Author: Mark

March 3 – “Live” seminar for financial departments of foreign companies

“Live” seminar for financial departments of foreign companies:

expert reviews and networking

In the current turbulent times it is more important than ever to stay in touch, be in touch, and follow the events and developments.

Therefore, despite the current acute situation, we are not cancelling the previously planned offline event on 03.03.2022, and offer you to meet offline in order to obtain useful information in your work and share experiences with other foreign companies.

We have invited leading experts who will talk about the latest changes in FSBU standards, specifics of interaction with foreign employees under the new rules and current tax issues.

Head of German luxury brand of organic cosmetics “Dr.Hauschka” Mr. Artem Boyko will share his experience and talk about brand products and care.

The seminar will take place on March, 3 in the German Center of Industry and Trade – we would like to thank for the cooperation the head of the center Dr.Hauschka Kristina Frank.

At the event you can get useful information from experts not only on the new accounting standards and auditors’ comments, but also learn about the latest tax changes and migration issues.

After the substantial part of the program, participants will be able to share their experience in current planning processes with other representatives of foreign businesses in Russia.

Snacks and drinks will be offered to participants.

MARCH 3 FROM 10:00 TO 17:30

LOCATION: The German center of industry and trade

Moscow, Andropov Ave, 18, 5-minutes-walk from Technopark metro station

PARTICIPATION IS FOR A FEE.

INFORMATION ABOUT THE CONDITIONS OF PARTICIPATION IS AVAILABLE AT THE REGISTRATION LINK.

We look forward to your participation!

Online Seminar 24.02.22: “Economic Forecasts for 2022 for German Companies in Russia”

Representation of Bavaria in Russia, swilar, with the kind support of the Representation of the Lower Saxony in Russia, DZ Bank AG, Schattdecor OOO, the law firm Balashova Legal Consultants and the audit company Sterngoff Audit

kindly invite you to the online seminar on the topic

“Economic forecasts for the year 2022

for German companies in Russia”.

Date: February 24, 2022

Time:

09:00-10:30 (CET).

11.00 – 12.30 (Moscow)

Language: The event will be held in German. No translation is provided.

Participation in the event is free of charge.

Programm:

1. Annual review 2021-2022: Analysis and forecast of the Bavarian economy in Russia

Claudia Schleicher, Head of Representation of Bavaria in Russia

Dr. Anastasia Nosova, Project Manager of Representation of Bavaria in Russia

2. Main changes in the legislation in 2021-2022: What to pay attention to? Review

Daria Pogodina, the General Director of swilar in Moscow

3. Overview of Macroeconomics 2022

Thorsten Erdmann, Head of Foreign Business Advisory & Sales in Bavaria and Baden-Wuerttemberg, DZ BANK AG

4. Updating in customs law and certification: what’s in store for 2022?

Anna Urumyan, Head of Representation of Lower Saxony in Russian

5. Changes in the Russian migration law

Elena Balashova, Managing Partner, Balashova Legal Consultants

6. Practice overview – Experience 2021 / Expectations 2022

Jens Palmen, General Director of Shattdecor OOO

7. Q&A

The event will be held via Zoom. The language of the event is German, no translation is available.

Please register for the online seminar by clicking on the link or by emailing Larisa Liadova larisa.liadova@swilar.ru.

We look forward to your participation!

Dactyloscopy, photography and mandatory medical examinations for foreign citizens

We would like to remind you that starting fr om December 29, 2021 (with the Federal Law № 274-FZ fr om 01.07.2021 coming into force) the new migration legal requirements, which require foreign citizens to undergo dactylography and photographing as well as a mandatory medical examination. This requirement concerns:

• those arriving in Russia for the purpose of carrying out labor activities and

• foreign citizens arriving to the Russian Federation for other purposes for a period exceeding 90 calendar days.

For your convenience, we have compiled for you the addresses of clinics/stations in Moscow wh ere you can apply to get the necessary procedures.

Dactyloscopy and photography

Duration of procedures:

Within 30 calendar days from the date of entry into the Russian Federation or when applying for a patent or a work permit.

Where you can get it done:

1. At the Multifunctional Migration Center in Sakharovo on the day of the receipt of the work permit.

Address: Moscow, Troitskiy AO, Voronovskoe settlement, Varshavskoe highway, 64th km, bld. 1/47.

Opening hours: from Monday to Sunday from 08.00 to 20.00.

!! Here you can also undergo necessary medical examinations.

2. In the State Budgetary Institution “Migration Center” only for foreign citizens who came to Russia to perform labor activities.

Opening hours: from Monday to Friday from 09.00 to 18.00

!! Here you can also submit documents about the medical examination.

What documents are required:

To undergo dactyloscopy and photography, a foreign citizen must present the following documents:

• passport and a notarized translation of the passport;

• certificate of absence of disease caused by human immunodeficiency virus (HIV infection);

• documents confirming medical examination.

Period of validity:

Dactyloscopic registration and photographing are taken once; the documents are valid indefinitely. In case of loss of documents confirming the passing of fingerprinting and photographing, duplicates of these documents can be obtained.

Medical examinations

Time requirements for medical examinations:

• for foreign citizens arriving in Russia for labor purposes – within 30 calendar days from the date of entry into the Russian Federation. At the same time the foreign citizen is obliged to present these documents to migration authorities within thirty days from the date of entry;

• for other foreign citizens – within 90 calendar days from the date of entry into the Russian Federation.

What documents are required:

• passport and notarized translation of the passport;

• migration card;

• registration at the place of residence.

Where you can get it done (in Moscow):

1. CENTRAL DEPARTMENT FOR SPECIALIZED MEDICAL CARE

Address: Leninsky Prospekt, 17, room 56.

Phone: 8 499 558-58-28, 8 495-952-34-22.

Opening hours: from 09.30 to 13.00 on working days according to the order of the person in the line.

Range of necessary medical examinations: except fluorography.

2. Kutuzovsky clinic

Address: 41 Kutuzovsky Prospekt.

Phone: 8 499-249-25-55, 8 499 558 58 28.

Opening hours: working days from 09.00 to 15.00.

Range of necessary medical examinations: except fluorography.

3. Clinic named after V.G. Korolenko

Address: 3, Kosinskaya str.

Phone: 8 495-770 -09-83.

Opening hours: working days from 09.00 to 15.00.

Range of necessary medical examinations: There is no information about the possibility of fluorography.

4. Proletarsky clinic

Address: 22 Melnikova St.

Phone: 8 495-674-36-24, 8-499-558-58-28.

Opening hours: working days from 09.00 to 15.00.

Range of necessary medical examinations: except for phthisiatrician.

5. Ostankinsky clinic

Address: 103, Prospekt Mira St.

Phone: 8-495-682-30-91, 8-495-682-30-80.

Opening hours: working days from 09.00 to 15.00.

Range of necessary medical examinations: There is no information about the possibility of fluorography.

6. Sakharovo Multifunctional Migration Center – Branch “Multifunctional Medical Center of Labor Migration”

Address: Moscow, Troitskiy AO, Voronovskoe settlement, Varshavskoe highway, 64th km, bld. 1/47.

Opening hours: from Monday to Sunday from 08.00 to 20.00.

Full range of necessary medical examinations, including fluorography: yes.

7. State Budgetary Institution “Moscow City Scientific and Practical Center for Fighting Tuberculosis of the Department of Health of the City of Moscow”.

Address: 18, Dokukin St.

Phone: 8-499-187-78-72, 8-499-187-90-77.

Opening hours: 8.00-20.00, Saturday from 9.00-16.00.

Full range of necessary medical examinations, including fluorography: Yes.

Please note that the approximate time to take the tests takes 3 hours. Term of preparation of the medical report after examination and tests takes up to 7 working days.

Wh ere to submit the results of the medical examination

The results of the medical examination must be submitted in person to the migration authorities, considering the deadlines established by law.

You can submit the results of the medical examination:

1. At the Multifunctional Migration Center in Sakharovo on the day of the receipt of the work permit.

Address: Moscow, Troitskiy AO, Voronovskoe settlement, Varshavskoe highway, 64th km, bld. 1/47.

Opening hours: from Monday to Sunday from 08.00 to 20.00.

2. In the State Budgetary Institution “Migration Center” only for foreign citizens who came to Russia to perform labor activities.

Opening hours: from Monday to Friday from 09.00 to 18.00

!! Here you can also undergo dactyloscopy and photography.

First-hand comment from our foreign colleague.

I came to Russia at the beginning of January and, therefore, had to undergo a medical examination and fingerprinting.

I had a medical check-up in the medical center at 18 Dokukin St., because you can take all the analyses there and there is no need to go to other institutions. The line (without an appointment, the principle of a live line) was already quite long at 10 o’clock in the morning, so it is advisable to come early. The staff is friendly and helpful, but if you do not speak Russian, it is worth bringing an interpreter.

I ended up spending 4 hours in the clinic, including 3 hours in line, the tests themselves were done within an hour.

I received the results in 7 working days in the same building.

For fingerprinting I decided to go to the migration center in Sakharovo. I arrived by public transportation at 8 am and was directed to Gate 1 (for work permit holders). It took me 1.5 hours to get a voucher, then another 2 hours before I could get fingerprinted and photographed. It takes 4-6 business days to get confirmation that all the documents have been submitted.

Including the drive there and back, the whole procedure took me 10 hours. The staff is friendly and diligent, but the process on site is very unclear.

Summary of the procedure

Let’s summarize the order and steps of the above procedures:

1. Have your tests done at one (or several, in case one of the specialists/examination options is not available at the chosen center) of the medical centers listed above.

2. Receive test results from the appropriate medical center after 7 business days.

3. Get fingerprinted and photographed.

4. After all the procedures you will get a fingerprint card with. The information will be sent for registration to the information center of the Main Directorate of the Ministry of Internal Affairs in Moscow.

Please note that the information in the overview is relevant as of the date of this posting. The procedure is being clarified, and information may change. We recommend you to clarify the information before you visit a clinic or an authority.

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025

Dear colleagues, Please accept our sincere congratulations on the upcoming New Year and Christmas!

New standards “accounting of leases/rentals” and “fixed assets” – practical emergency assistance for accountants

We would like to remind you that from 01.01.2022, the application of the standards FAS 6 “Fixed Assets” and FAS 25 “Accounting of Leases/Rentals” is mandatory.

Much has been written and said about the new FAS. We, for our part, have been reviewing the standards in our newsletters and webinars.

However, even with the information available from open sources, accountants have many practical questions about how to apply the new standards in their company. There are a number of issues that need to be resolved individually for each company.

For example:

• What discount rate should be used when calculating lease payments?

• How should cash flows be determined and at what rate should they be dis-counted in an impairment test?

• For which assets will the residual value be non-zero and how should the re-sidual value be determined?

• How do I make adjustments to a lease agreement?

• What entries should be made when the asset is impaired, when the asset is revalued?

• Which points should be changed/added in the accounting policy?

• and many others

Drawing on our extensive experience with international accounting standards, as well as a large number of real-life cases from clients, we can offer “emergency assis-tance” to accountants in answering these relevant and important questions.

In case you have difficulties and/or questions regarding the application of the new lease or fixed asset standards, send us an email with the subject “Question on the new FAS”. We will answer quickly and to the point.

Contacts:

Eugenia Chernova

Natalia Safiulina

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025

Dear colleagues, Please accept our sincere congratulations on the upcoming New Year and Christmas!

Changes in the tax treatment of finance lease transactions

On 29 November 2021, with the adoption of Federal Law No. 382-FZ, changes to the tax treatment of leasing transactions were introduced.

Changes affecting the calculation of property tax – clause 49 of Law 382-FZ makes amendments to Article 378 of Chapter 30 of the Tax Code, meaning that the tax for rented property, including finance lease (leasing) agreements, is payable by the lessor.

Changes affecting the calculation of profit tax:

- Law 382-FZ (clause 21) excludes clause 10 of Article 258 of the Tax Code, which allows the lessee or lessor to depreciate the leased property depending on who records the leased asset on their balance sheet under the terms of the agreement. In other words, the lessee will no longer be able to depreciate the leased asset in tax accounting starting from 2022, as was the case previously if the lessee accounted for the leased asset on their balance sheet – with the introduction of the changes, the leased asset will only be considered depreciable property by the lessor in tax accounting;

- clause 23 of the adopted law also changes the procedure for calculating profit tax in terms of how expenses under leasing agreements are recognised (sub-clause 10, clause 1 of Article 264 of the Tax Code) – if the payments under the agreement include the purchase price of the leased asset, which passes into the lessee’s ownership after the agreement ends under a sales agreement, the leasing payments are recognised as expenses less the purchase price;

Accounting for the purpose of paying transport tax does not change with the entry into force of Law 382-FZ.

The Federal Law comes into force on 1 January 2022.

Contacts:

Eugenia Chernova

Olga Kireyeva

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025

Dear colleagues, Please accept our sincere congratulations on the upcoming New Year and Christmas!

FAS 27/2021 – postponement of the due date for the requirement to store accounting documents

In our message No. 6/2021 dated 06/11/2021, we informed about the planned changes in the workflow regulations, which could have a significant impact on the work of companies that use ERP systems hosted on servers located outside the territory of the Russian Federation.

On December, 24th 2021 the Ministry of Finance of Russia issued information message No. IS-Uchet-35 on the adoption of Order No. 224n dated 23.12.2021, according to which the due date for the requirement to store accounting documents on the territory of the Russian Federation, according to the Federal Accounting Standard FAS 27/2021, is postponed from January, 1st 2021 to January, 1st 2024.

The amendments were adopted in order to provide conditions for the organizations for proper preparation to store accounting documents in the Russian Federation, by postponing the due date of paragraph 25 of FAS 27/2021 from January 1st , 2022 to January 1st, 2024.

It is noted that the due date of the beginning of whole FAS 27/2021 standard remain in force, with the exception of paragraph 25 of FAS 27/2021 on the storage of accounting documents, data contained in such documents, and the placement of databases on the territory of the Russian Federation, which is subject to mandatory application from January 1st, 2024.

Information message No. 6/2021 with a detailed review of FAS 27/2021 can be found found at the following link.

We will be glad to answer your questions!

Contacts:

Eugenia Chernova

Olga Kireyeva

Natalia Safiulina

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025

Dear colleagues, Please accept our sincere congratulations on the upcoming New Year and Christmas!

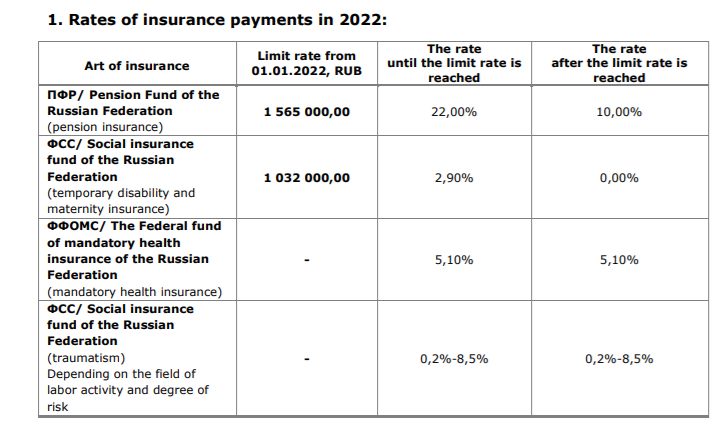

The rate limit for insurance payments in 2022

Оn January 1, 2022, the Resolution of the Government of the Russian Federation №1951 dd. 16.11.2021 comes into force. It concerns increasing the rate limit for insurance payments in cases of temporary disability and maternity, and also mandatory pension insurance:

- The rate limit for social insurance, in cases of temporary disability and maternity, for each individual does not exceed 1,032,000 rubles on a cumulative basis starting fr om the 1 January 2022;

- The rate limit for mandatory pension insurance does not exceed 1,565,000 rubles on a cumulative basis starting from the 1 January 2022 for each individual.

The payments for health care insurance and social payments in case of injuries will have to be made on the basis of all the taxable incomes irrespective of their amount. There will be no lim it for them, as before.

The limits and regulations for calculating insurance payments given above will be valid in 2022 for all companies, except for those with the status of SMEs.

2. Social contributions for SMEs in 2022:

We remind you that in accordance with the Federal Law of 01.04.2020 № 102-FZ dated April 1, 2020, the total amount of insurance payments for SME to state extrabudgetary funds in respect of payments to individuals, in excess of the minimum monthly wage, is reduced to 15%.

This reduced rate for SME applies irrespective of the maximum amount of payments to an individual (see above). At the same time, a part of payments less than or equal to the minimum monthly wage (determined at the end of each calendar month) is taxable at the general insurance contribution rate of 30%.

The value of the minimum monthly wage is set simultaneously on the entire territory of the Russian Federation by the federal law and is subject to annual indexation.

The minimum wage is established at the rate of 13 890 rubles for 2022 (Federal law N 406-FZ dated 06.12.2021).

Please note! Reduced tariff of insurance payments for SME from 01.01.2021 is determined for unlimited term (Item 17, clause 1, Art. 427 of the Tax Code, as amended from 01.01.2021).

We will be happy to answer your questions!

Contacts:

Natalia Safiulina

Ekaterina Babenko

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025

Dear colleagues, Please accept our sincere congratulations on the upcoming New Year and Christmas!

FAS 6/2020 “Fixed Assets” from 01.01.2022

We would like to draw your attention to the fact that starting fr om January 1, 2022 a new standard for accounting for fixed assets (hereinafter referred to as FA) is mandatory for usage – FAS 6/2020.

The corresponding changes were made by the Order of the Ministry of Finance N204n dated September 17, 2020. Before transition to the new standard, we recommend that you do the following:

• Establish a limit on the cost of fixed assets to allocate the cost of an asset to the FA or the low-value FA category;

• Conduct an inventory of fixed assets and other assets that, in accordance with FAS 6/2020, could be classified as fixed assets based on the new cost limit;

• Make appropriate changes to the accounting policy of the Company;

• Determine the useful life period of the FA and the terms of the annual testing of it for relevance;

• Sel ect the method of subsequent accounting of the FA (after initial recognition), at initial or revalued cost;

• Determine the liquidation value (hereinafter referred to as LV) of fixed assets on the balance sheet of the enterprise. and the timing of the annual LV assessment;

• For the method of assessing fixed assets at a revalued cost, establish the frequency of revaluation of fixed assets for each group of revalued fixed assets;

• Reflect changes in the organization’s balance sheet as of 01.01.2022 using incoming adjustments;

• Disclose relevant information in the accounting (financial) statements of the company.

What does this mean in practice?

According to the new standard, an organization has the right to independently set a cost limit for classifying an object as a fixed asset, in the contrast to the previously existing limit of 40,000 rubles.

With an increase in the limit (if, for example, an organization decides to set it at the level of 100,000 rubles in order to make it equal to the FA limit in tax accounting), some fixed assets may no longer meet the accounting FA lim it criteria and will need to be reclassified as low-value FA, writing off the net book value of the period as an expense (clause 5 of FAS 6 / 2020), while it will be still necessary to keep inventory and off-balance sheet records of such objects.

The standard introduces the concept of residual value – the amount that an entity would receive if an item were disposed of (including tangible assets remaining after disposal), less the estimated disposal costs at the time of disposal. A LV of the particular can be equal to zero if at the end of the UL no more benefits are expected fr om the disposal of the object, if receipts are expected, but they are not material, or if it is impossible to determine how much will be received upon disposal of an asset (paragraph 31 of FAS 6/2020).

The liquidation value of fixed assets should be systematically (at least, at the end of each year) analyzed for changes and, if necessary, adjusted (clause 37 of FAS 6/2020).

Also, the innovation of the standard – the accrual of depreciation on fixed assets is not suspended (including in cases of downtime or temporary break in the use of fixed assets), except for the case when the residual value of an item of fixed assets becomes equal to or exceeds its book value (hereinafter BV). If subsequently the residual value of such an item of fixed assets becomes less than its book value, depreciation is resumed on it (paragraph 30 of FAS 6/2020).

What should be done?

According to paragraphs 48-49 of FAS 6/2020, the consequences of a change in accounting policy associated with the beginning of the application of the new standard should be reflected retrospectively – as if the specified standard had always been applied.

It is necessary to recalculate and adjust the balance sheet statement in the part of fixed assets as of 01.01.2022, in case there was no early application of the standard, and also determine the BV – the initial asset cost less accumulated depreciation. The initial cost should be calculated according to the previously existing rules, and the accumulated depreciation – according to the norms of the new standard (clause 49).

Prospective application of the standard, without incoming adjustments at the beginning of the year, is possible only for organizations that are entitled to use simplified accounting methods, including simplified accounting (financial) statements (paragraph 51 of FAS 6/2020).

We will be happy to answer your questions!

Contacts:

Eugenia Chernova

Olga Kireyeva

Natalia Safiulina

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025

Dear colleagues, Please accept our sincere congratulations on the upcoming New Year and Christmas!

Changes in Migration Legislation

We would like to pay your attention to the fact that the changes specified in the Federal Law No. 274-FZ of July 01, 2021 “On the introduction of amendments to the Federal Law “On the legal status of foreign citizens in the Russian Federation” and the Federal law “On state fingerprint registration in the Russian Federation” shall become effective from December 29, 2021.

According to the Federal Law No. 274-FZ of July 01, 2021 foreign citizens who have arrived in the Russian Federation for working purposes (including highly qualified specialists) shall be subject to mandatory medical examination for substance abuse, infectious diseases that constitute a danger to the public, as well as HIV infection, to state fingerprint registration and photography within 30 calendar days from the date of arrival in the Russian Federation or from the date of receipt of work permission documents.

Besides, foreign citizens who have arrived in the Russian Federation for purposes other than work for a period exceeding 90 calendar days shall be subject to the abovementioned mandatory medical examination, mandatory state fingerprint registration and photography within 90 calendar days from the date of arrival in the Russian Federation.

State fingerprint registration and photography of foreign citizens will need to be completed once.

The medical examination must be repeated multiple times depending on period of validity of medical certificates. It is necessary to mention that in accordance with the clause 20 of the Ministry of Healthcare of the Russian Federation Order No. 1079нof November 19, 2021 that enters into force from March 01, 2022, medical certificates issued to foreign citizens will be in force within 3 months from their issuance. The Law specifies the procedure for repeated medical examination and submission deadline of its results to the territorial authority of the Ministry of Internal Affairs of the Russian Federation within 30 calendar days from the date of expiry of medical certificates. The results of the medical examination are to be submitted by a foreign employee in person or through the Russian unified portal of state and municipal services (Gosuslugi).

If a foreign citizen fails to comply with the above-mentioned mandatory procedures, the period of his residence is reduced and he will be obliged to leave the territory of the Russian Federation.

Contacts:

Maria Matrossowa

Project leader swilar OOO Project Manager of SWILAR LLC

maria.matrossowa@swilar.ru + 7 499 978 37 87 (ext. 308)Tatiana Ushakova

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025

Dear colleagues, Please accept our sincere congratulations on the upcoming New Year and Christmas!

The members of German-Russian Chamber of Commerce (AHK) in their own words: three questions to swilar

Comment of swilar Moscow General Director Daria Pogodina for the December issue of the Russian-German Chamber of Commerce briefing

– What does your company do?

– We provide the full range of administrative services for foreign business in Russia. Usually we start the interaction at the stage of management consultancy support in Europe, and then work with the structure in Russia in the format of, amongst other things, outsourcing of accounting, controlling and reporting.

– This year your company celebrates its 10th anniversary. How do you evaluate the path you’ve traveled?

– Over the past few years, we have been actively developing new areas: for example, we started working in SAP and other systems. However, despite the constant dynamics of development, we are particularly proud of the stability of the processes: many customers have been with us for all these years and have no plans to change this. For us, this is an important indicator and recognition of the quality of our work. Another great achievement is our close-knit team: thanks to the coordinated work of our employees our processes not only didn’t sag in the pandemic, but also reached a new level of automation and quality.

– What do you value most about AHK?

– We have been members of AHK practically since the company was founded, and we are proud to be part of such an active business community. The most valuable thing for us in AHK is networking, feeling of constant support and possibility to cooperate with the specialists of different fields.

Synopsis. AHK Briefing is a newsletter that includes an overview of key news in the Russian market.

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025