Author: Mark

Online review from the auditors: the “hottest” issues of autumn 2021

As soon as auditors start the pre-audit season, a stream of questions from clients begins.

Therefore, on October 27, swilar OOO participated in an online meeting organized by the auditors, where the issues of audit practice on various issues were discussed in detail – on disputes with customs on license fees, on intragroup services and on shareholder activities on the basis of the current clarifications of the Federal Tax Service.

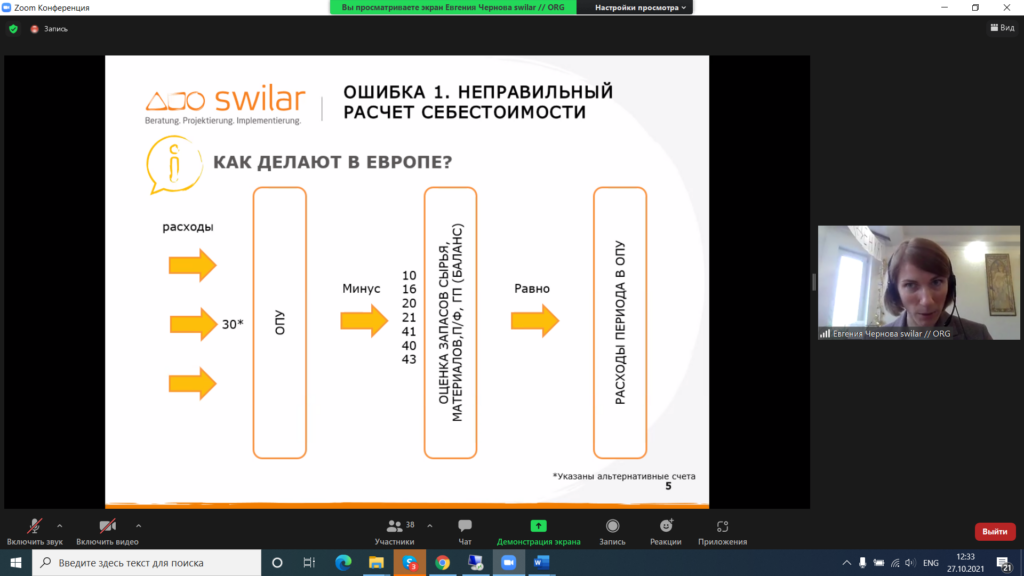

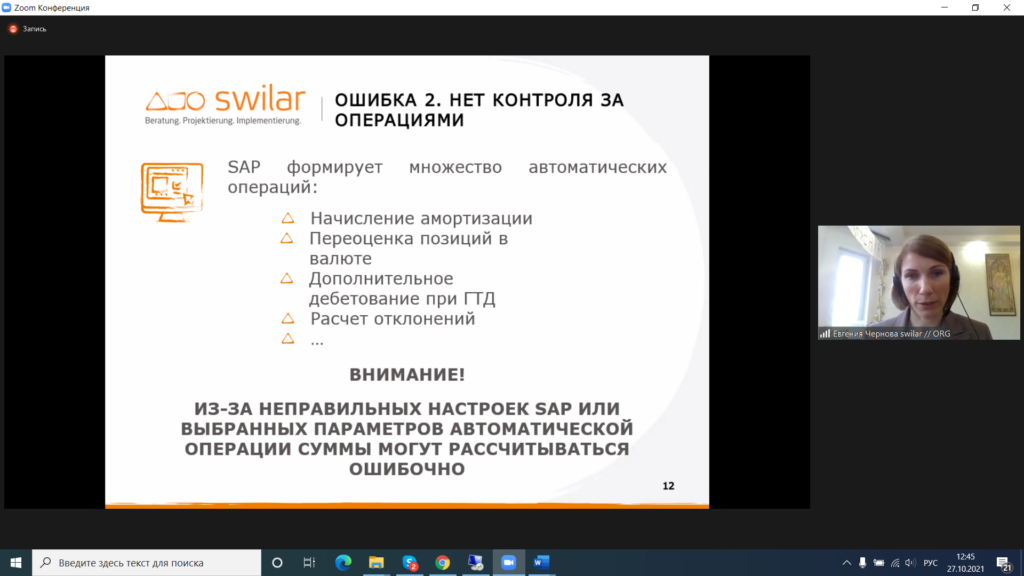

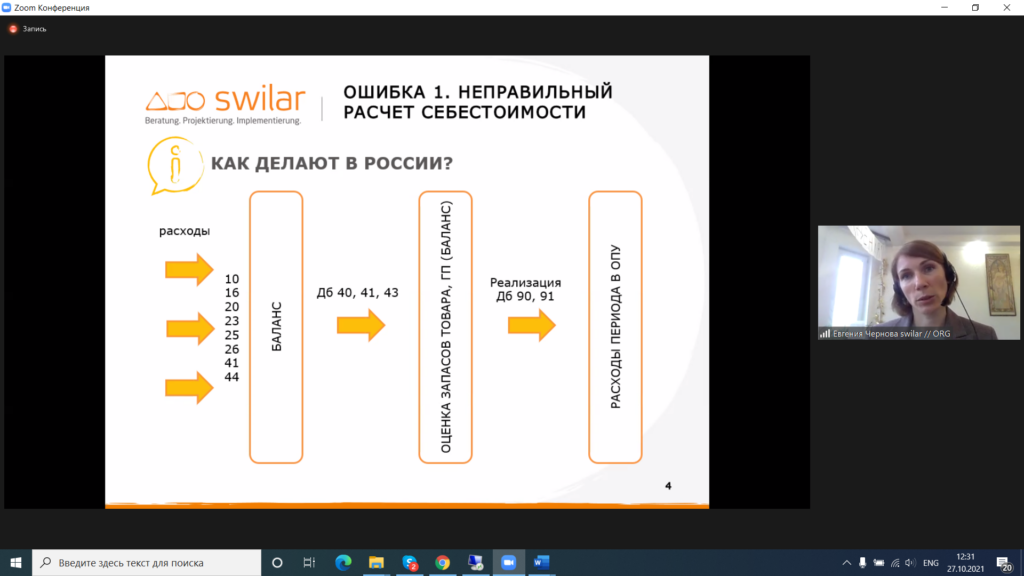

Eugenia Chernova, Head of Controlling in swilar OOO, has analyzed the errors in SAP and gave the options for solutions for the most common cases.

The speakers also reviewed the mistakes identified by the auditors in the analysis of legal documents and highlighted the new limitations of pandemic in the aspect of working with the personnel.

Follow the schedule of our events so you don’t miss similar seminars in the future.

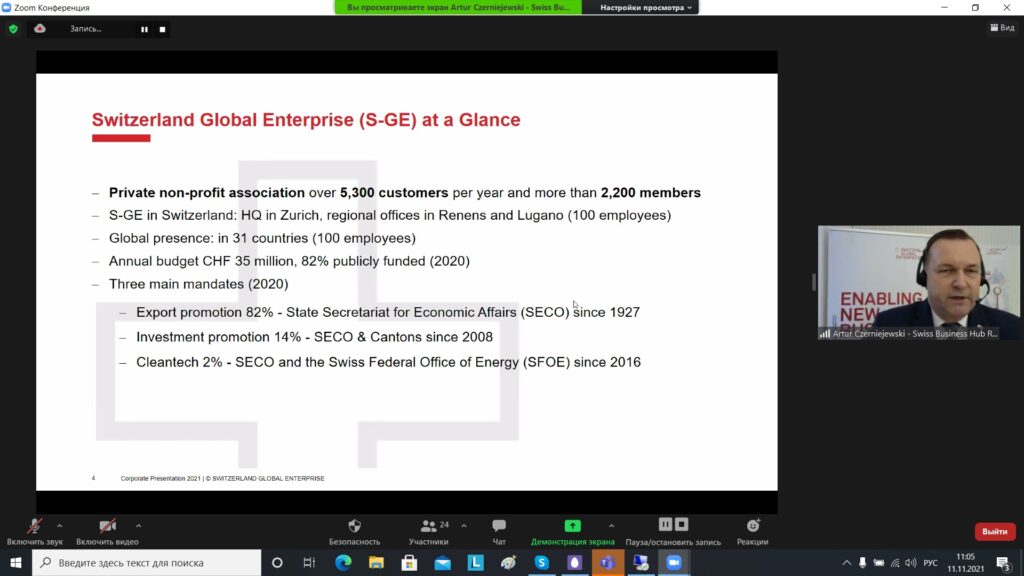

Online seminar 11.11.21: “Selling pharmaceutical manufacturing equipment and ingredients in Russia”

Оverview, important issues and practical experience

On November 11, an online seminar on the topic “Selling pharmaceutical manufacturing equipment and ingredients in Russia: overview, important issues and practical experience” was held.

Dr. Anastasia Nosova (State of Bavaria Representative Office in Russia) analyzed and summarized how the Bavarian business is represented in the pharmaceutical-technical industry in Russia. Yulia Parinova, the General Director of Biogrund, shared the details of entering the Russian market of pharmaceutical excipients by the example of her company. Vadim Sviridov from “MEDITEX” Ltd. told how the system of technical regulation is transformed during the transition to the Eurasian market.

Of particular interest to the audience and most of the additional questions at the end of the meeting was a presentation on the general aspects of exports to Russia, which was given by Daria Pogodina, the General Director of swilar.

If your company also needs advice on organizing exports, please contact swilar specialists.

Organizers: Swiss Business Hub Russia, the State of Bavaria Representative Office in Russia and swilar with the kind support of MEDITEX and Biogrund.

Transport tax for legal entities: Main changes in 2021

We remind you that starting from January 1, 2021 important changes concerning the transport tax came into force.

For your convenience, we have made an overview of the main changes and recommendations on their application.

From January 1, 2021 the obligation of organizations to provide tax returns on transport tax for 2020 and subsequent tax periods (clause 17 of Article 1 of the Federal Law № 63-FZ of 15.04.2019, Federal Tax Service Order of 04.09.2019 Nr. MMV-7-21/440) was canceled.

Also, from this date uniform deadlines and advance payments for payment of transport tax were introduced for all organizations:

- the tax is to be paid no later than March 1 of the year following the expired calendar year;

- advance payments, if they are introduced by the law of the Federal subject of the Russia, are to be paid not later than the last day of the month following the expired quarter.

Starting from 2021 organizations must calculate and pay transport tax on their own (clause 1, Article 362 of the Tax Code of the Russian Federation).

The total amount of tax is calculated for each transport vehicle as the multiplication of tax base and tax rate with the multiplying coefficient (clause 2, Article 362 of the Tax Code of the Russian Federation).

The rates are set by the Federal subjects of Russia within the limits specified in the Article 361 of the Tax Code of the Russian Federation.

Organizations that have the right to transport tax benefits must send to the tax authority an application for a tax benefit (Article 361.1 of the Tax Code of the Russian Federation). At the same time organizations are also entitled to submit documents confirming the right to this benefit with the application.

The form of an application for a tax benefit is prescribed by Order No. ММВ-7-21/377@ of the Federal Tax Service dd. July 25, 2019.

From 2022, taxpayers will submit to the tax authority an application for a tax benefit in the form as amended by Order of the Federal Tax Service of Russia No. ED-7-21/574@ of 18.06.2021.

The Tax Code does not set a deadline for filing an application.

An application for tax benefit shall be considered by the tax authority within 30 days from the date of its receipt. This period can be extended in case of necessity for the tax authority to request information confirming the taxpayer’s right to tax benefit from other authorities and persons who have such information. In this case, the taxpayer shall be notified of the extension of the deadline for review of the application.

After considering of the application, the tax authority shall send to the taxpayer:

- notification on granting tax benefit;

- notification of refusal with the explanation of the grounds for refusal.

In order to ensure the full payment of tax, from 2021 the tax authorities will send taxpayers messages about the amount of tax calculated by the tax authorities (paragraph 4 of Article 363, paragraph 5 of Article 363 of the Tax Code).

The tax will be calculated basing on the information available at the tax authority:

- from the authorities that register vehicles – the Traffic Police;

- according to the information about the declared tax benefits received from the owners of vehicles.

Deadlines for mailing tax notices:

- Six months from the date the tax payment deadline expired (e.g., the notification for 2020 must be received by the taxpayer no later than September 1, 2021);

- Two months from the date of receipt of information on the recalculation of the tax;

- One month from the date of receipt of information from the Unified State Register of Legal Entities (EGRUL) that the company is being liquidated.

Tax notification is sent to the taxpayer via telecommunications, personal account on the website of the tax office, or by regular post (if it is impossible to notify by other means).

However! Please note that the above-mentioned notification is informative in nature and is sent to the taxpayer after the expiration of the tax period and the deadline for tax payment, and, consequently, does not cancel the obligation of the taxpayer to calculate and pay the tax on his own in the accordance with the law requirements.

Shall the tax amount independently calculated and paid by the taxpayer not match the data specified in the tax notification, within ten working days from the date of receipt of the message about the calculated tax amount the organization (tax payer) can send to the tax inspection its explanations and documents confirming: the correctness of the calculation, completeness and timeliness of the tax payment, the validity of the use of lower tax rates, tax benefits or the existence of the grounds for tax exemption (paragraph 6 of Article 363 of the Tax Code).

The term for considering the application is one calendar month. Shall the term take longer, the tax authorities are obliged to notify the taxpayer.

According to the results of consideration the taxpayer will receive:

- A message on recalculation of the amount to be paid, considering the explanations, evidence and arguments provided;

- A demand for additional payment if the taxpayer’s explanations are not accepted by the Federal Tax Service.

Also, starting from 2021 taxpayers are obliged to send a report on the owned transport vehicles which are considered to be objects of taxation. This obligation applies in case of non-receipt of a message about the amount of transportation tax calculated by the tax authorities concerning objects of taxation for the whole period of their ownership (Letter of the Federal Tax Service of Russia of 29.10.2020 N BS-4-21/17770@).

A report must be sent to the tax authority by the 31 December of the year following the expired tax period with the attachment of documents confirming the state registration of vehicles.

Wrongful non-submission (untimely submission) of the report leads to the fine at the rate of 20% of the unpaid tax amount of the vehicle, the report about was not submitted (untimely submitted) (clause 3 of article 129.1 of the Tax Code of the Russian Federation).

The standards for filling in the report on the owned transport vehicles have been determined by the Order of the Federal Tax Service No. ED-7-21/124@ dated 25.02.20.

Sending the above-mentioned report is not required if organization sends an application for a tax exemption in relation to the relevant object of taxation.

If you have any questions, we will be happy to offer you additional information on this topic.

Contacts:

Natalia Safiulina

Ekaterina Babenko

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025

Dear colleagues, Please accept our sincere congratulations on the upcoming New Year and Christmas!

Online seminar 29.09.21: “Mechanical engineering and industrial equipment production in Russia: current trends and market opportunities”.

On September 29th we discussed “Machine building and industrial equipment production in Russia: current trends and existing market opportunities” in our online seminar.

The seminar began with an overview of the machinery and equipment industry in Russia given by Monika Hollacher, foreign trade specialist (Russia, Central Asia, Eastern Europe, ASEAN, VDMA).

Hans-Jurgen Wittmann (GERMANY TRADE AND INVEST) shared analysis of the needs and current investment projects in mechanical engineering and plant engineering, summarizing the export opportunities in this area

Daria Pogodina (swilar OOO) described some specifics of machinery and equipment exports to Russia.

Denis Tropin, head of Russian representative office of machine tool manufacturer “SPINNER GmbH”, presented a report about the experience of machine building in Russia

Andreas Brunnbauer and Anastasia Nosova (Representation of the State Bavaria in Russian Federation) told about the options for supporting Bavarian companies that export machinery and plant production to Russia.

The event was held within the context of the German-Russian thematic year “Economics and Sustainable Development”.

Organized by: Representation of the State Bavaria in Russian Federation and swilar with the support of Germany Trade and Invest and VDMA.

CFO Conference in St. Petersburg

On September 24, St. Petersburg hosted for the eighth time the traditional annual CFO Conference, which was organized by the Tax and Financial Reporting Committee of Russian-German Chamber of Commerce and its Northwest Branch.

Among the speakers of the event was Eugeniya Chernova, Head of Controlling and Reporting of swilar Moscow, who reminded in her speech that the crisis is a reason for any company to think about its internal control system (ICS).

During the pandemic, all companies in one way or another faced the reasons for paying special attention to the ICS:

- communication difficulties in a remote work environment,

- high level of uncertainty in the market,

- increase of the level of process automation,

- bureaucratic obstacles, etc.

Properly organized internal control allows the prompt identification of risks and reduction of the possible damage from these factors, and often prevents them.

Eugenia covered the legislative base related to setting up internal control, spoke about the step-by-step scheme of ICS, outsourcing and co-sourcing.

The participants and experts also discussed transfer pricing, document flow and IT accreditation, operating leasing, and digital solutions for finance management.

More than 150 people participated in the conference on- and offline, including financial and general managers, heads of commercial departments and legal departments, tax experts and financial analysts.

Photos: Financial Reporting Committee of Russian-German Chamber of Commerce.

Online seminar 09.09.21: “Public procurement as a foreign company in Russia explained: knowing the law and participating successfully”

On September 9th, swilar together with its partners held an online seminar in English on “Public procurement as a foreign company in Russia explained: knowing the law and participating successfully”.

Participating in tenders in Russia is challenging for every company, especially foreign one. The purpose of the seminar was to introduce participants to the basics of the legal framework and provide practical advice on the successful participation of foreign companies in public procurement in Russia.

Seminar participants were greeted by Artur Chernievsky, head of Swiss Business Hub Russia and Dr. Anastasia Nosova, project manager of Bavaria Representative Office in Russia.

Vlad Rudnitsky, Deputy Director for the Russian Market and Anna Zaitseva, Tax Advisor at Peterka&Partners, introduced the audience to the general legal framework of public procurement in Russia.

Russia has a special national public procurement regime. Alexander Gavrilov, Principal Associate of Eversheds Sutherland, and Nikita Butenko, Counsel, spoke about preferences and restrictions for foreign goods and services.

The topic of special conditions for foreign SMEs and foreign companies was covered by Daria Pogodina, the General Director of swilar.

Alexey Inozemtsev, Director of ENERGAZ/Samapi Group in Russia, shared his experience of participation in tenders for companies of Russian energy sector.

Markus Vollmer, Head of Sales, BIOWORKS Verfahrenstechnik GmbH presented the case of BIOWORKS on public procurement in the Russian market.

Organized by Swiss Business Hub Russia, Bavaria Representative Office in Russia and swilar.

Inclusion of license fees in the customs value

Earlier, we provided you with an overview of the current situation with the liquidation of LLCs in Russia.

In addition to the previous review, we would like to further draw your attention to this year’s innovation: a simplified liquidation procedure.

A simplified liquidation procedure is available for SMEs (for the latest information on the status of SMEs, see here and here) and allows you to reduce the time and cost of the liquidation procedure, as well as reduce possible risks of improper liquidation (for example, restrictions on participation and management in new companies within three years).

However, not all SMEs are eligible for simplified liquidation by default. To do this, the company must comply with a list of certain additional criteria.

What conditions must be met to be eligible for simplified liquidation?

- All founders (members) of the company made a resolution to terminate activities unanimously.

- The company is included in the unified register of small and medium enterprises (SMEs).

- The company is not a VAT payer (it is on a simplified tax system) or is exempt fr om VAT.

- The company does not have debts to creditors, including debts to employees and the state budget.

- There are no marks in the Unified State Register of Legal Entities about the inaccuracy of data and about the initiation of bankruptcy proceedings.

- The company has no real estate and vehicles in the property.

- The organization is not in the process of liquidation, reorganization or in the process of forced exclusion from the Unified State Register of Legal Entities by decision of the Federal Tax Service.

How to implement simplified liquidation?

To start a simplified liquidation, you must submit an application to the tax service on form P19001. At the moment, the paper and electronic formats of this form have not yet been approved, at the current stage, you can familiarize yourself with the draft form.

In the application, the founders (members) of the company confirm that:

- All financial obligations to counterparties have been fulfilled.

- All payments due to dismissed employees have been made.

- No later than one business day before exclusion from the Unified State Register of Legal Entities, all taxes have been paid and final tax reporting has been provided.

The application can be submitted electronically (using an enhanced qualified electronic signature of each participant), directly to the tax service on paper (notarization of signatures will be required) or through a notary public.

What is the time lim it for simplified liquidation?

The tax service will check the application and within 5 business days will make a decision on the upcoming exclusion of the company from the Unified State Register of Legal Entities or refusal.

In case of a positive decision by the tax service, information about the upcoming exclusion of the company from the register will be published in the Unified State Register of Legal Entities and in the State Registration Bulletin.

Within 3 months from the date of publication in the bulletin, the creditors of the company will be able to send their objections, if any.

If there are no objections from creditors within 3 months, the liquidated company will be excluded from the register.

It is important to know:

The initial conditions for simplified liquidation must be met at the time of exclusion. If during this period the company accumulates debts or assets, or fails to submit reports, simplified liquidation will not take place.

Contacts:

Maria Matrossowa

Project leader swilar OOO Project Manager of SWILAR LLC

maria.matrossowa@swilar.ru + 7 499 978 37 87 (ext. 308)Tatiana Ushakova

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025

Dear colleagues, Please accept our sincere congratulations on the upcoming New Year and Christmas!

New: changes in the procedure for providing information about participants of foreign companies from 2021

In accordance with the Federal Law № 100-FZ of 20.04.2021 additional responsibilities for foreign companies, as well as foreign entities without incorporation, registered with the Russian tax authorities were added. This includes directly foreign companies, which have received Russian TIN for a bank account in Russian Federation, branches and representatives (hereinafter, – foreign organizations).

In particular, the law obliges foreign organizations, as well as foreign entities without incorporation to report the following information to the tax authorities at the place of their registration:

- Information about the participants of the foreign organization;

- Information on founders, beneficiaries and managers (for a foreign entity without incorporation);

- Information on participation (if any) of a natural person or company, if the share of their direct and (or) indirect participation in the foreign company exceeds 5%.

The above-mentioned information should be submitted to the tax authority annually not later than March 28, considering that the information should be formed in the tax authorities as of December 31 of the year preceding the year of its submission. Thus, the next report with information as of 2021 should be submitted not later than March 28, 2022. The form of this report will be approved additionally.

Previously p. 3.2 of Art. 23 of the Tax Code provided for the above obligation only for foreign organizations that had their own taxable immovable property in Russian Federation.

Failure to provide this information in accordance with p. 6. of Art. 1 of the Federal Law № 100-FZ of 20.04.2021 shall entail a penalty of 50 000 ruble. Please note that this obligation does not apply to foreign companies which are registered with the Russian tax authorities only due to the provision of services in electronic form, as well as subsidiaries (OOO) with foreign ownership.

Contacts:

Maria Matrossowa

Project leader swilar OOO Project Manager of SWILAR LLC

maria.matrossowa@swilar.ru + 7 499 978 37 87 (ext. 308)Tatiana Ushakova

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025

Dear colleagues, Please accept our sincere congratulations on the upcoming New Year and Christmas!

New rules for document management and storage in Russia from 01.01.2022: FAS 27/2021

We would like to introduce you to the new standard FAS 27/2021 “Documents and document flow in accounting”, approved by Order No. 62n (registered with the Ministry of Justice on 07.06.2021).

The standard introduces new concepts and legislative norms that significantly change the order of document flow and storage of companies’ documents (except for organizations in the public sector).

The new standard regulates such things as the procedure for signing documents, the date of documents, the language of documents, making corrections and other aspects mandatory for local accounting services in Russia after the introduction of the standard. For your convenience, we have prepared a consolidated overview of the main changes introduced by the new FAS (the overview is available in Russian at the link).

Special attention of foreign companies operating in Russia deserves paragraph 25 of the standard:

Storage of accounting documents

An economic entity must keep accounting documents as well as data contained in such documents and locate the databases of such data in the territory of the Russian Federation.

If the laws or regulations of the country – the place of business outside the Russian Federation – require storage of accounting documents in the territory of this country, such storage should be ensured.

The paragraph about the need to keep accounting registers in the Russian Federation raises the most questions from foreign companies.

Many international companies (especially those using SAP, Navision and other international accounting systems) often use servers outside the Russian Federation, which are shared by the group of companies, so the requirement to store registers within the country may entail significant structural changes.

At the moment, however, there is no direct indication in the standard (paragraph 25) as to whether the primary accounting registers should be stored in Russia or whether it will be sufficient to ensure the storage of a copy of the registers to meet the requirements of the new FAS.

In this connection, collective appeals by international business associations to the Ministry of Finance requesting the necessary clarifications are currently being prepared. We are closely monitoring the situation and will be happy to offer updates on this topic should further information become available.

We will be glad to answer your questions!

Contacts:

Eugenia Chernova

Natalia Safiulina

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025

Dear colleagues, Please accept our sincere congratulations on the upcoming New Year and Christmas!

Liability for violation of personal data protection

In case your activity involves processing of personal data by using a website, we recommend that you check compliance with all legal requirements for the protection of personal data.

Starting March 27, 2021 the liability for violation of the processing of personal data became more strict: provisions of the Federal Law dated February 24, 2021 Nr. 19- FZ “On Amending the Russian Federation Code of Administrative Offences” will come into force.

This law increases the following fines:

- Legal entities may face a fine from sixty thousand to one hundred thousand rubles for unlawful and/or non-purpose data processing.

- In the absence of legally required consent to the processing of personal data, legal entities face a fine of thirty thousand to one hundred and fifty thousand rubles.

- Failure to provide users/subjects of personal data with access to the personal data processing policy or information on the personal data protection requirements being met may subject legal entities to a fine of thirty to sixty thousand rubles.

In addition to the fines increase, the warning as a form of administrative responsibility for violation of legislation on personal data is eliminated. According to clause 2 of the mentioned law, the limitation period for that kind of violation is increased to 1 year. Please note that Federal Supervision Service for Communications, Information Technologies and Media (Roskomnadzor) may inspect the compliance of the data collection and processing with Russian law. The first check may take place after three years from the date of registration of a legal entity by the tax authority. The second check will also be possible after the expiration of the three-year period from the date of the last scheduled check of the operator.

We recommend that you check your company for inclusion in the inspection plan on the official website of Roskomnadzor and prepare the necessary documents in case of an inspection. Unscheduled inspection of the company can be initiated if violations on the website are detected or if previously detected violations have not been eliminated. We will be happy to answer your questions!

Contacts:

Maria Matrossowa, Project leader swilar OOO

M: maria.matrossowa@swilar.ru, T: + 7 499 978 37 87 (ext. 308)

Tatiana Ushakova, Project manager swilar OOO

M: tatiana.ushakova@swilar.ru, T: +7 499 978 37 87 (ext. 309)

Contacts:

Eugenia Chernova

Olga Kireyeva

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025