Category: Corporate issues

Conditions for authorizing transactions with company shares and dividend payments have been updated

On 12.07.2023 an extract fr om the decision of the sub-commission of the Government Commission for Control of Foreign Investment in the Russian Federation dated 07.07.2023 No. 171/5 was published on the official website of the Russian Ministry of Finance which:

- has updated the conditions for authorizing transactions with company shares and dividend payments;

- has declared the minutes of the meetings of the sub-commission dated 22.12.2022 No. 118/1 and dated 02.03.2023 No. 143/4, which we informed you about earlier, as invalid.

To be more specific, now the conditions for granting permissions by the Government Commission for transactions with company shares are as follows:

- a report on independent assessment of the market value of the assets carried out by an appraiser that works in private practice and is listed among the appraisers (appraisal organizations) that are recommended by the sub-commission, or by an appraiser who has concluded the employment agreement with a legal entity that is included in this list.

- an expert opinion prepared by an expert or by experts from an appraiser’s self-regulatory organization listed among the appraiser’s self-regulatory organizations that have been recommended by the sub-commission to prepare an expert opinion;

- sale of assets at a discount of at least 50% of the market value of the relevant assets as indicated in the assets assessment report;

- the obligation to make a voluntary contribution to the federal budget within three months from the date of the transaction in the amount of:

- at least 10% of half of the market value of the relevant assets – if the assets are sold at a discount of less than 90% of the market value of the relevant assets, or

- at least 10% of the market value of the relevant assets – if the assets are sold at a discount of more than 90% of the market value of the relevant assets.

- establishment of key performance indicators for purchasers and (or) the OOO acquired by them, which should provide for:

- preservation of the technological potential and the main type of economic activity of such OOO;

- preservation of jobs;

- discharge of contract obligations under agreements with other legal entities.

- buyback transaction at the market value on the date of exercise of such option, economic benefit to the holder of the asset who is a Russian resident, and restriction of the period of validity of the permission (generally, no longer than two years from the date of the primary transaction) – for a transaction that provides for the buyback transaction;

- settlement of the transaction:

- either using a C-type account (more details here);

- or in rubles within the banking system of the Russian Federation without transfer of money out of the Russian Federation;

- or by transfer of money to the vendor’s account in a foreign bank, but in case of installment payment.

- the applicant has any other permissions required for the transaction under Russian law, details of which are provided by the applicant (g., the approval of the Federal Antimonopoly Service of Russia).

When decisions are made on granting permissions for dividend payments to foreign creditors, the followings shall be taken into account:

- the amount of dividends to be paid is no higher than 50% of the amount of net profit for the previous year;

- the results of retrospective analysis of dividend payments for previous periods shall be taken into account;

- readiness of participants (shareholders) who are foreign creditors to continue commercial activities in the territory of the Russian Federation;

- accounting of the positions of federal executive authorities on the assessment of the importance of the organization’s activities and the influence of the organization’s activities on the technological and industrial independence of the Russian Federation and the social and economic development of the Russian Federation (constituent entities of the Russian Federation);

- applicant’s performance of its obligations to meet the key performance indicators that has been confirmed by the federal executive authorities;

- the opportunity for dividends to be paid on a quarterly basis, if the established key performance indicators are met.

We would like to draw your attention to the fact that the abovementioned conditions for dividend payments have been mitigated according to the extract from the minutes of the sub-commission of the Government Commission for Control of Foreign Investment in the Russian Federation dated 09.08.2023 No. 182/5 which was published on the official website of the Ministry of Finance of Russia on 23.08.2023.

In particular, residents may now be authorized to pay dividends to foreign creditors without meeting these conditions, as a rule, in cases wh ere after 01.04.2023 foreign creditors make investments in the Russian economy, including the expansion of production in the Russian Federation, development of new technologies, and in the amount not exceeding the amount of such investments.

Contacts:

Maria Matrossowa

Yulia Belokon

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025

Dear colleagues, Please accept our sincere congratulations on the upcoming New Year and Christmas!

Online seminar 09.08.2023 — FAQ OF FOREIGN SUBSIDIARIES IN RUSSIA

Daria Pogodina participated in an online seminar and spoke in detail about the possibilities of transferring Russian subsidiaries with foreign participation to the so-called “sleep mode”, as well as about liquidation procedures in the current legal environment. Restrictions, approvals with the government commission and practical steps that are be considered when making corporate decisions were reviewed. The seminar aroused keen interest among companies considering restructuring or curtailing operations in Russia.

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025

Dear colleagues, Please accept our sincere congratulations on the upcoming New Year and Christmas!

Liquidation of a company – peculiarities of the procedure in 2023

In this overview, we would like to draw your attention to some of the issues that foreign-owned companies face in liquidating an LLC (rus. OOO) in Russia in 2023.

What is generally important to keep in mind when deciding on liquidation:

- Liquidation is not a quick process and will take up to 1 year. This term may be extended for 6 months through the court (para 6 of the article 57 of the Federal Law No. 14-FZ dated 08.02.1998 “On Limited Liability Companies”);

- As soon as the decision is made to liquidate the company, the powers of the current CEO will be terminated and the liquidator/liquidation commission will take over the management of the company (a previously acting CEO may also be appointed);

- The company will need to carry out “preparatory work”: by the time of liquidation, it will need to ensure that it has no open tax and supplier/buyer debts;

- It is necessary to plan work with personnel and terminate labor contracts;

- It will be necessary to archive documents: archiving is mandatory for certain types of documents, and the retention period should be 75 years or even more, depending on the type of a document;

- It is necessary to be prepared for a possible tax audit: the depth of the audit, as a rule, may be up to three preceding years.

In addition to the abovementioned general standards, in 2023 the companies with foreign participation from unfriendly countries must consider the following points:

- Restrictions on payments with participants from foreign (unfriendly) states.

Payments in the amount exceeding 10 million Rub. (or equivalent in other currency) per calendar month made by residents to persons from unfriendly states as a result of liquidation of Russian legal entities are subject to a special procedure: in accordance with paras 2-9 of the Presidential Decree No. 95 dated 05.03.2022, they must be made through C-type accounts. More details on C-type accounts can be found here.

Payments may be made without following this procedure on the basis of permissions issued by the Bank of Russia and the Ministry of Finance of Russia (Presidential Decree No. 737 dated 15.10.2022).

- Permission of the Governmental Commission

Based on the official explanations of the Russian Ministry of Finance, liquidation is not directly included in the list of transactions for the purpose of applying Presidential Decree No. 618 dated 08.09.2022 and does not relate to transactions that require permission of the Governmental Commission for Control over Foreign Investment in the Russian Federation (the “Governmental Commission”).

Still most notaries refuse to certify liquidation applications if there is no permission issued by the Governmental Commission, so it is necessary to take this factor into account when planning the process.

Thus, when deciding on liquidation, we recommend to consider the abovementioned peculiarities, carefully weigh the pros and cons, including considering other possible options that may help to simplify this procedure.

Contacts:

Maria Matrossowa

Yulia Belokon

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025

Dear colleagues, Please accept our sincere congratulations on the upcoming New Year and Christmas!

New in migration legislation: changes for highly qualified specialists

On July 10, 2023, Federal Law No. 316-FZ was adopted, introducing a number of significant changes regarding the legal status of foreign citizens in the Russian Federation (hereinafter referred to as “Law No. 316-FZ”).

This law entered into force on July 10, 2023, but provides for separate, later deadlines for the entry into force of a number of provisions (more details below).

According to the new rules, family members of highly qualified specialists (hereinafter referred to as “HQS”) will be required to undergo a medical examination again within 30 calendar days from the date of the decision to extend the validity of the HQS work permit or from the date of entry into the Russian Federation (if they were outside the Russian Federation on the day of such a decision). Previously, family members of HQS were required to undergo a medical examination annually.

In addition, after 180 days from the official publication of Law No. 316-FZ, the following changes will come into force:

The obligation to obtain a work permit within 30 calendar days from the date of the decision to issue (extend) it is introduced.

In the presence of documented valid reasons and a written application from the employer, a work permit may be obtained at a later date, but not exceeding 30 calendar days. After the expiration of the established period, a work permit is not issued, and the decision to issue (extend) it is canceled.

In the event of early termination of an employment or civil law contract, the HQS, as before, has the right to search for another employer or customer of work within 30 working days.

If a new contract has not been concluded upon expiration of this period, the HQS and his family members will be required to leave the Russian Federation within 30 calendar days, and their visas and residence permits (if any) will be considered cancelled.

Before the said changes come into force, HQS and their family members will be given 30 working days to leave.

A HQS who has worked in this capacity in the Russian Federation for at least two years and his family members who have a residence permit will be issued an indefinite residence permit if the following conditions are met:

The HQS and family members reside in the Russian Federation with a residence permit;

during the period of the HQS’s employment, the employer calculated, withheld and transferred taxes to the budget system of the Russian Federation.

It is envisaged to issue a work permit for highly qualified specialists to carry out labor activities in two or more constituent entities of the Russian Federation if the following conditions are met:

work in other constituent entities is provided for by the provisions of an employment or civil law contract for the performance of work (provision of services);

a foreign citizen carries out labor activities in separate divisions of an organization, branches or representative offices of a legal entity or with related parties located in these constituent entities.

A ban on the employer to attract foreign highly qualified specialists to labor activities in the Russian Federation for two years in the event of failure to provide the tax authorities with information on the amounts of personal income tax calculated and withheld by the tax agent in relation to highly qualified specialists after 6 months, as well as if the information provided turned out to be fake or counterfeit.

In addition, from 01.03.2024, the level of wages (remuneration) of highly qualified specialists will increase to 750 thousand rubles per quarter. Before the changes were introduced, the threshold was 2 million rubles/year.

At the same time, Law No. 316-FZ does not cancel the previous reduced wages required to attract highly qualified specialists who are medical, teaching staff, participants in the implementation of the Skolkovo project, and employees of resident companies of special economic zones.

We are closely monitoring the development of the situation and innovations in legislation and will be happy to answer any questions you may have!

Your contacts on this topic:

Maria Matrosova

Yulia Belokon

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025

Dear colleagues, Please accept our sincere congratulations on the upcoming New Year and Christmas!

Reminder: time to think about your SME status

We would like to remind you that in order to keep SME status companies with foreign participation should apply the list of required documents for entry into the register.

As for now, SME status is still available for those companies in which foreign participation exceeds 49%.

At the same time the necessary condition for entry is the compliance of both the foreign parent company and the Russian subsidiary with the criteria of small and medium-sized businesses set in the Russian Federation (in terms of headcount and income not exceeding the threshold for medium-sized businesses) – according to the Federal Law of 24.07.2007 N 209-FZ:

- the size of the average number of employees for the previous calendar year does not exceed 250 people (the maximum threshold for medium-sized enterprises);

- The amount of income from business activities in the previous calendar year does not exceed 2 billion roubles (maximum threshold for medium-sized enterprises).

For companies with foreign participation the data for inclusion in the register must be input by the authorized auditing organization in the period from July 1st to July 5th , 2023.

Expert comment from Olga Grigorieva, CEO of the audit company Sterngoff Audit:

“The authority to confirm information for the SME registry and to submit it to the tax authority is the function of auditing organizations (part 6.2 of Article 4.1 of the Federal Law “On the Development of Small and Medium Entrepreneurship in the Russian Federation”).

That’s why the support from the auditors should be obtained. The auditors will conduct the necessary auditing procedures, check the data of the subsidiary and the parent company, and, in case the criteria are met, the auditing company will submit information to the register.

We submit the information monthly from the 1st to the 5th calendar day of the month. IMPORTANT NOTICE – the status previously obtained must be confirmed annually!”

Organizations which fail to provide information to the tax authority or which no longer meet the SME criteria will be removed from the register annually on July, 10th.

As a reminder, if SME status has not previously been obtained or has been lost, an application for status can be submitted any month.

The SME registry will be updated on the 10th day of each month (in the period from July 10th to December 10th – on the basis of reporting for the previous calendar year; in the period from January 10th to June 10th – on the basis of reporting for the calendar year before).

It is important to remember that regardless of the month in which the company was entered in the register, its status must be confirmed in the period from 01st to 05th of July of the following year.

Should all the criteria for SME status be met, it is worth to think on the preferences available to SMEs:

- Reduction of the amount of insurance and social contributions to be paid from the payroll (from 30% to 15% in the part exceeding the minimum wage level);

- Support measures from the federal authorities, such as a simplified procedure for filing certain forms of tax and statistical reporting, preferential lending for SMEs, reducing the supervisory burden (for example, a moratorium on non-tax audits until 31.12.2023, etc.);

- Support measures from regional authorities (there is a need to check at the place of company registration).

What should be done now:

- Submit a request to the auditing organization for a list of required documents;

- Request necessary documents from the foreign parent company to confirm that the criteria are met;

- Prepare data from the side of russian company.

If you need assistance in preparing of the necessary document package, we will be glad to provide you our support on the issue.

Contacts:

Eugenia Chernova

Olga Kireyeva

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025

Dear colleagues, Please accept our sincere congratulations on the upcoming New Year and Christmas!

Overview: Double taxation avoidance agreements – what has been changed

Here is a consolidated overview of the latest developments in double taxation avoidance agreements (DTAAs).

Following a mutual exchange of relevant notes in June-August 2022, the double taxation avoidance agreement between Russia and Ukraine is terminated as of 01.01.2023. Relevant changes should be considered with respect to withholding taxes and other taxes for tax periods beginning on or after January 1st, 2023.

Decree 668 of September 26th, 2022 suspended the double taxation avoidance agreement with Latvia, which had previously suspended DTAA in its turn from May 16th, 2022.

Strictly speaking, the Agreement does not provide for a “suspension” option, it is assumed that it can be terminated or denounced, and The agreement was later denounced by Federal Law No. 40-FZ of 28.02.2023.

As it was – as it has become:

- interest, dividends from Russia to Latvia, paid by Russian tax agent at a rate of 5% to 10% – 20% tax on interest, royalties, 15% tax on dividends;

- it was possible to offset tax paid by a tax agent of one country in another country – now the tax must be paid in both countries as required by local law.

Another country with which the Agreement could be suspended or terminated is Denmark (see information in our Telegram Channel).

A relevant bill has been submitted to the local parliament. If adopted, the changes would come into force on January 1st, 2024. The consequences would be similar to the abolition of the Agreement with Latvia.

At the same time, the Russian Federation has initiated a review of agreements with some “friendly” countries – the United Arab Emirates, Turkey, Malaysia and Oman. In this case, it is announced that the purpose of the revision is to create comfortable tax conditions for attracting direct investments in the Russian economy – thus, favourable changes for investors should be expected in the agreements with these countries.

The latest initiative concerns the suspension of Agreements with “unfriendly” countries (EU countries, Switzerland, UK, USA, Canada, Australia, New Zealand, Singapore, Japan and South Korea). The proposal was made by the Russian Ministry of Foreign Affairs and the Ministry of Finance in response, among others, to Russia’s inclusion in the EU “blacklist”. The initiators proposed that the agreements be suspended unilaterally. The suspension should be based on a Russian presidential decree.

The decree is expected to be signed at the end of June this year. However, no exact dates have been given.

Until the text of the document is published, there is also no complete clarity about the expected effective date of the new rules – according to general logic, the changes should not be applied before 2024, according to the beginning of the new tax period (for profit tax and personal income tax) from which all tax innovations under the Russian Tax Code usually apply.

At the same time, the press release of the above initiative states that in case the proposal of the Ministry of Foreign Affairs and the Ministry of Finance of Russia is supported, the application of reduced withholding tax rates (tax exemptions) in respect of income covered by double taxation agreements will be suspended from the date of issuance of the relevant Decree.

We are following the development of events.

For the purpose of applying the current agreements – we recommend reading the letter of the Federal Tax Service dated March 9th, 2023 No. SY-4-13/2691@ “On Taxation of Foreign Organisations Receiving Income from Sources in the Russian Federation, and the Procedure for Applying the Provisions of DTAAs”.

We remind you that, as before, as before, in order to use the preferences provided by the current DTAA, you must obtain in advance from the counterparty the necessary package of documents (usually a certificate of residency and proof of right to income).

We will be happy to answer your questions!

Contacts:

Eugenia Chernova

Olga Kireyeva

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025

Dear colleagues, Please accept our sincere congratulations on the upcoming New Year and Christmas!

Online seminar 04/24/2023 – FAQ OF FOREIGN SUBSIDIARIES IN RUSSIA

Daria Pogodina participated in an online seminar on the topic “FAQ of Foreign Subsidiaries in Russia. Overview on Current Regulations for Transactions with LLC shares, “sleep” mode or LLC liquidation”. The speaker covered current legal aspects related to the management of foreign subsidiaries in Russia: the procedure for transactions with shares in LLCs, the features of the “sleep” mode and liquidation options. The report was accompanied by practical examples and explanations of current restrictions, which aroused keen interest among representatives of foreign structures.

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025

Dear colleagues, Please accept our sincere congratulations on the upcoming New Year and Christmas!

Ordinary general meeting of LLC participants in 2023

Since Russia has been closely interacting with China in various fields over the past decades, many Russian representatives of small and medium-sized businesses are beginning to actively cooperate with Chinese partners. Russian businessmen who are not aware of the peculiarities of the Chinese mentality may encounter serious difficulties when signing contracts with Asian partners.

In this review we would like to draw your attention to the important features of concluding contracts between partners from Russia and China, which will help you to avoid a number of mistakes:

1. The only official language in China is Chinese. Thus, it is advisable to sign the text of the contract not in Russian and English, but in Russian and Chinese (the official languages of Russia and China).

If the Chinese partners do not insist on this, this can only mean that they do not intend to register the contract with the Chinese government authorities.

2. The name of a Chinese company registered in China can only be in Chinese, and the English name of the company is not legally valid to the full extent Chinese, as well as Russian, courts do not consider claims if the documents do not indicate the real (registered) company names.

3. It is necessary to check the registration of the Chinese company by requesting from the partner a certificate of registration of a legal entity, and also make sure that its representative has the appropriate authority.

It should be kept in mind that only the legal representative of the company has the right to sign a contract without a power of attorney. This may not always be the CEO of the company. The legal representative must be indicated in the certificate of registration of a legal entity.

If someone else signs the contract on the Chinese side, they are required to present a power of attorney. Therefore, when concluding a contract with a Chinese company, it is worth asking the future partner for a power of attorney confirming the authority of the signatory.

4. It is important to check the registration (legal status) of the Chinese seal.

Each Chinese company generally has one main seal, which is strictly controlled. However, to support various types of activities, companies often produce additional types of seals, including “contract seals.” Having produced such seals, Chinese companies often do not amend the registration documents accordingly or otherwise register their legal status.

In this regard, it is recommended to check whether the Chinese partner’s seal is registered by requesting a certificate from the State Commerce and Industry Administration of the government at the place of registration of the Chinese company. It is quite easy to obtain such a certificate, and falsifying it is dangerous for a Chinese partner.

5. To protect yourself, it is recommended to check the company’s website. The site must have a Chinese version, otherwise there is a high chance of encountering scammers. You should check the domain name registration date and ownership.

6. In order to avoid difficulties with the recognition and enforcement of decisions of Russian courts in China, it is recommended to introduce an arbitration clause and include in it one of the well-known institutional arbitration centers in China, for example, the China International Economic and Trade Arbitration Commission (CIETAC), the Beijing Arbitration Commission (BAC), etc.

On the one hand, this will require additional costs for contacting Chinese lawyers or Russian specialists with experience in representing the interests of parties in Chinese arbitration. On the other hand, this will simplify the issue of recognition and enforcement of the decision under the New York Convention of 1958.

If the Chinese partners do not want to resolve the dispute in arbitration due to the high cost of the procedure, then, in order to avoid difficulties with the recognition and execution of decisions of Russian courts in China, it is better to establish a clause for those disputes, for which this is possible, regarding their resolution in a Chinese state court, since Russian courts readily recognize decisions of Chinese courts.

Contacts:

Maria Matrossowa

Yulia Belokon

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025

Dear colleagues, Please accept our sincere congratulations on the upcoming New Year and Christmas!

Business Abroad: What Notifications Need to Be Filed?

In this review, we have summarized the rules governing the required notifications and reports that must be filed in the Russian Federation if you have (or are acquiring) a share in a foreign organization.

When creating/acquiring a share in a foreign organization: notification

When a share in a foreign organization arises (or changes), regardless of the size of the share, an individual who is a tax resident of the Russian Federation must file a notification of participation in foreign organizations (on the establishment of foreign structures without forming a legal entity).

This notification must be filed no later than three months from the date of the emergence (change in share) of participation in a foreign organization.

Failure by a taxpayer to submit a notification of participation in foreign organizations to the tax authority within the prescribed period or submission of a notification of participation in foreign organizations containing inaccurate information entails a fine of 50,000 rubles for each foreign organization.

What is considered a controlled foreign organization (CFO)?

A controlled foreign company is a legal entity or a structure without the formation of a legal entity, the place of tax residence of which is a jurisdiction other than the Russian Federation, controlled by a legal entity or an individual who is a tax resident of the Russian Federation.

When creating / acquiring a share in a CFC (controlled foreign organization)

When a share in the CFC arises (changes) the individual must submit a notification of controlled foreign companies to the tax authority at the place of registration during the reporting year, but no later than April 30 of the year following the reporting year. The deadlines for sending an annual notification of a CFC to the Federal Tax Service for individuals are set out in Article 25.14 of the Tax Code of the Russian Federation.

The notification form is set out in legislation.

In addition to the notification form itself, it is necessary to collect a package of documents on the controlled foreign company and its participant. Typically, this list includes:

1. Certificate of registration of the organization and an extract from the trade register;

2. Certificate of the state – tax registrar;

3. Financial statements of the CFC, prepared in accordance with the personal law of such a company for the financial year. In case of its absence, it is necessary to submit other documents that confirm the profit or loss of the company;

4. Auditor’s report on the financial statements of the CFC, if the audit is mandatory or the company voluntarily conducted an audit;

5. Copy of the passport of the CFC participant;

6. Notarized power of attorney in case of notification by a third party.

If the original documents are attached not in Russian, a notarized translation is required.

Calculation of the tax base for the CFC

The minimum amount of CFC profit that can be used as a taxable base is 10 million rubles, CFC profit below this amount is not taxed in the Russian Federation and is not subject to declaration.

If the profit of a controlled foreign company exceeds 10 million rubles, it is used as a tax base for calculating income tax and is filled in the 3-NDFL declaration (Sheet B) for individuals. Information on each CFC is submitted separately, the data is not summarized. Declarations must be submitted to the Federal Tax Service as part of the normal procedure for filing declarations along with other sheets of the document.

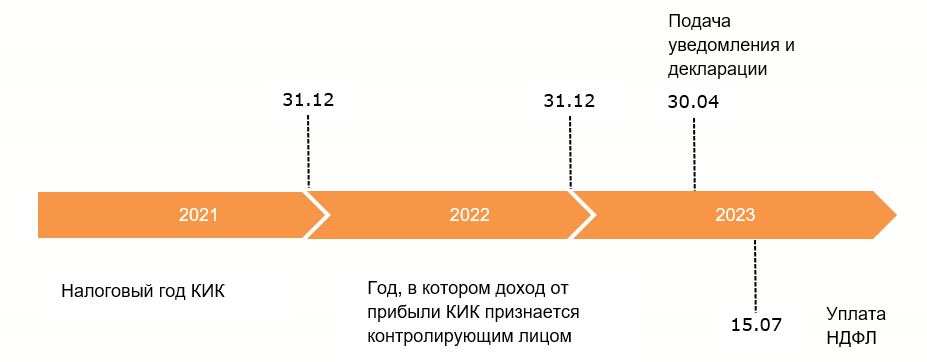

Particular attention should be paid to determining the date of receipt of profit from the CFC by the controlling person – December 31 of the year following the tax year of the foreign organization. The dates of receipt of profit and reporting on it are clearly presented in the diagram:

The profit (loss) of a CFC is the amount of profit (loss) of this company, determined in one of the following ways:

1. According to its financial statements prepared in accordance with the laws of the jurisdiction in which the company is registered, for the financial year;

2. According to the rules established by Chapter 25 of the Tax Code of the Russian Federation (in the event of failure to meet the conditions for determining the profit (loss) of a CFC based on its financial statements, as well as at the choice of the taxpayer – the controlling person).

In order to determine the profit (loss) of a CFC, the unconsolidated financial statements of such a company, prepared in accordance with the standard established by the personal law of such a company, are used. If the personal law of a CFC does not establish a standard for preparing financial statements, the profit (loss) of such a CFC is determined based on the financial statements prepared in accordance with International Financial Reporting Standards or other internationally recognized standards for preparing financial statements.

For tax purposes, the following are deducted from the profit of a CFC:

Distributed dividends (have already been taxed at source);

Dividends paid from Russian organizations (have already been taxed at the time of payment in the Russian Federation);

Losses from previous years (which can be offset against taxable profit regardless of the position of the CFC jurisdiction on this matter);

Distributed profit of a foreign person without forming a legal entity.

Exemption from taxation of profit of a controlled foreign company

The profit of a CFC is exempt from taxation in the Russian Federation if at least one of the following conditions is met with respect to such a CFC:

1. A CFC is a non-profit organization that, in accordance with its own law, does not distribute the profit (income) received between shareholders (participants, founders) or other persons;

2. A CFC is formed in accordance with the legislation of a member state of the Eurasian Economic Union and has a permanent location in this state;

3. The effective tax rate on income (profit) for this CFC based on the results of the period for which, in accordance with the personal law of such an organization, financial statements for the financial year are prepared, is at least 75% of the weighted average tax rate for corporate income tax;

4. The CFC is one of the following companies:

an active foreign company;

an active foreign holding company;

an active foreign subholding company;

and others that are less commonly applicable.

Carry-forward of a CFC loss

If, according to the financial statements of the CFC prepared in accordance with its personal law for the financial year, a loss is determined, the said loss may be carried forward to future periods without restrictions and taken into account when determining the CFC profit.

A CFC loss may not be carried forward to future periods if the taxpayer – the controlling person has not submitted a notification of the CFC for the period for which the said loss was incurred.

Fines for failure to provide notification of CFC

More information on the FTS website.

Contacts

Evgeniya Chernova

Olga Kireeva

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025

Dear colleagues, Please accept our sincere congratulations on the upcoming New Year and Christmas!

Cross-border transfer of personal data: new rules

Cross-border transfer of personal data: new rules

On 14.07.2022 the Federal Law No. 266-FZ introduced substantial amendments to the Federal Law of 27.07.2006 No. 152-FZ “On Personal Data” (hereinafter referred to as the “Personal Data Law”) with regard to cross-border transfer of personal data that will become effective as of 01.03.2023.

Additional requirements will apply to personal data operators.

Who is considered as the operator of personal data?

Pursuant to the clause 2 of the article 3 of the Personal Data Law, the operator is a public authority, municipal authority, legal entity or natural person that independently or jointly with other persons organizes and/or carries out the processing of personal data, as well as determines the purposes of personal data processing, the personal data to be processed and the actions (operations) carried out with the personal data.

For example, an organisation is an operator of personal data in relation to its employees and other individuals whose data it receives.

What is personal data and what is recognized as a cross-border transfer?

Let us remind you that under clause 1 of the article 3 of the Personal Data Law, personal data means any information relating to a directly or indirectly defined or identifiable natural person (personal data subject) (e.g. full name, nationality, tax identification number, gender, etc.).

In turn, the cross-border transfer of personal data is the transfer of personal data to the territory of a foreign state to a foreign authority, a foreign natural person or a foreign legal entity (clause 11 of the article 3 of the Personal Data Law).

Some examples of cross-border data transfer:

Example 1. Employees are sent on a business trip abroad (e.g. to the holding company). The employer (Russian company) sends the employees’ names, phone numbers, positions and email addresses to the holding company to arrange meetings abroad.

Example 2. The acceptance of applicants for certain positions or internal transfers requires the approval of the founders (participants, shareholders), who are foreign persons, and the personal data of the applicants/employees is sent abroad for this purpose.

What will change in 2023?

Fr om 01.03.2023 the operator will have to notify Federal Service for Supervision in the Sphere of Telecom, Information Technologies and Mass Communications (Roskomnadzor) of its intention to transfer personal data across borders before starting a cross-border transfer of personal data. This notification shall be sent separately fr om the notification of the intention to process personal data mentioned in the article 22 of the Personal Data Law.

Please note that operators who transferred personal data across borders before 01.09.2022 and continue to do so after 01.09.2022 must send notifications about cross-border transfers of personal data to Roskomnadzor no later than 01.03.2023.

The notification of the intention to transfer personal data across borders shall be sent as a paper document or in the form of an electronic document and shall be signed by an authorized person of the operator. The requirements for the content of the notification are stipulated by para 4 of the article 12 of the Personal Data Law (as amended by Federal Law No. 266-FZ of 14.07.2022).

What must be done before submitting a notification to Roskomnadzor?

The following information must be obtained from the foreign persons, to whom the transfer of personal data is planned (foreign authorities, foreign natural or legal persons):

- information on measures taken by the foreign persons to protect the personal data transmitted and conditions of termination of their processing;

- information on legal regulations in the field of personal data of the foreign country, under which jurisdiction the foreign persons are;

- information on foreign persons (company name or full name, as well as contact telephone numbers, postal and email addresses).

Why is it important to obtain the above information and data before submitting a notification to Roskomnadzor?

They may be requested by Roskomnadzor in order to assess the reliability of the information contained directly in the notification. In such a case, the operator will be obliged to provide the requested data to Roskomnadzor within 10 working days since the moment of the request receipt.

Can Roskomnadzor prohibit or lim it the cross-border transfer of personal data?

Yes, Roskomnadzor may prohibit or lim it the cross-border transfer of personal data for the purposes of:

- protecting the foundations of the constitutional system of the Russian Federation, morality, health, rights and legitimate interests of citizens,

- ensuring national defence and state security,

- protecting the economic and financial interests of the Russian Federation,

- ensuring the protection of rights, freedoms and interests of citizens of the Russian Federation, sovereignty, security, territorial integrity of the Russian Federation and its other interests in the international arena by diplomatic and international legal means.

In such a case, the operator will be obliged to ensure that the previously transmitted personal data is destroyed by foreign persons.

What are the penalties for failure to submit or untimely submission of a notification to Roskomnadzor?

Under article 19.7 of the Code of Administrative Offences of the Russian Federation, failure to submit or late submission of a notification to Roskomnadzor may entail a warning or imposition of an administrative fine on both an official and a legal person.

Our services:

- advising on compliance with legislation on personal data processing and protection;

- preparation of notifications to be sent to Roskomnadzor;

- development and/or comprehensive audit of local acts of your organization, regulating the processes of personal data processing and protection and, if necessary, amendment of these local acts.

Contacts:

Maria Matrossowa

Yulia Belokon

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025