Category: Accounting

Changes in the tax treatment of finance lease transactions

On 29 November 2021, with the adoption of Federal Law No. 382-FZ, changes to the tax treatment of leasing transactions were introduced.

Changes affecting the calculation of property tax – clause 49 of Law 382-FZ makes amendments to Article 378 of Chapter 30 of the Tax Code, meaning that the tax for rented property, including finance lease (leasing) agreements, is payable by the lessor.

Changes affecting the calculation of profit tax:

- Law 382-FZ (clause 21) excludes clause 10 of Article 258 of the Tax Code, which allows the lessee or lessor to depreciate the leased property depending on who records the leased asset on their balance sheet under the terms of the agreement. In other words, the lessee will no longer be able to depreciate the leased asset in tax accounting starting from 2022, as was the case previously if the lessee accounted for the leased asset on their balance sheet – with the introduction of the changes, the leased asset will only be considered depreciable property by the lessor in tax accounting;

- clause 23 of the adopted law also changes the procedure for calculating profit tax in terms of how expenses under leasing agreements are recognised (sub-clause 10, clause 1 of Article 264 of the Tax Code) – if the payments under the agreement include the purchase price of the leased asset, which passes into the lessee’s ownership after the agreement ends under a sales agreement, the leasing payments are recognised as expenses less the purchase price;

Accounting for the purpose of paying transport tax does not change with the entry into force of Law 382-FZ.

The Federal Law comes into force on 1 January 2022.

Contacts:

Eugenia Chernova

Olga Kireyeva

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025

Dear colleagues, Please accept our sincere congratulations on the upcoming New Year and Christmas!

FAS 27/2021 – postponement of the due date for the requirement to store accounting documents

In our message No. 6/2021 dated 06/11/2021, we informed about the planned changes in the workflow regulations, which could have a significant impact on the work of companies that use ERP systems hosted on servers located outside the territory of the Russian Federation.

On December, 24th 2021 the Ministry of Finance of Russia issued information message No. IS-Uchet-35 on the adoption of Order No. 224n dated 23.12.2021, according to which the due date for the requirement to store accounting documents on the territory of the Russian Federation, according to the Federal Accounting Standard FAS 27/2021, is postponed from January, 1st 2021 to January, 1st 2024.

The amendments were adopted in order to provide conditions for the organizations for proper preparation to store accounting documents in the Russian Federation, by postponing the due date of paragraph 25 of FAS 27/2021 from January 1st , 2022 to January 1st, 2024.

It is noted that the due date of the beginning of whole FAS 27/2021 standard remain in force, with the exception of paragraph 25 of FAS 27/2021 on the storage of accounting documents, data contained in such documents, and the placement of databases on the territory of the Russian Federation, which is subject to mandatory application from January 1st, 2024.

Information message No. 6/2021 with a detailed review of FAS 27/2021 can be found found at the following link.

We will be glad to answer your questions!

Contacts:

Eugenia Chernova

Olga Kireyeva

Natalia Safiulina

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025

Dear colleagues, Please accept our sincere congratulations on the upcoming New Year and Christmas!

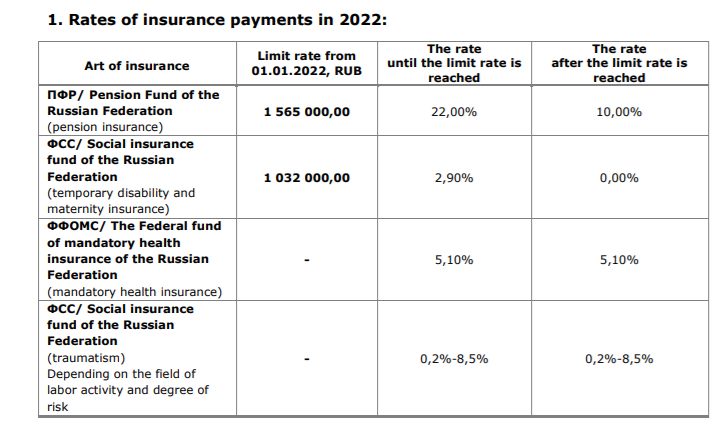

The rate limit for insurance payments in 2022

Оn January 1, 2022, the Resolution of the Government of the Russian Federation №1951 dd. 16.11.2021 comes into force. It concerns increasing the rate limit for insurance payments in cases of temporary disability and maternity, and also mandatory pension insurance:

- The rate limit for social insurance, in cases of temporary disability and maternity, for each individual does not exceed 1,032,000 rubles on a cumulative basis starting fr om the 1 January 2022;

- The rate limit for mandatory pension insurance does not exceed 1,565,000 rubles on a cumulative basis starting from the 1 January 2022 for each individual.

The payments for health care insurance and social payments in case of injuries will have to be made on the basis of all the taxable incomes irrespective of their amount. There will be no lim it for them, as before.

The limits and regulations for calculating insurance payments given above will be valid in 2022 for all companies, except for those with the status of SMEs.

2. Social contributions for SMEs in 2022:

We remind you that in accordance with the Federal Law of 01.04.2020 № 102-FZ dated April 1, 2020, the total amount of insurance payments for SME to state extrabudgetary funds in respect of payments to individuals, in excess of the minimum monthly wage, is reduced to 15%.

This reduced rate for SME applies irrespective of the maximum amount of payments to an individual (see above). At the same time, a part of payments less than or equal to the minimum monthly wage (determined at the end of each calendar month) is taxable at the general insurance contribution rate of 30%.

The value of the minimum monthly wage is set simultaneously on the entire territory of the Russian Federation by the federal law and is subject to annual indexation.

The minimum wage is established at the rate of 13 890 rubles for 2022 (Federal law N 406-FZ dated 06.12.2021).

Please note! Reduced tariff of insurance payments for SME from 01.01.2021 is determined for unlimited term (Item 17, clause 1, Art. 427 of the Tax Code, as amended from 01.01.2021).

We will be happy to answer your questions!

Contacts:

Natalia Safiulina

Ekaterina Babenko

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025

Dear colleagues, Please accept our sincere congratulations on the upcoming New Year and Christmas!

FAS 6/2020 “Fixed Assets” from 01.01.2022

We would like to draw your attention to the fact that starting fr om January 1, 2022 a new standard for accounting for fixed assets (hereinafter referred to as FA) is mandatory for usage – FAS 6/2020.

The corresponding changes were made by the Order of the Ministry of Finance N204n dated September 17, 2020. Before transition to the new standard, we recommend that you do the following:

• Establish a limit on the cost of fixed assets to allocate the cost of an asset to the FA or the low-value FA category;

• Conduct an inventory of fixed assets and other assets that, in accordance with FAS 6/2020, could be classified as fixed assets based on the new cost limit;

• Make appropriate changes to the accounting policy of the Company;

• Determine the useful life period of the FA and the terms of the annual testing of it for relevance;

• Sel ect the method of subsequent accounting of the FA (after initial recognition), at initial or revalued cost;

• Determine the liquidation value (hereinafter referred to as LV) of fixed assets on the balance sheet of the enterprise. and the timing of the annual LV assessment;

• For the method of assessing fixed assets at a revalued cost, establish the frequency of revaluation of fixed assets for each group of revalued fixed assets;

• Reflect changes in the organization’s balance sheet as of 01.01.2022 using incoming adjustments;

• Disclose relevant information in the accounting (financial) statements of the company.

What does this mean in practice?

According to the new standard, an organization has the right to independently set a cost limit for classifying an object as a fixed asset, in the contrast to the previously existing limit of 40,000 rubles.

With an increase in the limit (if, for example, an organization decides to set it at the level of 100,000 rubles in order to make it equal to the FA limit in tax accounting), some fixed assets may no longer meet the accounting FA lim it criteria and will need to be reclassified as low-value FA, writing off the net book value of the period as an expense (clause 5 of FAS 6 / 2020), while it will be still necessary to keep inventory and off-balance sheet records of such objects.

The standard introduces the concept of residual value – the amount that an entity would receive if an item were disposed of (including tangible assets remaining after disposal), less the estimated disposal costs at the time of disposal. A LV of the particular can be equal to zero if at the end of the UL no more benefits are expected fr om the disposal of the object, if receipts are expected, but they are not material, or if it is impossible to determine how much will be received upon disposal of an asset (paragraph 31 of FAS 6/2020).

The liquidation value of fixed assets should be systematically (at least, at the end of each year) analyzed for changes and, if necessary, adjusted (clause 37 of FAS 6/2020).

Also, the innovation of the standard – the accrual of depreciation on fixed assets is not suspended (including in cases of downtime or temporary break in the use of fixed assets), except for the case when the residual value of an item of fixed assets becomes equal to or exceeds its book value (hereinafter BV). If subsequently the residual value of such an item of fixed assets becomes less than its book value, depreciation is resumed on it (paragraph 30 of FAS 6/2020).

What should be done?

According to paragraphs 48-49 of FAS 6/2020, the consequences of a change in accounting policy associated with the beginning of the application of the new standard should be reflected retrospectively – as if the specified standard had always been applied.

It is necessary to recalculate and adjust the balance sheet statement in the part of fixed assets as of 01.01.2022, in case there was no early application of the standard, and also determine the BV – the initial asset cost less accumulated depreciation. The initial cost should be calculated according to the previously existing rules, and the accumulated depreciation – according to the norms of the new standard (clause 49).

Prospective application of the standard, without incoming adjustments at the beginning of the year, is possible only for organizations that are entitled to use simplified accounting methods, including simplified accounting (financial) statements (paragraph 51 of FAS 6/2020).

We will be happy to answer your questions!

Contacts:

Eugenia Chernova

Olga Kireyeva

Natalia Safiulina

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025

Dear colleagues, Please accept our sincere congratulations on the upcoming New Year and Christmas!

New rules for document management and storage in Russia from 01.01.2022: FAS 27/2021

We would like to introduce you to the new standard FAS 27/2021 “Documents and document flow in accounting”, approved by Order No. 62n (registered with the Ministry of Justice on 07.06.2021).

The standard introduces new concepts and legislative norms that significantly change the order of document flow and storage of companies’ documents (except for organizations in the public sector).

The new standard regulates such things as the procedure for signing documents, the date of documents, the language of documents, making corrections and other aspects mandatory for local accounting services in Russia after the introduction of the standard. For your convenience, we have prepared a consolidated overview of the main changes introduced by the new FAS (the overview is available in Russian at the link).

Special attention of foreign companies operating in Russia deserves paragraph 25 of the standard:

Storage of accounting documents

An economic entity must keep accounting documents as well as data contained in such documents and locate the databases of such data in the territory of the Russian Federation.

If the laws or regulations of the country – the place of business outside the Russian Federation – require storage of accounting documents in the territory of this country, such storage should be ensured.

The paragraph about the need to keep accounting registers in the Russian Federation raises the most questions from foreign companies.

Many international companies (especially those using SAP, Navision and other international accounting systems) often use servers outside the Russian Federation, which are shared by the group of companies, so the requirement to store registers within the country may entail significant structural changes.

At the moment, however, there is no direct indication in the standard (paragraph 25) as to whether the primary accounting registers should be stored in Russia or whether it will be sufficient to ensure the storage of a copy of the registers to meet the requirements of the new FAS.

In this connection, collective appeals by international business associations to the Ministry of Finance requesting the necessary clarifications are currently being prepared. We are closely monitoring the situation and will be happy to offer updates on this topic should further information become available.

We will be glad to answer your questions!

Contacts:

Eugenia Chernova

Natalia Safiulina

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025

Dear colleagues, Please accept our sincere congratulations on the upcoming New Year and Christmas!

Transferpricing: penalties from tax authorities for non-submission of master file

Recently, there have been an increasing number of cases in which Russian companies that are part of an international group of companies have been asked to submit the global documentation (so-called master file) to the Russian tax authorities, especially in the context of the formation of the regular transfer price declaration and documentation.

As a reminder: the global documentation (master file) must be provided to the supervisory authority upon their request within 3 months fr om the date of having received an according notice. The file is to be provided in Russian language.

The master file may be requested not earlier than 12 months and no later than 36 months after the end of the reporting year, so e.g. starting from 01.01.2022 till 31.12.2024 for the year 2020. The documentation must comply with the requirements of Article 105 16-4 of the Russian Tax Code.

Please note that the violation of the rules of the Tax Code – failure of the taxpayer to submit global documentation in time (paragraph 2 of Article 129.11 of the Tax Code) may result in a fine in the amount of 100,000 rubles.

From 2020 onwards, the benefits of the so-called “Transitional period” (2017-2019), for which no fines were imposed, no longer apply. From 2020, failure to comply with the requirement to submit the master file to the authorities upon request can result in a maximum amount of fine.

In order to provide the required information to the tax authorities on time, if requested, we recommend the Russian member companies of international company groups to fulfill the following steps in advance:

- request the Global Documentation from the parent company,

- check it for compliance with the requirements of Article 105 16-4 of the Tax Code of the Russian Federation and, if necessary, supplement the File;

- translate the Global Documentation into the Russian language, if applicable.

Expert comment

Eugenia Chernova, Project Leader at swilar: “Not every taxpayer who is a member of an international group of companies may be required to provide global documentation. The existing limits are bound to the total revenue of the group. The lim it depends on the country of residence of the parent company.” If you have any questions about the necessity of global documentation for your company, swilar specialists will be happy to give you qualified advice.

Contacts:

Eugenia Chernova

Olga Kireyeva

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025

Dear colleagues, Please accept our sincere congratulations on the upcoming New Year and Christmas!

Changes in the algorithm for payment of benefits for temporary disability, maternity and childhood

The Ministry of Labor and Social Protection of the Russian Federation has prepared a draft of amendments to Federal Law № 125-FZ dd. 24.07.1998 and Federal Law № 255-FZ dd. 29.12.2006, which will come into force from January 1, 2021 in terms of payment of benefits for temporary disability, maternity and childhood.

“Direct payments” is a project implemented by the Social Insurance Fund of the Russian Federation since 2011. During this time, 77 regions of the Russian Federation have already joined it. The remaining 8 largest regions (Moscow, St. Petersburg, Krasnodar and Perm, Moscow, Sverdlovsk and Chelyabinsk regions, the Khanty-Mansi Autonomous District) will move to direct payments from January 1, 2021.

Thus, the system of “direct payments” will be effective throughout the Russian Federation from January 2021.

The point of the amendments is that from 1 January 2021 all benefits (with few exceptions) will be paid directly to employees by the Social Insurance Fund (FSS).

Besides, employers will transfer insurance payments to FSS (including contributions for accidents at work and occupational diseases) in full, i.e. without reducing the amount of benefits paid to employees.

Direct payments of employee benefits from the Social Insurance Fund, which are considered in the draft, include:

- temporary disability allowance (including in the case of an accident at work and (or) occupational disease);

- maternity allowance;

- one-time allowance for women who have registered at medical institutions in the early stages of pregnancy;

- one-time allowances upon the birth of a child;

- monthly child care allowance;

- payment of leave (in excess of the annual paid leave) to an insured person who was injured at work.

Temporary disability benefits for the first 3 days of an employee’s illness will be assigned and paid, as before, only by the employer.

With subsequent reimbursement from the Social Insurance Fund, the employer will assign, and pay to working citizens the following types of benefits (the mechanism remains the same):

- payment of 4 additional days off to care for children with disabilities;

- funeral allowance;

- payment of temporary disability benefits from inter-budgetary transfers (to persons exposed to radiation).

The mechanism of direct payments is as follows:

1. The employee must submit to the employer:

-

a certificate of the amount of earnings (if he/she worked for other (other) employers during the calculation period);

-

confirming documents (certificate of disability for work, certificate of registration at a medical institution in the early stages of pregnancy, certificate of birth of a child, etc.);

-

application, wh ere details for the transfer of the allowance are specified.

Please be awared, that allowance will be paid by FSS only to the card of payment system MIR.

Important! The term for submission of the sick leave and other documents confirming the occurrence of an insured event is 6 months after the sick leave is closed.

2.The employer within 5 calendar days sends a package of documents to the FSS.

3. The FSS within 10 calendar days checks the documents provided by the employer and makes a decision on the assignment or refusal to pay the allowance.

4. If the decision is positive, the allowance is transferred to the employee’s current account or sent by mail.

5. If the documents are insufficient or incorrect, the FSS sends a notification to the employer. Within 5 calendar days the insured is obliged to replace them, or provide the missing documents.

The way of sending data to the FSS depends on the average number of employees:

- 25 people and more – the documents, including the register of information, are sent to the FSS digitaly;

- 24 people and less – the documents, including the inventory, can be sent to the FSS both digitaly and on paper.

The amount and methodology of benefit calculation remain the same.

Monthly child care allowance awarded in 2019-2020 and continuing into 2021 are paid as follows:

-

The employer pays the December 2020 allowance to the employee in the regular order;

-

To process an allowance payment from 2021 directly from the FSS:

· the employee must submit to the employer an application for the allowance directly from the regional branch of the FSS in the standard form and the necessary documents;

· the employer within 5 calendar days is obliged to transfer the data (inventory, application and documents from the employee or register) to the FSS.

The monthly child care allowance will be transferred from the 1st to the 15th of the month following the month for which the allowance is paid. The allowance for care of the child till 1,5 years at transition to direct payments from FSS, is not subject to recalculation, the sum of the allowance appointed till 01.01.2021, does not change.

We will be happy to answer your questions!

Contacts:

Natalia Safiulina

Ekaterina Babenko

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025

Dear colleagues, Please accept our sincere congratulations on the upcoming New Year and Christmas!

Status of SMEs and foreign business

In the conditions of the current world crisis and increasingly strict measures to combat the virus, business is much more than usual counting on assistance and support measures from the state.

At the moment, many support measures are being developed and implemented in Russia, starting from the postponement of reporting deadlines and preferential lending up to measures to reduce the tax burden (in particular, insurance premiums). A significant part of these measures is aimed at supporting small and medium-sized businesses.

Briefly, let us remind you that the status of SMEs and the criteria are prescribed in the Federal Law No. 209-FZ dated 07.24.2007 with subsequent amendments.

Meaning has:

the size of the average number of employees for the previous calendar hour (up to 100 people for small enterprises; up to 250 people for medium-sized enterprises);

the amount of income from conducting business activities for the preceding calendar year (up to 800 million rubles for small enterprises; up to 2 billion rubles for medium-sized enterprises);

To obtain SME status, the company must also be entered in the appropriate register (https://rmsp.nalog.ru/).

For a long time, the status of an SME was closed to companies with a large share of foreign capital, since in addition to the threshold values indicated above, there was a restriction on the share of Russian capital at a minimum of 51%.

Does this mean that subsidiaries of foreign founders will not be able to take advantage of the benefits and preferences offered by the government?

We remind you that December 1, 2018 certain clauses of the Federal Law No. 313-FZ “On Amendments to the Federal Law “On the Development of Small and Medium Enterprises in the Russian Federation” entered into force, according to which the criteria for the status of an SME subject were changed. We wrote about this in our review 02/2018 dated 08/22/2018. After the entry into force of these amendments, the status of an SME became available to those companies in which the share of foreign participation exceeds 49%.

At the same time, a necessary condition is the compliance of the parent company with the criteria of small and medium business established in the Russian Federation.

However, Russian companies with more than 49% foreign participation will be able to be entered into the Register (see above), that is, to officially receive SME status, only after the reporting of their parent organizations is checked for compliance with the SME criteria in force in Russia.

Authorized auditing organizations, entered in the control copy of the register of auditors and auditors, carry out similar checks organizations

Olga Grigoryeva, general director of Shternhoff Audit LLC, comments:

“According to part 6.2 of article 4.1 of the Law on SMEs, the source of such data for maintaining a single register of small and medium-sized enterprises are auditor organizations. This authority is implemented in the following order:

1) the auditing organization provides auditing services (at the initiative of the economic entity) to economic entities interested in including information about them in the unified register of SME entities. The service consists in confirmation by the auditing organization of the compliance of the participants of the economic society – foreign legal entities with the above criteria (confirmation is carried out annually).

This audit service is provided by audit organizations in accordance with:

Part 6.2 of Article 4.1 of the Federal Law “On the Development of Small and Medium-Sized Entrepreneurship in the Russian Federation” (as amended by Federal Law dated August 3, 2018 No. 313-ФЗ);

The international standard, which provides confidence (MSZOU) 3000.

2) in order to confirm the indicated compliance, the auditing organization compares the data on the amount of income per hour and the average number of employees of the foreign legal entity with the above criterion. For comparison, the company-customer of the service must present to the auditing organization the report of the foreign legal entity for the corresponding year, submitted to the tax authority of the country where the entity is established;

3) based on the results of the provision of this service, the auditing organization forms a list of companies that were created before December 1 of the year preceding the current calendar year, and whose participants are foreign legal entities that meet the criteria described above;

4) the auditing organization sends a list of such companies to the Federal Tax Service of Russia. The list is presented in the form of an electronic document, signed with an enhanced qualified electronic signature, using the official website of the Federal Tax Service of Russia. The deadline for submitting the list is from July 1 to July 5.”

According to the currently presented explanations and comments, only companies with official status, that is, entered in the register, will be able to take advantage of the proposed preferences for SMEs in the Russian Federation.

It is not yet clear whether this regulation will be clarified. In this regard, we recommend checking the relevance of the procedure described above for your company.

We will be happy to answer your questions on this and other topics!

Your contact persons on this topic:

Maria Matrosova

Daria Pogodina

Clarifications of the auditors: Olga Grigoryeva

General Director of “Sternhoff Audit”

audit@sterngoff.comOther news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025