Category: Past events

Topics 2025: Practical Experience and Recommendations for Business Operations in Changing Conditions

PROGRAM

1. Current situation with international payments — overview and practical recommendations. Cryptocurrency payments — new opportunities for business?

Daria Pogodina — Managing Partner, swilar

2. Possibilities of transfers within the framework of foreign economic activity in rubles and yuan

Vasily Lukyanenko — Head of Department, JSC OTP Bank, Corporate Business Directorate

3. What to consider when working with personnel

Elena Balashova — Managing Partner, Balashova Legal Consultants

4. Liability insurance as an important element of risk management. Risks of directors and managers

Nikolay Artamonov — Underwriter for financial risks, JSC IC Turikum

5. Audit checklist — main errors identified by auditors in accounting and tax accounting based on the results of 2024 in the context of constant changes. Preparation for the annual audit

Olga Grigorieva – General Director of Sterngoff Audit LLC

6. Logistics and customs risks when importing to the Russian Federation. Latest practice: routes, customs control, inclusion of agent fees, dividends

Anna Dashicheva – Commercial Director of Polar Group LLC

Online seminar 13.12.2024: Doing Business in Russia – Practical Experience in New Circumstances

PROGRAM

Detailed reviews and Q&A session with experienced experts on the following topics

1. Doing business in Russia

Legal, tax, HR and migration issues. Basics.

2. Overview on bank transaction with Russia

SWIFT, currency exchange and other.

3. Practical experience of foreign companies in Russia

FAQ in the regular business processes.

Online seminar 11/12/2024: Features of liquidation of companies with foreign participation: latest changes and practice

PROGRAM

1. Features of liquidation of foreign subsidiaries in 2024-2025.

Daria Pogodina, Managing Partner of swilar

2. Liquidation audit – features of the procedure.

Olga Grigorieva, General Director of Sterngoff Audit

3. Closing representative offices and branches of foreign companies – what to consider?

Daria Pogodina, Managing Partner of swilar

4. Features of termination of employment relations with employees during company liquidation.

Elena Balashova, Managing Partner of Balashova Legal Consultants

5. Planning the budget and financing of the company during the liquidation period.

Natalia Samonova, Head of Controlling Projects of swilar

6. Business valuation in Russia for the purpose of submission to the Government Commission.

Alexey Sitnikov, Director, Swiss Appraisal

FSBU 27/2021 and new sanctions restrictions in terms of impact on the IT sector: risks, deadlines, necessary actions

PROGRAM

1. FSBU 27/2021 and new sanctions restrictions in terms of their impact on the IT sector. Overview.

Daria Pogodina, CEO of SVILAR LLC

Olga Grigorieva, CEO of Shterngoff Audit LLC

2. Localization and support of ERP taking into account the 12th package of sanctions.

Stanislav Malyshev, CEO of ALPE Consulting LLC

3. The 12th package of sanctions and other restrictions in the IT sector.

(How to prepare a company’s infrastructure for changes)

Sergey Idiyatov, Head of Corporate Client Support, ALP ITSM

Autumn 2023 Topics: Practical Experience and Recommendations for Working in Changing Conditions

On November 30, the online seminar was held on the topic “Current topics of autumn 2023: practical experience and recommendations for working in changing conditions” where experts discussed with the audience the issues of suspension of the DTT, liability of companies for failure to maintain military records, company adaptation to sanctions and restrictions in IT, as well as the specifics of transfer pricing and trends in logistics.

The General Director of swilar Daria Pogodina spoke in more detail about the expansion of the list of offshore companies, the consequences and mitigations in the issue of suspension of the DTT.

Elena Balashova, Managing Partner of Balashova Legal Consultants, analyzed the current changes and judicial practice regarding the maintenance of military records.

Sergey Bezruchenok from ALP ITSM shared his experience in solving problems with the termination of support for Microsoft, VPN and Russian email addresses.

Head of the Controlling and Reporting Department of swilar Eugenia Chernova discussed in more detail how to prepare for work in the changed conditions of transfer pricing, and Managing Partner of Sterngoff Audit Olga Grigorieva gave a checklist of the main errors that auditors identified in accounting and tax accounting in the first half of 2023.

Commercial Director of Polar Logistics Solutions Anna Dashicheva spoke in detail about current trends in logistics using the example of the North-West. At the end of the meeting, the speakers discussed questions from the audience.

Follow the program of our events in the future and join in if the topic is relevant to you.

Organizers: swilar group of companies together with the audit company Sterngoff Audit, the law firm Balashova Legal Consultants, the IT company ALP ITSM and the logistics company Polar Logistics Solutions.

Online seminar 10/24/23

On October 24, a checklist seminar was held entitled “Main tax changes, suspension of SUDAT, new FSBU, HR electronic document management. Convergence of HGB IFRS and RAS taking into account the new standards.” Tatyana Rolzing (Vorontsova), leading expert-consultant on taxation at ELKOD LLC and external consultant of Sterngoff Audit, discussed current issues of applying new FSBU: issues of applying FSBU 6/2020, FSBU 26/2020, as well as FSBU 25/2018 for rent and leasing and the transition to FSBU 14/2020 in 2023.

Olga Grigorieva, the General Director of Sterngoff Audit, highlighted the errors identified by auditors during the audit of the first half of 2023.

Evgenia Chernova, Head of Controlling Projects, swilar, gave a comparative analysis of the new FSBU 14 (intangible assets), IAS 38 and HGB.

Anastasia Zaitseva, Head of Labor Practice, Partner, Balashova Legal Consultants, highlighted the specifics of maintaining personnel electronic document management (KEDO).

Daria Pogodina, the General Director of swilar, focused on the issues of DTT: suspension, mitigation, comments, consequences.

Polina Kolmakova, external consultant, Sterngoff Audit, analyzed the main changes in the procedure for calculating and paying taxes in 2023-2024, based on the practice of application, taking into account the clarifications of financial departments and judicial practice.

Online seminar 04/26/23: “Tax changes, FSBU, ETS, tax risks, dividend payments and other issues”

Online seminar 02.03.23: “Situation of foreign SMEs in Russia — Practical experience and reorientation under new conditions: Update”

On 2 March, the online seminar on “Situation of foreign SMEs in Russia — Practical experience and reorientation under new conditions: Update” was held.

The meeting started with a welcome speech by Artur Chernievski, Head of Swiss Business Hub Russia and continued with a discussion of the most relevant topics for foreign SMEs in Russia.

Daria Pogodina, the General Director of swilar LLC, talked about the peculiarities of business restructuring in the current situation and discussed options such as management buyout, liquidation, “sleep mode”.

Ivan Ashaulov, Director, Key Accounts&Partners, gave advice on preparing the business before submitting it to the Government Commission.

Eugenia Chernova, Head of Controlling of swilar LLC, reminded of recent changes related to the payment of dividends from a Russian subsidiary to a foreign parent company.

At the end of the meeting, the speakers answered questions from the audience. Keep an eye on our events programme in the future and join us if the topic is relevant to you.

Organised by Switzerland Global Enterprise, swilar and Swiss Appraisal.

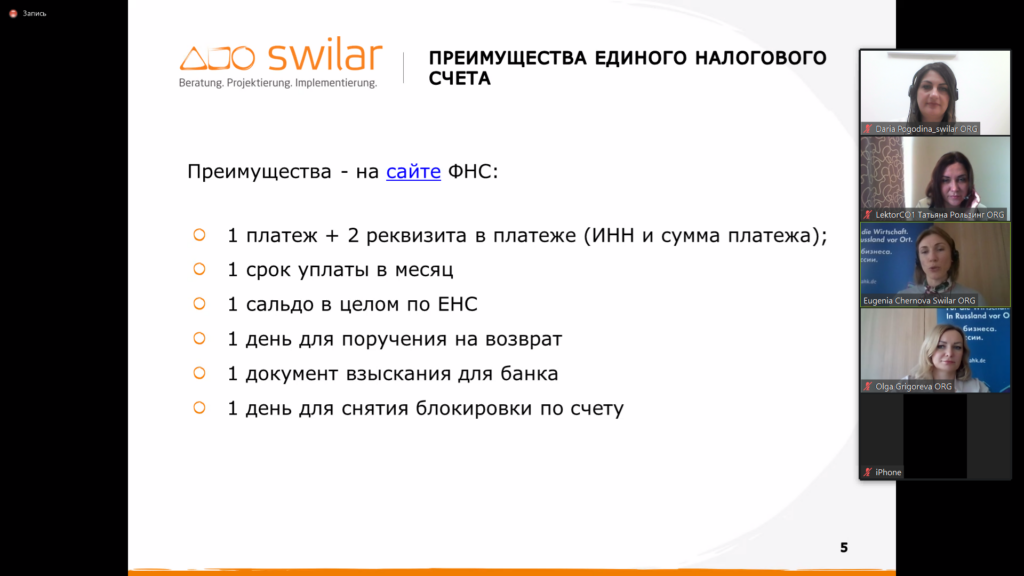

Online seminar on 21.12.22″Overview of the main changes in 2022-2023″

Overview of FSBU changes, unified tax account, military records, work with founders (dividends, management responsibility), employees abroad, customs value

On 21 December, the online seminar “Overview of FSBU changes, unified tax account, military records, work with founders (dividends, management responsibility), employees abroad, customs value” was held.

Daria Pogodina, the General Director of swilar, spoke about the peculiarities of dividend payments to foreign participants and transactions with LLC shares under the new conditions and Eugenia Chernova, Head of Controlling Projects of swilar, spoke about the new rules for settlements with the state from 01.01.2023. The issues of unified tax account and unified tax payment were covered.

Olga Grigorieva, General Director, Auditor of Sterngoff Audit, gave an overview of the new FSBU.

Elena Balashova and Anastasia Zaitseva, partners of Balashova Legal Consultants, highlighted practical aspects of the organization of military records and employer responsibility of international business in the Russian Federation.

Erich Rath, Managing partner of the law firm RECHTSANWALT ERICH RATH, spoke about how to minimize risks in the context of subsidiary liability of a company executive.

Albina Ostrovskaya, tax consultant at Sterngoff Audit, explained the specifics of personal income tax when an employee performs his or her employment duties abroad and the main mistakes accountants make in paying remuneration.

Alexander Revtyuk, customs law expert at Sternhoff Audit, parsed a new clarification of the Supreme Arbitration Court regarding inclusion of dividends to customs value.

The meeting ended with answering questions from the seminar participants.

Follow the programme of future events on the website or in our Telegram-channel and join us.

Organised by swilar company in cooperation with the audit company Sterngoff Audit, legal firm Balashova Legal Consultants and law office RECHTSANWALT ERICH RATH.

Online seminar on 28.10.22: “FAS 6, FAS 26, Single Tax Account”

On October 28, the online seminar “FAS 6, FAS 26, single tax account” was held by swilar experts together with the colleagues from Sterngoff Audit. They gave an overview of the current changes in legislation and answered the main questions regarding the accounting of fixed assets and capital expenditure under the new FAS, as well as regarding the single tax account.

Eugenia Chernova, Project Manager of swilar, thoroughly explained the changes in the rules for tax settlements with the Russian Federation, the new payment schedule, the nuances of individual taxes and contributions and gave practical advice to accountants during the transition period.

At any time, and especially now, it is important to feel supported. Keep an eye on our events, and be sure to join us in discussing topics that are relevant to you in the future. Announcements and news are published regularly on the swilar Telegram channel.