Author: Mark

Russia changes double taxation avoidance agreements terms with countries

The latest news regarding the revision of double taxation avoidance agreements (DTAAs)

The DTAA protocol with Luxembourg was ratified in February, thus the protocol entered into force on 5 March 2021 and its provisions will apply from 1 January 2022 (the changes were previously expected to be adopted from 1 January 2021).

The protocol increases the withholding tax rate on dividend and interest income to 15%, with some exceptions for institutional investments.

In 2020, protocols to make similar changes to the DTAA were also signed with Cyprus and Malta, with effect from 1 January 2021.

On 26 May 2021, the law No. 1147902-7 on the denunciation of the double taxation avoidance agreement with the Netherlands was approved and published. The adoption of the law leads to the fact that parent companies registered in the Netherlands will pay tax on dividends at a rate of 15% instead of 3-5%, and the rate for interest and royalties will be 20%.

On June 7, 2021 Russia notified the Netherlands about denunciation of the agreement, the changes will come into force on January 1, 2022.

Switzerland is the next major jurisdiction in the negotiation process initiated by Russian Ministry of Finance. There are 2 more key jurisdictions remaining for revising the DTAAs, said Deputy Finance Minister Alexei Sazanov, namely, Hong Kong and Singapore.

There have been no official announcements of changes to other DTAAs yet.

Contacts:

Eugenia Chernova

Olga Kireyeva

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025

Dear colleagues, Please accept our sincere congratulations on the upcoming New Year and Christmas!

Transferpricing: penalties from tax authorities for non-submission of master file

Recently, there have been an increasing number of cases in which Russian companies that are part of an international group of companies have been asked to submit the global documentation (so-called master file) to the Russian tax authorities, especially in the context of the formation of the regular transfer price declaration and documentation.

As a reminder: the global documentation (master file) must be provided to the supervisory authority upon their request within 3 months fr om the date of having received an according notice. The file is to be provided in Russian language.

The master file may be requested not earlier than 12 months and no later than 36 months after the end of the reporting year, so e.g. starting from 01.01.2022 till 31.12.2024 for the year 2020. The documentation must comply with the requirements of Article 105 16-4 of the Russian Tax Code.

Please note that the violation of the rules of the Tax Code – failure of the taxpayer to submit global documentation in time (paragraph 2 of Article 129.11 of the Tax Code) may result in a fine in the amount of 100,000 rubles.

From 2020 onwards, the benefits of the so-called “Transitional period” (2017-2019), for which no fines were imposed, no longer apply. From 2020, failure to comply with the requirement to submit the master file to the authorities upon request can result in a maximum amount of fine.

In order to provide the required information to the tax authorities on time, if requested, we recommend the Russian member companies of international company groups to fulfill the following steps in advance:

- request the Global Documentation from the parent company,

- check it for compliance with the requirements of Article 105 16-4 of the Tax Code of the Russian Federation and, if necessary, supplement the File;

- translate the Global Documentation into the Russian language, if applicable.

Expert comment

Eugenia Chernova, Project Leader at swilar: “Not every taxpayer who is a member of an international group of companies may be required to provide global documentation. The existing limits are bound to the total revenue of the group. The lim it depends on the country of residence of the parent company.” If you have any questions about the necessity of global documentation for your company, swilar specialists will be happy to give you qualified advice.

Contacts:

Eugenia Chernova

Olga Kireyeva

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025

Dear colleagues, Please accept our sincere congratulations on the upcoming New Year and Christmas!

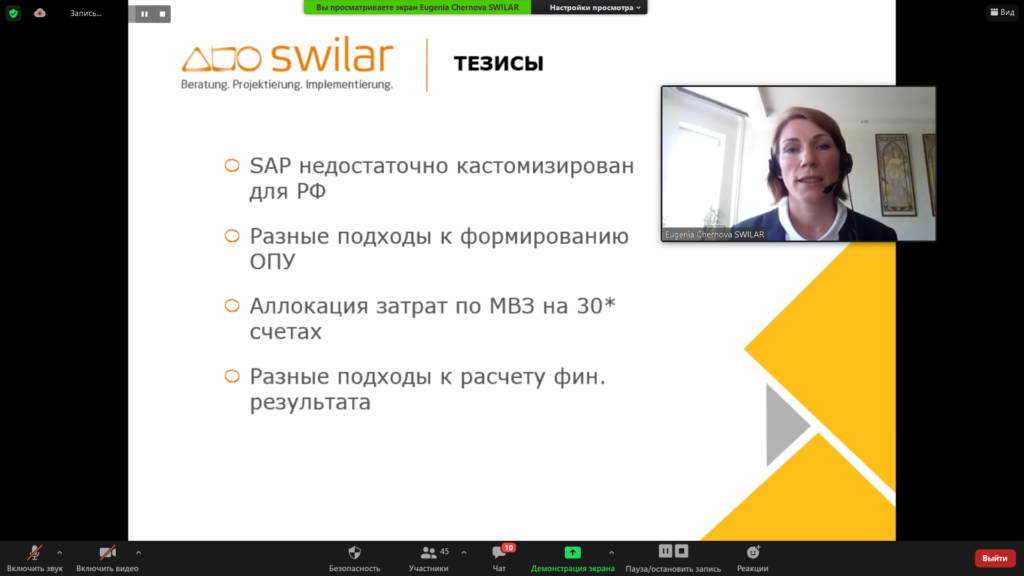

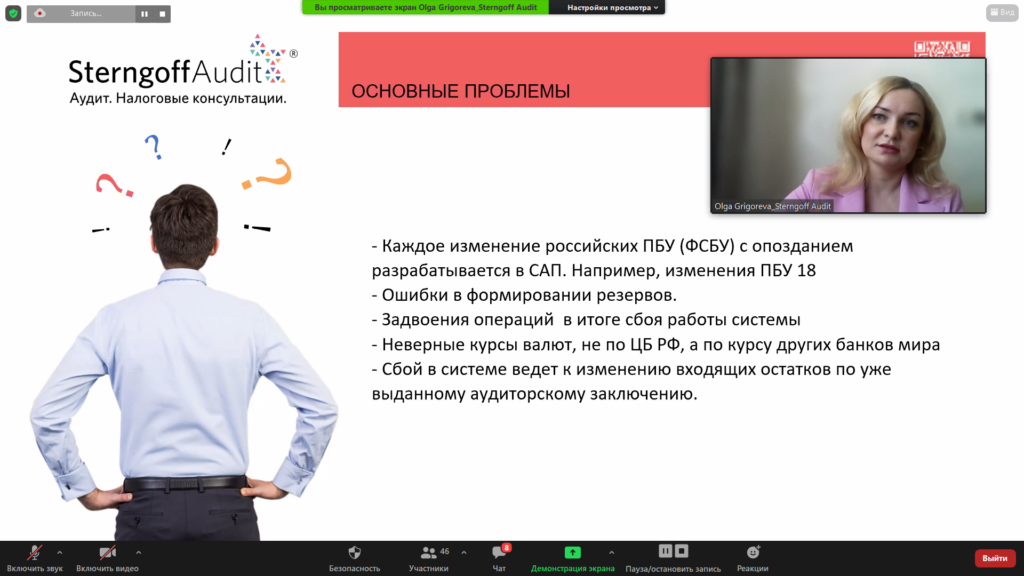

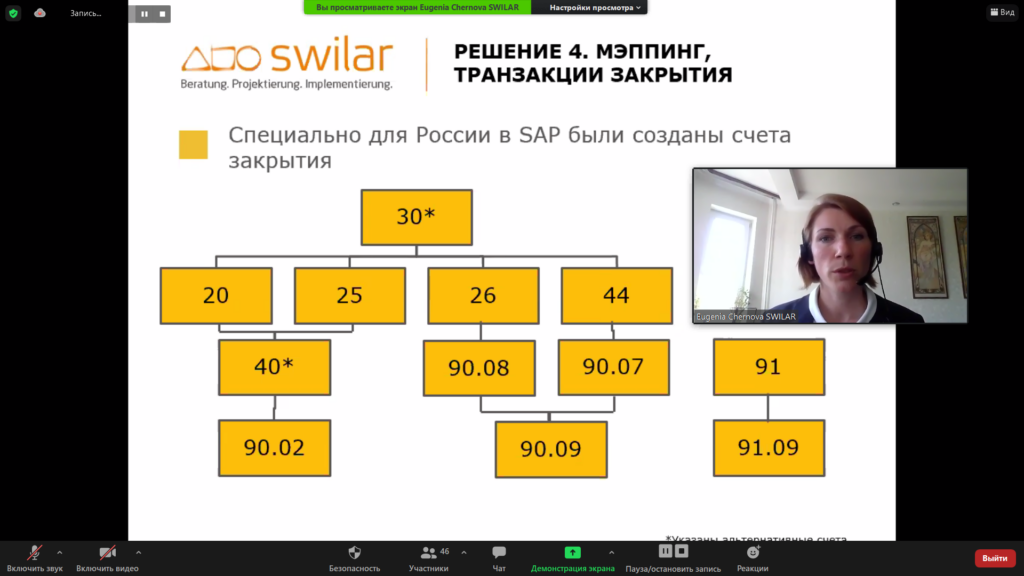

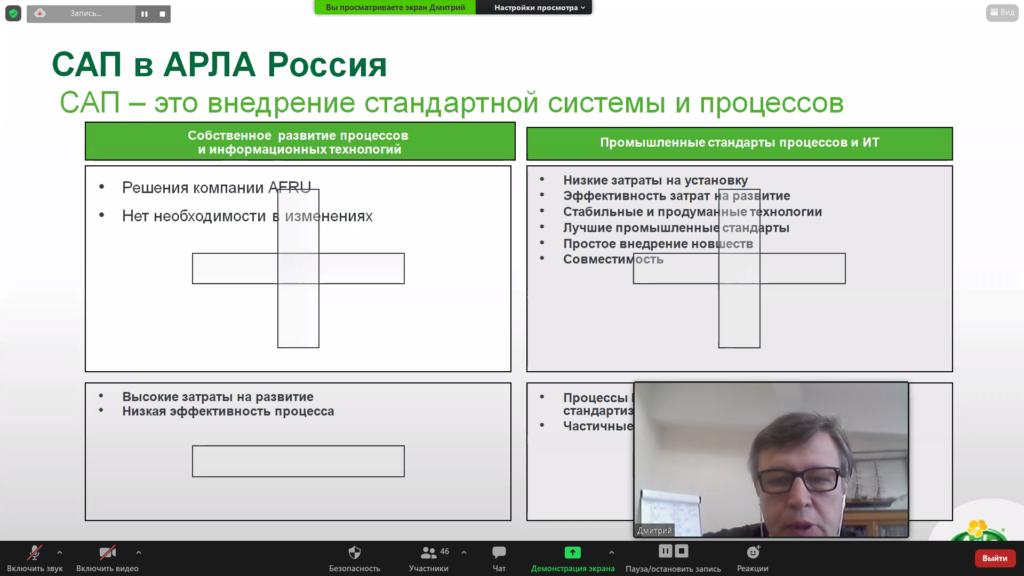

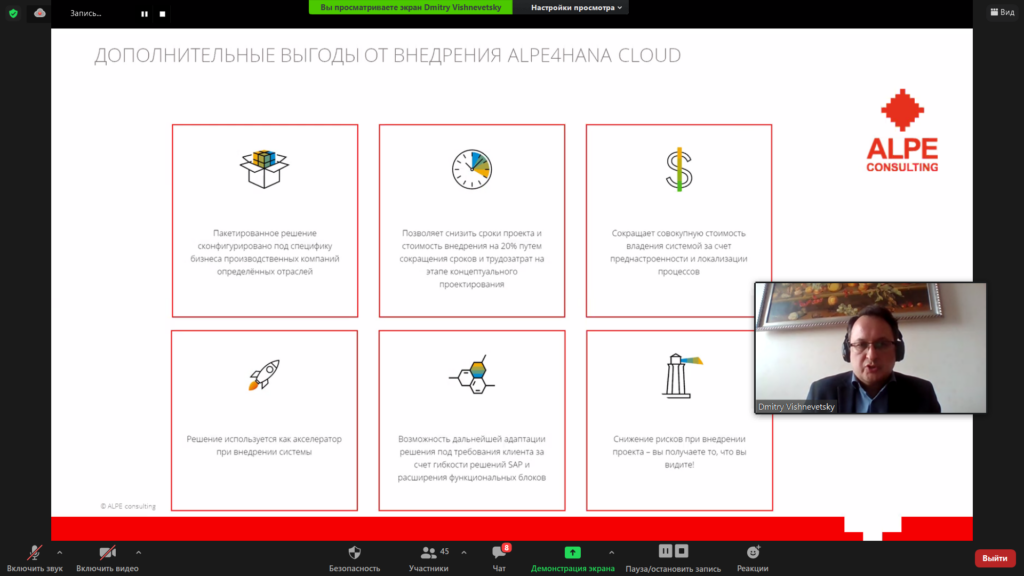

Online seminar 18.05.21: “Current issues of implementation and use of SAP in Russia”

On May 18, swilar specialists together with experts from ALPE Consulting discussed current issues of SAP implementation and use in Russia. The online meeting was held in Russian.

A team of experienced experts from different fields told about the nuances of the transition to SAP and its working in Russia, described the most common difficulties and issues, and disclosed ways to solve them.

Eugenia Chernova, Project Manager of swilar OOO, gave an overview of frequently occurring issues during the migration to SAP, gave examples and solutions from practice.

Conclusions were complemented by practical experience of ARLA Foods, implementing and successfully using SAP.

Organized by: swilar Group and ALPE consulting, together with the auditing company Sterngoff Audit, with the support of Arla Foods.

New: days off in may 2021 extended

We would like to inform you that in accordance with the Decree of the President of the Russian Federation dated 23.04.2021 No. 242 non-working days will be established in the period from 1 to 10 May 2021 (in contrast to the initially planned state holidays on 01.05.-03.05., 08.05.-10.05.2021). Herewith 11.05. will be the first working day after the holidays.

However, the decree retained the right for organizations to determine the number of employees to support the functioning of the organization during the specified period.

Our recommendations in connection with this decree:

- to monitor the deadlines for the payment of salaries, taxes and other mandatory payments carefully; better is to proceed these payments before the start of the specified period;

- to analyze and check the working schedule of employees at your Russian branches/subsidiaries during the newly specified non-working period;

- to request in advance information about the working schedule of your Russian business partners on those days.

We are at our disposal in case of any questions or inquiries!

Contacts:

Eugenia Chernova

Olga Kireyeva

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025

Dear colleagues, Please accept our sincere congratulations on the upcoming New Year and Christmas!

Russia resumes air flights with Germany from 01.04.2021

We would like to inform you that in accordance with the Order of the Russian Government № 814-rs dd 31.03.2021 starting with the April 1, 2021 the flights with Germany were resumed.

According to the official announcement of the Russian Government dd. 25.03.2021 the flights are resumed on the following routes:

- Frankfurt am Main – Moscow – Frankfurt am Main – 5 times a week;

- Frankfurt am Main – St. Petersburg – Frankfurt am Main – 3 times a week;

- Moscow – Berlin – Moscow – 5 times a week;

- Moscow – Frankfurt am Main – Moscow – 3 times a week.

Thus, citizens of Germany with a valid visa to Russia (including business visa) can enter the Russian Federation.

Please note that according tothe Order of the Chief State Sanitary Inspector of theRussian Federation from 27.07.2020 № 22 for foreign citizens it is necessary to have a negative PCR-test made not earlier than 72 hours before the flight to Russia. The requirement (point 6.1. of the mentioned above Order №22) to keep a two-week quarantine for citizens arriving from Germany in order to perform employment activities is still in force.

We will be happy to answer your questions!

Contacts:

Maria Matrossowa

Tatiana Ushakova

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025

Dear colleagues, Please accept our sincere congratulations on the upcoming New Year and Christmas!

In-house services and shareholder activity

Client Information

In August 2020, the Russian Federal Tax Service issued a Letter detailing the tax authorities’ approach to the analysis of in-house services. In particular, it drew attention to the fact that in-house activity can be considered as service if it provides economic benefit to the company-taxpayer, is not a shareholder activity and similar services can be purchased from the third parties.

In-house services include administrative support, financial services, legal advice, internal control and audit, services related to the development of production and sales, and information technology support.

Nevertheless, taxpayers still have questions regarding shareholder activities.

In February 2021, the Federal Tax Service published another Letter further defining the term “shareholder activity”.

As defined by the Federal Tax Service, shareholder activity:

- is based on the needs of the shareholders themselves, not the individual members of the group of companies;

- economic benefit from such activities is evident for the whole group;

- the members of the group of companies would not engage third independent parties to provide such services against payment.

In addition to the characteristics, the Letter also included a list of specific functions related to shareholder activity.

Strategic management functions:

1. drafting of the development strategy of the group of companies;

2. market research;

3. evaluating the relevance and costs in implementing investment projects.

Business planning and control functions:

1. strategic planning and budgeting;

2. consolidated financial and management accounting;

3. analysis of the effectiveness of investments in the group of companies;

4. controlling of the financial and business activities of the group;

5. financing of the group of companies;

6. developing standards, methods, guidelines and/or other internal regulations to be applied to group of companies;

7. implementing and controlling compliance with such standards, methods, guidelines and/or other internal regulations;

8. approval of significant decisions and transactions.

However, in practice, some of the functions mentioned above may not be related to shareholder activity. Taxpaying organizations in Russian Federation should take an individual approach to each specific case.

The test to identify shareholder activity includes three questions:

- Has the subsidiary in Russia received a benefit from the service rendered, and if so, what kind of benefit?

- Is the benefit obvious and defined, and how is it expressed?

- Would a subsidiary in Russia pay an independent company to provide a similar service?

Please note that if the nature of payments abroad is disputed, expenses may be excluded from the income tax base and the relevant payments may be reclassified as dividends or other passive income with an additional withholding tax charge in Russia (up to 15% for countries without a signed CIT). It is also possible that fines and penalties of up to 20% of the underpaid tax will be imposed.

Our experts are ready to provide you with expert assistance in analyzing the current situation with regard to in-house services and assessing the need for changes in documents and processes.

Contacts:

Natalia Safiulina

Eugenia Chernova

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025

Dear colleagues, Please accept our sincere congratulations on the upcoming New Year and Christmas!

Business with Russia? Sure!

In March, www.karenina.de published an interview with Dr. Georg Schneider, “Geschäfte mit Russland? Aber ja!”. Journalist Peter Kopf asked the General Director of swilar a number of questions about opportunities and problems of business-cooperation with Russia.

The key issues of the interview:

-

Whether import substitution policy in Russia is a problem for German companies;

-

Whether it is possible to say that the state runs the economy in Russia;

-

How German companies may use the huge gap which exists in Russia between individual and serial production;

-

How to gain the trust of business partners in Russia and why it is so important to conclude a framework agreement;

-

Whether banks hinder German companies from doing business in Russia;

-

How customs issues affect business;

-

How risky it is to invest in Russia at the moment;

-

U.S. sanctions and the rate of their impact on German-Russian business;

-

Pharmaceutical industry and the Sputnik V vaccine as the oil of tomorrow – fantastic opportunities for economic cooperation.

The full text of the interview is available on the website. Enjoy reading!

For reference

KARENINA www.karenina.de is the online edition of the German-Russian discussion forum “St. Petersburg Dialogue”, which began to develop during the pandemic. The goal of the online platform is to establish internal communication between forum members and working groups, as well as to make the association, founded in 2001, visible to the outside world through its own journalistic activities

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025

Dear colleagues, Please accept our sincere congratulations on the upcoming New Year and Christmas!

Annual general meeting for JSCS and LLCS in 2021

On February 24, 2021 the President of Russia signed a law which allows conducting of general meetings (including also annual) in 2021 for JSCs and LLCs by a form of absentee voting.

According paragraphs of Federal Law No. 208-FZ of 26 December 1995 “On Joint Stock Companies” and Federal Law No. 14-FZ of 8 February 1998 “On Limited Liability Companies” which do not allow holding general meetings of shareholders/participants in form of absentee voting on several issues, were herewith suspended till the end of 2021.

Thus, the general meeting of LLC participants, the agenda of which includes approval of annual reports and annual balance sheets, in 2021 can also be held in the form of absentee voting (by questioning).

Meanwhile, the new regulation does not extend the deadline for annual meetings, as it was done in 2020 (at that time the deadline for annual meetings was extended up to September 30).

In this regard, when planning the annual meeting and approval of the financial statements for 2020, standard terms stipulated by the legislation should be taken into account: the general annual meeting shall be held not earlier than 2 months and not later than 4 months after the end of the financial year (i.e. within the period from March 1 to April 30).

Proceeding of the annual meeting by a form of absentee voting shall be approved by the executive body of the LLC. The procedure for convening the meeting and its protocol shall fully comply with the conditions applicable for the year 2021.

We will be glad to answer your questions and to support you on the issue if needed!

RECOMMENDATIONS

-

Due to the continuing restrictions on cross-border travel, we recommend to consider the possibility of holding general meetings (including annual meetings) in 2021 by absentee voting.

-

When planning the meeting to approve the results of 2020, please note that the deadline (differently than in 2020), remained standard: from 01.03. to 30.04.2021.

-

We also recommend to pay special attention to the execution of the relevant documents when holding the general annual meeting in the form of absentee voting.

Contacts:

Maria Matrossowa

Tatiana Ushakova

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025

Dear colleagues, Please accept our sincere congratulations on the upcoming New Year and Christmas!

Online event “Fashion: Spring-Summer 2021 Season Trends

Online event about trends of the season and the capsule closet of the businesswoman was a gift for the Women´s Day to our colleagues.

We realize that sometimes we need to switch from issues of coronavirus, closed borders, tax audits and financial reports to other topics to rest and restore balance.

The online event was conducted by Nina Bergmann, a stylist and image-maker with international experience, and Elena Costa, a fashion designer, founder of a premium studio with experience in Italian fashion houses and pret-a-porter.

We discussed Spring-Summer 2021 trends in business closet, peculiarities of capsule closet organization and advantages of tailoring, and touched upon the most burning issues: how pandemic influenced fashion development, what of outerwear and accessories are the most fashionable, and what recommendations can be given for creating online images for the home office.

We thank our speakers and participants for the evening and hope that the event was useful and created a spring mood.

Organized by: swilar and Sterngoff Audit with the participation of FITS Russia

Online seminar “Russian Market: FAQ. Day 2”

On February 25th the second online seminar of the two-day event series “Russian Market: FAQ” was held. We were pleased with the participants who attended the first meeting, as well as new listeners.

This time the focus was on customs clearance, banking business, and entry opportunities, which were examined through case studies.

The meeting was opened with an overview by Dr. Georg Schneider (swilar GmbH) about the various options for the presence of German companies in the Russian market, the advantages and disadvantages of these options.

Anna Urumyan (Representative Office of the State of Lower Saxony in the Russian Federation, Representative Office of the German Academy of Management of Lower Saxony in Moscow, BMS LLC) assessed the Russian market from the perspective of companies from Lower Saxony. She gave examples of projects in Russia, taking into account the peculiarities of customs clearance and certification.

The experience of Thuringian companies in Russia was summarized by Guzel Shaikhullina (Thüringen International in Russia) and Irina Heiss (Thüringen International, Landesentwicklungsgesellschaft Thüringen GmbH)

The topic of banking business in Russia was brought up by Maxim Lubaskin (Rosbank). He outlined the differences and similarities compared with Germany, using financing and hedging transactions as examples.

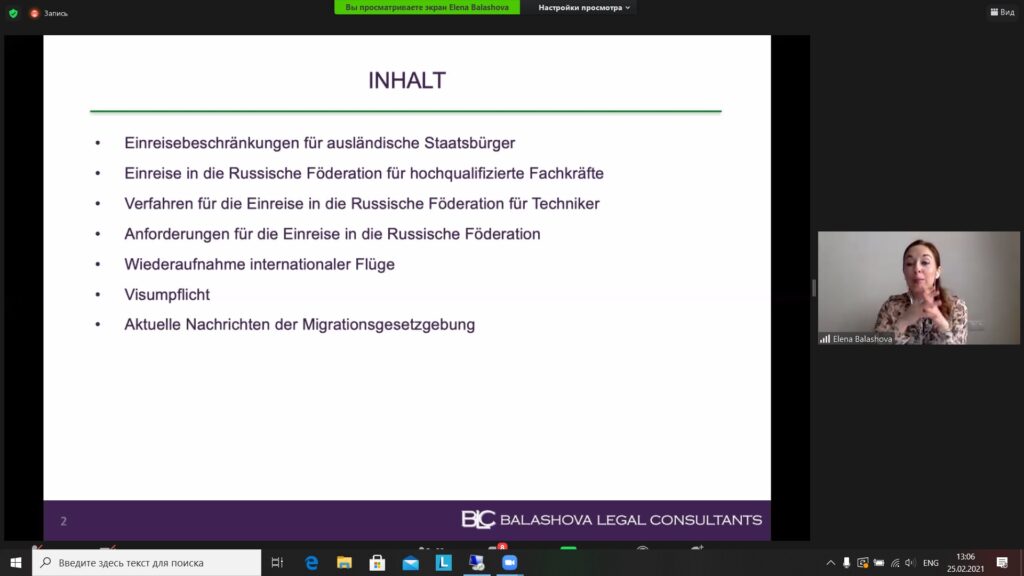

Elena Balashova (Balashova Legal Consultants) discussed current opportunities for entering Russia and peculiarities of migration issues for foreign employees.

Igor Bruyevich (KWS RUS LLC) shared the experience of KWS Group in establishing an enterprise in Russia.

At the end of the seminar participants actively asked questions, which proves that the topic is very relevant. We will be organizing similar meetings in the future, so please follow our announcements and news.

The event was held in the framework of German-Russian Thematic Year of Economy and Sustainable Development 2020-2022.

Organized by: swilar, Bavaria Representation Office in the Russian Federation, Lower Saxony Representation Office in the Russian Federation, NRW.Global Business Russia and Thüringen International with active cooperation of KFW IPEX-Bank and Rosbank as well as the auditing company “Sterngoff Audit” and the law firm Balashova Legal Consultant.