke on the topic that the company constantly monitors — “The current situation with payments to friendly countries.” Conference participants highly appreciated the comprehensive analysis and effective practical recommendations that were given in the report.

The VTP conference became a platform for lively discussions and exchange of experience between CFOs of leading foreign companies, especially regarding the situation with expected tax changes, international payments and financial service management in the context of the economic crisis.

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025

Dear colleagues, Please accept our sincere congratulations on the upcoming New Year and Christmas!

Counterparty verification in CIS countries: Kazakhstan

We would like to draw your attention to the screening possibilities of foreign counterparties in the Republic of Kazakhstan.

To reduce risks and check the reliability, solvency and security of your foreign counterparty, you should take the following steps:

- Legal check;

- Financial check;

- Check valid licences, if applicable;

- Check other factors such as publicly available information / business reputation: customer reviews, relationships with partners or contractors.

As part of the legal review of an LLP (Limited Liability Partnership or “TOO”), which acts as a separate legal entity based on its own Charter, you should request the following legal documents:

- Charter;

- Memorandum of Association (however, the counterparty may refuse to provide this as the provisions may be confidential);

- Resolution/protocol on the appointment of the directors;

- State registration certificate – certificate of registration. What to check: Consistency of the information in the certificate with other incorporation documents;

- Business Identification Number (BIN) – a unique number created for a legal entity (branch and representative office) and self-employed persons;

- Registration number of the VAT payer’s certificate.

Also pay attention to the company’s legal address for local authorities. It must be specified in the Charter and other documents when registering the LLP and can be either a commercial premises or a private address (e.g. the founder’s flat).

There are following risk factors:

- “mass registration address”;

- mismatch between the legal and actual addresses (when submitting to the tax office), which is especially relevant for VAT payer counterparties.

The charter capital of an LLP must be at least 100 times the monthly calculate on index (MCI) at the time of submitting the formation documents for state registration. Fr om January 1, 2024, the MCI will be 3,692 tenge, i.e. the minimum capital must be 369,700 tenge (approx. RUB 73,000). The charter capital must be fully paid within one year from the date of registration. For small companies (up to 100 employees, income up to 300,000 MCI/year) there is no minimum capital (it can therefore be 0 tenge).

The executive body can be collective (directorate) or individual (director). An LLP can have several directors who act independently of each other (but only natural persons).

In addition, we would like to draw your attention to the official regime of “suspension of activity” in the Republic of Kazakhstan (the official analogue of “sleep mode” in the Russian Federation). During suspension, a company cannot conduct any profitable activities, but it is not liquidated and can be reinstated. Information on companies whose activities have been suspended can be obtained from the website of the State Revenue Committee of the Ministry of Finance of the Republic of Kazakhstan (SRC).

Further, in case the signatory of the contract is a director acting on the basis of the Charter, you should check the following aspects:

- Timeliness of the authorization (the data in the decision / protocol of appointment should coincide with the data in the state registers);

- Duration of the authorization;

- Existence of possible restrictions (e.g. transactions above a certain amount may require the approval of the participants, this may be specified in the Charter);

- Delimitation of powers if there are several directors.

If the signatory of the contract is acting on the basis of a power of attorney, be sure to request and scrutinize it for:

- The authority of the person issuing the power of attorney. If it is not signed by a director, but by another person based on the power of attorney with the right of overriding power of attorney, you should also request and check the original power of attorney;

- Description of the powers of the person acting on the basis of the power of attorney.

Wh ere to get data (open sources):

- Portal of the Bureau of National Statistics of the Agency for Strategic Planning and Reforms of the Republic Kazakhstan (RK).

Here you can find basic information about the company.

- Portal of the State Revenue Committee of the Ministry of Finance of the RK (www.kgd.gov.kz).

Here you can find:

- Details on suspension / non-suspension of activities;

- Information on the absence (presence) of tax arrears;

- Total amount of taxes paid;

- Presence of the counterparty in the List of unreliable taxpayers;

- Information about being / not being in the process of liquidation.

Here you can find the availability of open and past court cases.

- Public procurement portal.

Here you can see if the counterparty is on the list of unfair participants in public procurement.

- Portal of the Electronic Government of the Republic of Kazakhstan Egov.kz.

Here you can find:

- Information about the registered legal entity as of a given date;

- Details of the latest amendments to the constituent documents;

- Information about participation of the legal entity in other legal entities;

- Information on the presence of branches and representative offices of the legal entity;

- Information on the category of the subject of entrepreneurship;

- Data on encumbrances (seizure) on the legal entity’s share;

- Information on recognition of the legal entity as an inactive legal entity or involvement of its participants in inactive legal entities.

Unfortunately, as in many other jurisdictions, to obtain full data from public official sources, in most cases verification or authorization may be required, which requires a local phone number or IIN / BIN (analogue to the Russian TIN). In this regard, it may be necessary to engage a local partner to carry out a full-fledged verification.

For bigger or more significant deals, of course, the financial condition of the counterparty should be checked. For this purpose, it is necessary to request and analyze financial and tax statements for the last reporting periods:

- Balance sheet,

- Profit and Loss Statement,

- Cash flow statement.

Analyzing the financial statements will help to understand how successful and sustainable the company is, and to identify problems / risk factors.

We would also advise you to look at:

- review of financial ratios,

- analysis of current assets and total debt,

- profit and loss analysis,

- and get information about the bank details of the counterparty in advance – not all banks in Kazakhstan accept and send payments to Russia or do so with restrictions on the type of currency / banks from the Russian Federation.

We will be happy to answer your questions and, if necessary, carry out a counterparty check at your request.

Contacts:

Maria Matrossowa

Nadezhda Maskaeva

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025