Category: Accounting

Environmental Fee: what changed since January 1, 2026 and what business should expect

Dear colleagues,

Last autumn we provided you with the overview of the current regulation and upcoming changes regarding environmental fee reporting and payment terms – more information can be found here.

As a reminder, one of the changes we recommend monitoring was the entry into force since 01.01.2026 (Article 24.5 of the Federal Law No. 89-FZ dated June 24, 1998 “On Environmental Fee”) of the obligation for importers to ensure the recycling of waste from the use of goods:

- for imports from EAEU countries – from the day the goods are recognized

- for imports from countries outside the EAEU – before the day of release by the customs authority for domestic consumption.

Good news: on December 31, 2025 the Federal Law No. 495-FZ dated December 28, 2025 “On Amending Article 29¹ of the Federal Law “On Production and Consumption Waste” and Certain Legislative Acts of the Russian Federation” came into force. This law postponed the enactment of the new rules until 01.01.2028.

More details of the changes

The adopted law alters the timeline for the environmental fee reform and implemented a key proposal from the draft law by the Russian Ministry of Natural Resources published on 20.10.2025 (which we covered in our previous overview): the transitional provisions for importers from countries outside the EAEU have been extended by two years – until January 1, 2028 (instead of the originally set date of January 1, 2026).

Therefore, this year the submission of reports and payment of the environmental fee should be carried out according to the usual terms.

However, the adopted law did not implement all proposals included in earlier versions of the draft.

In this regard, we recommend continuing to monitor potential changes amidst the ongoing discussions between the regulator, business and relevant ministries.

What needs to be done in any case? Reporting and terms for the environmental fee payment for 2025.

The Federal Service for Supervision of Natural Resources (Rosprirodnadzor) has reminded of the terms for submitting environmental fee reports and making payments for 2025.

By April 15, 2026 manufacturers and importers of goods and packaging subject to recycling are to submit their environmental fee reports to Rosprirodnadzor and pay the environmental fee for 2025.

We would like to remind you that the List of goods and packaging, the waste from which is subject to recycling, was approved by the Russian Government Decree No. 2414 dated December 29, 2023.

Furthermore, it is important to note that the environmental fee is not included in the Unified Tax Payment (UTP) and must be paid separately.

List of required reports:

- Report on the weight of goods and packaging (form of the Appendix 1 to the Rules approved by the Russian Government Decree No. 741 dated May 31, 2024).

- Report on self-executed recycling (form of the Appendix 1 to the Rules approved by the Russian Government Decree No. 742 dated May 31, 2024). This report is submitted only if the company performs the recycling itself.

- Calculation of the environmental fee amount (form of the Appendix 1 to the Rules approved by the Russian Government Decree No. 1990 dated December 30, 2024).

All listed forms are to be submitted in electronic form. The authority recommends using the personal account of natural resource user for this purpose.

We will be glad to answer your questions.

Submit a request

Other news

10.03.2026

Submission of information on participants of a foreign organization for 2025

23.12.2025

Dear colleagues, Please accept our sincere congratulations on the upcoming New Year and Christmas!

Environmental fee in 2025-2027: what awaits business and how to avoid fines

Dear colleagues,

In response to numerous inquiries from companies about the environmental fee and the active changes in this area expected in 2025-2026, we have prepared an overview of the topic to help you understand some key aspects.

The environmental fee and related reporting represent a system that reflects the responsibility placed on manufacturers and importers to consider the fate of their goods and packaging after they have served their term. The system is becoming more complex, the rates are increasing and control is tightening. We examine the upcoming changes and their implications for companies.

Who is liable?

The following entities are required to pay the environmental fee and submit reporting:

- Manufacturers of goods and packaging released within the territory of the Russian Federation.

- Importers bringing goods and packaging from abroad.

- Disposal companies, if they take on the responsibility of meeting disposal standards.

Important: the obligation arises for the entity that first releases the goods or packaging on the market in the Russian Federation, provided that the goods or packaging are included in the relevant List. The environmental fee is calculated considering the standards.

What changes take effect in 2025

1. Significant rate increase

The Government has approved new base rates for the environmental fee for 2025–2027 (Resolution No. 1041 dated August 1, 2024). Compared to 2024, the rates will increase by 15% in 2025, with further planned increases in subsequent years.

- Example for tires and rubber:

- 2025 — 10,310 RUB/tonne

- 2026 — 11,135 RUB/tonne

- 2027 — 11,580 RUB/tonne

- Example for textile products:

- 2025 — 18,750 RUB/tonne

- 2026 — 20,250 RUB/tonne

- 2027 — 21,060 RUB/tonne

Furthermore, the Ministry of Natural Resources has already prepared a new draft resolution that starting from 2026 could introduce even higher rates (e.g., for textiles — up to 89,184 RUB/tonne). This indicates a sustained trend of increasing environmental compliance costs.

How to calculate? In its inquiries the Federal Service for Supervision of Natural Resources refers to data from customs declarations. These declarations contain information about the goods, including weight, codes and volumes. All this data is automatically compared.

Data required for calculating the environmental fee:

- Manufacturers of goods – a list of goods indicating the code in accordance with the Russian Classification of Products by Economic Activities (OKPD2), product name, the weight of all manufactured products.

- Importers – the customs declaration which specifies the HS code of the imported goods, the packaging code in most cases and the gross and net weights.

2. Tightening of the rules for importers from 2026.

From 1 September 2024 to 31 December 2025 a special experimental regime will apply to certain types of goods: reporting and payment of environmental fee should be completed before the date of their release by the customs authorities for domestic consumption.

The current version of the law stipulates that upon completion of the experiment (from 01.01.2026), these rules will become mandatory for all importers (the Article 24.5. Environmental Fee of the Federal Law No. 89-FZ dated 24.06.1998).

The obligation to ensure the recycling of waste from the use of goods will arise for the importer of goods:

- for imports from EAEU countries – from the day the goods are recognized.

- for imports from countries outside the EAEU – before the day of release by the customs authority for domestic consumption!

An alternative may be to submit a notification of intent to dispose of the waste independently or to provide a bank guarantee or surety agreement from the disposal company for the amount of the fee (the term of the guarantee or surety agreement shall not be earlier than 15 October of the following year).

The good news is that legislators are considering extending the experimental regime – see the draft of the Federal Law (prepared by the Russian Ministry of Natural Resources). The ministry has proposed extending the experiment on the payment of environmental fees prior to the submission of customs declarations for another year, as well as easing the conditions for paying the fees prior to the submission of declarations (within 90 days after the release of goods).

The bill was submitted on 20 October 2025 – we recommend monitoring the progress of this initiative.

Liability: risks and fines

The risks should not be underestimated. The Federal Service for Supervision of Natural Resources actively employs a system of cross-checks, comparing data from companies’ reports with information from customs declarations and other state databases.

The fines for violations are substantial:

- For failure to submit or late submission of reports: for legal entities — from 70,000 to 150,000 RUB.

- For inaccurate data in reports: the fine for legal entities is twice the amount of the fee (but not less than 250,000 RUB).

- For missing payment deadlines or non-payment of the fee: the fine for legal entities is three times the unpaid amount (not less than 500,000 RUB).

Who is exempt from payment?

Payment is not required, but reporting is still mandatory if:

- The goods are for export.

- They are used as raw materials or components for manufacturing other goods.

- The recycling target has already been met (independently or through an accredited recycling operator).

Manufacturers and importers who recycle their products are subject to special statistical waste management reporting. This is the annual form 2-TP (waste).

Practical recommendations for business

- Audit. Verify whether your goods and packaging are included in the current list (Government Resolution No. 2414 dated December 29, 2023).

- Be proactive. If you receive a letter from The Federal Service for Supervision of Natural Resources, it is advisable to comply with the requirement within the specified deadline (submit the report, pay the fee) and only then challenge their position. A delay results in an automatic fine.

- Remember the deadlines for 2025:

- Submit reports — by April 1, 2026.

- Pay the environmental fee — by April 15, 2026.

Important: If April 15 falls on a weekend or holiday, the fee should be paid before this date. The deadline is not extended to the next business day.

Conclusion

The environmental fee is no longer a formality but have become a significant expense and a serious regulatory risk for businesses. Rising rates and tighter controls signal that it is time to build a transparent system of environmental reporting and waste disposal. Those who do so now will not only avoid multimillion fines, but also lay the foundation for sustainable development in the new economic reality.

Submit a request

Other news

10.03.2026

Submission of information on participants of a foreign organization for 2025

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

Notice of participation in an international group of companies: procedure and deadlines

Dear colleagues,

This is a reminder that the deadline for submitting Notice of Participation in an International Group of Companies (hereinafter, the “IGC”) is August 31, 2025, for groups whose financial year coincides with the calendar year.

Filing the notice is an obligation for Russian organizations and foreign companies that recognize themselves as tax residents of Russia, which are part of an IGC and meet the criteria defined in article 105/16-1 of the RF Tax Code.

Below, we detail the key requirements, deadlines, and content of this notice.

1. The notice must be submitted by all IGC participants that are taxpayers in Russia, except for foreign organizations that only receive income specified in article 309 of the RF Tax Code (e.g., dividends, interest on debt obligations, etc.).

2. Exemption from the obligation

Exemption from the obligation to file the notice is provided in the following cases:

3. Filing deadline

The notice must be submitted electronically no later than eight months from the end of the reporting period of the IGC’s parent company (article 105.16-2 of the RF Tax Code). For example, if the reporting period ends on December 31, the filing deadline is August 31 of the following year.

4. Content of the notice

The notice must include the following information as of the end of the reporting period:

5. Notice format

Notices must be submitted to the tax authorities electronically in XML format, in accordance with the current form established by Order No. ММВ-7-17/124@ of the Federal Tax Service of Russia dated March 6, 2018 (as amended on July 16, 2020) “On Approval of the Format of the Notice of Participation in an International Group of Companies, the Procedure for its Completion and Submission in Electronic Form“.

6. Correcting errors in the notice

If errors or incomplete information are discovered, the taxpayer has the right to submit an amended notice. If this is done before the tax service discovers the inaccuracy, the participant is exempt from liability under article 129.9 of the RF Tax Code.

7. Liability for failure to file the notice

Failure to submit the notice by the deadline or submission of inaccurate information entails a fine of 500,000 rubles for each violation.

Practical recommendations:

Conclusion

Submitting a notice of participation in an IGC is an important responsibility of members of international groups. Compliance with the deadlines and requirements for the content of the notice will help to avoid fines and claims from tax authorities.

Submit a request

Other news

10.03.2026

Submission of information on participants of a foreign organization for 2025

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

Tax monitoring: procedure and conditions for switching to it

Dear colleagues,

In 2025, tax monitoring continues to gain popularity: approximately 740 companies from more than 20 industries already use tax monitoring, another 143 companies plan to join the project and a total of more than 13,000 companies comply with the program criteria (according to the portal https://налоговыймониторинг.рф/).

Recently, we have noticed growing interest to this topic in the business community and in this review we have compiled answers to the most frequently asked questions about the procedure and conditions for applying the tax monitoring regime.

Tax monitoring is a special form of tax control, a method of extended information exchange, whereby an organization provides the tax authority with real time access to its accounting and tax records.

What are the advantages of tax monitoring?

- this type of tax control allows you to forget about traditional audits by the Federal Tax Service.

- no penalties or fines if you follow the reasoned opinion.

- you can find out about existing errors and discrepancies identified by the Federal Tax Service in real time.

Methods of information exchange:

- providing access to the organization’s information systems;

- by telecommunication channels through an electronic document management operator (until 01.01.2026, the Article 6 of the Federal Law No. 389-FZ of 31.07.2023);

- providing access to an analytical datamart.

An organization is eligible to apply tax monitoring if it complies with all of the following criteria (clause 3 of the Article 105.26 of the Tax Code):

- the total amount of taxes for the previous year was at least RUB 80 million (VAT, excise taxes, personal income tax, income tax, mineral extraction tax, insurance contributions are added up, except for VAT and excise taxes, which are paid when goods are moved across the customs border of the EAEU);

- income according to accounting (financial statements) for the previous year is at least RUB 800 million;

- the book value of assets as of 31 December of the previous year is at least RUB 800 million.

Important: compliance with one or two conditions does not entitle a business entity to apply tax monitoring. All three conditions are to be fulfilled.

There are exceptions to every rule, so compliance with the above conditions is not required for organizations specified in the clause 3.1 of the Article 105.26 of the Tax Code of the Russian Federation:

- residents of advanced development territories (ADTs),

- participants in industrial clusters,

- residents of special economic zones,

- former members of consolidated groups of taxpayers,

- state and municipal institutions, lottery operators.

It is also important to note that on April 29, 2025 the Ministry of Finance published draft amendments to the Tax Code (02/04/01-25/00154001), which include measures to improve tax monitoring.

The Ministry of Finance experts have proposed to weaken the requirements: in order to switch to tax monitoring, it will be necessary to comply with at least one of the criteria, for example, in terms of asset value, income or the amount of taxes paid.

The switch to tax monitoring is voluntary. If your company complies with all of the above criteria, in order to participate you are to submit an application not later than September 1 of the year (clause 1 of the Article 105.27 of the Tax Code of the Russian Federation) preceding the year of introduction of monitoring, including:

- regulations for information exchange (Appendix No. 7, the Order of the Federal Tax Service of Russia dated 11 May 2021 No. ED-7-23/476),

- information of the related parties — organizations and individuals who directly or indirectly participate in the organization and whose share of participation exceeds 25%,

- tax accounting policy for the current year,

- documents regulating the organization’s internal control system (ICS) (Appendix No. 13, the Order of the Federal Tax Service of Russia dated 11 May 2021 No. ED-7-23/476).

Until November 1 inspectors review the materials received and decide whether to perform tax monitoring or to refuse it, indicating the reasons for the refusal. Possible reasons for refusal are specified in the clause 5 of the Article 105.27 of the Tax Code of the Russian Federation, in particular:

- non-provision of documents or submission of incomplete documents by the organization;

- non-compliance by the organization with the monetary criteria (the Article 105.26 of the Tax Code of the Russian Federation);

- non-compliance of the information exchange regulations with the established form and requirements (Appendix No. 7, Order of the Federal Tax Service of Russia dated 11 May 2021 No. ED-7-23/476);

- non-compliance of the internal control system used by the organization with the established requirements for the internal control system (Appendix No. 13, Order of the Federal Tax Service of Russia dated 11 May 2021 No. ED-7-23/476).

In conclusion we should note, that in tax monitoring interaction takes place in real time and remotely instead of traditional audits. The company itself provides the tax authority with access to its accounting data.

This simplifies interaction with the Federal Tax Service, minimizes the risks of fines, penalties and additional charges. In addition, the company receives public recognition as a conscientious taxpayer and access to qualified support in complex tax issues. At the same time the company is obliged to be fully prepared to perform its activities openly and transparently and to comply with all reasonable opinions of the inspectors.

In the following reviews we plan to focus in more detail on various aspects of tax monitoring.

We will be glad to answer any questions you may have.

Submit a request

Other news

10.03.2026

Submission of information on participants of a foreign organization for 2025

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

Prior period expenses for income tax purposes

Dear colleagues,

we would like to inform you of the planned changes in the tax accounting which are expected in the nearest time.

As a general rule, according to the Article 54 of the Tax Code of the Russian Federation, if in the current tax period expenses relating to past periods are identified, they can be recognized in the current period.

However, according to the position of the Ministry of Finance, reflected in the Letter dated 15.05.2025 № 03-03-06/1/47786, the expenses of previous years cannot be recognized in the calculation of income tax for the current period if in the previous period the tax rate was lower as this will lead to an artificial understatement of current tax liabilities. Where errors (misstatements) in the calculation of the tax base relating to previous tax (accounting) periods are identified in the current tax (accounting) period, the tax base and the amount of tax should be recalculated for the period in which these errors (misstatements) were made.

The position of the Ministry of Finance is also confirmed by the latest bill 02/04/01-25/00154001, which amends the Article 54 of the Tax Code of the Russian Federation. The bill completes the Article 54 of the Tax Code with a provision prohibiting the recognition of expenses of previous periods in the current period if the tax rate of the current period is higher than the rate applicable in the period to which the errors relate.

With great probability the bill will be adopted in the nearest time, in such case the approach described by the Ministry of Finance will be established at the level of the Tax Code of the Russian Federation.

The planned date of coming into force of the amendments to Article 54 of the Tax Code of the Russian Federation is 1 January 2026. At the moment, when the amendments have not yet come into force, we recommend to follow the approach set out in the letter of the Ministry of Finance of Russia and include all expenses relating to periods earlier than 01.01.2025 in the adjusted declaration, rather than recognize them in the current period.

We will be glad to answer questions arising from the specified changes.

Submit a request

Other news

10.03.2026

Submission of information on participants of a foreign organization for 2025

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

Topics 2025: Practical Experience and Recommendations for Business Operations in Changing Conditions

PROGRAM

1. Current situation with international payments — overview and practical recommendations. Cryptocurrency payments — new opportunities for business?

Daria Pogodina — Managing Partner, swilar

2. Possibilities of transfers within the framework of foreign economic activity in rubles and yuan

Vasily Lukyanenko — Head of Department, JSC OTP Bank, Corporate Business Directorate

3. What to consider when working with personnel

Elena Balashova — Managing Partner, Balashova Legal Consultants

4. Liability insurance as an important element of risk management. Risks of directors and managers

Nikolay Artamonov — Underwriter for financial risks, JSC IC Turikum

5. Audit checklist — main errors identified by auditors in accounting and tax accounting based on the results of 2024 in the context of constant changes. Preparation for the annual audit

Olga Grigorieva – General Director of Sterngoff Audit LLC

6. Logistics and customs risks when importing to the Russian Federation. Latest practice: routes, customs control, inclusion of agent fees, dividends

Anna Dashicheva – Commercial Director of Polar Group LLC

Online seminar 13.12.2024: Doing Business in Russia – Practical Experience in New Circumstances

PROGRAM

Detailed reviews and Q&A session with experienced experts on the following topics

1. Doing business in Russia

Legal, tax, HR and migration issues. Basics.

2. Overview on bank transaction with Russia

SWIFT, currency exchange and other.

3. Practical experience of foreign companies in Russia

FAQ in the regular business processes.

Review of FSBU 4/2023 “Accounting (financial) statements”

Elena Kameneva spoke at the meeting of the Accounting Working Group of the Russian-German Chamber of Commerce with a report on the topic “Review of FSBU 4/2023 “Accounting (financial) statements””. During the speech Elena analyzed in detail the main provisions of the new standard, which came into force in 2023 and its impact on the procedure for preparing and submitting financial statements. The report included an analysis of key changes, features of the standard’s application for Russian companies, as well as practical recommendations for implementing the new approach in accounting practice. The seminar aroused interest among specialists in the field of accounting and finance.

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025

Dear colleagues, Please accept our sincere congratulations on the upcoming New Year and Christmas!

Account of a Russian LLC abroad

In the context of ongoing difficulties with international payments, many companies have found it necessary to open an account in a foreign bank.

However, it is important to remember that opening a bank account in another jurisdiction imposes a number of additional obligations on the company, including the submission of necessary reports and notifications.

In our review, we will look at how not to violate the law in this situation and how to avoid penalties.

Let’s take a step-by-step look at what a company has to do to comply correctly with all requirements.

1. Notify the Federal Tax Service of Russia.

It is necessary to notify the Federal Tax Service in the following cases:

- opening a bank account outside the Russian Federation;

- closing such an account;

- changing the account details.

All Russian organizations are required to submit the corresponding notification. (Part 2, Part 8 of Art. 12 of the Law No. 173-FZ). The notification should be sent to the tax authority at the location of the organization in the form approved by the Order of the Federal Tax Service of Russia dated 26.04.2024 N SD-7-14/349@, within one month from the date of opening (closing) an account or changing the details, respectively (Part 2 of Art. 12 of the Currency Control Law).

Two forms have been approved: one is for opening and closing an account (Appendix N1), the other is for changing the details of this account (Appendix N2).

The notification can be submitted to the tax authority on paper (in person, through a representative, by registered mail) or in electronic form via telecommunication channels (TCC) or through the taxpayer’s personal account (PA).

When making the first transfer to a bank account abroad, the organization needs to provide the Russian bank with a notification on opening this account with a tax inspector’s note on its acceptance (Part 4 of Art. 12 of the Currency Control Law).

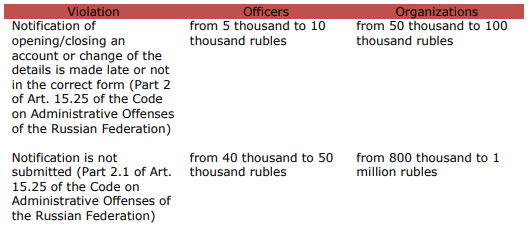

Failure to submit a notification about account or violation of the terms or procedure for submitting it may result in a penalty being imposed on the organization.

Their amounts are established in the Art. 15.25 of the Code on Administrative Offenses of the Russian Federation.

2. Report to the Federal Tax Service on flow of funds.

If a legal entity (resident of the Russian Federation) has foreign accounts, it has to submit a cash flow statement to the tax authority quarterly within 30 days after the end of the reporting quarter, attaching supporting documents: statements or other documents issued by the bank (Decree of the Government of the Russian Federation dated 28.12.2005 N 819 (as amended on 22.05.2024)).

If the documents are drawn up in a foreign language, the organization has to attach a translation into Russian, duly certified in accordance with the legislation of the Russian Federation (cl. 7 of the Rules for the Submission of Reports by Residents – Legal Entities).

The translation can be carried out by an employee of an organization or an organization engaged in translation activities, since the methods of translation are not limited by the law.

If necessary, at the request of the tax authorities, translation into Russian, notarized in accordance with the requirements of the legislation of the Russian Federation, shall be provided.

3. Comply with the currency legislation, in particular, carry out only legal currency transactions.

Contracts with non-residents, the amount of obligations for which exceeds the established threshold, namely, import contracts from 3 million rubles and export contracts from 10 million rubles, must be registered by an authorized bank of the Russian Federation.

The bank will assign a unique number to the contract (cl. 4.2, 5.5 of the Bank of Russia Instruction dated 16.08.2017 N 181-I (as amended on 09.01.2024).

When crediting export proceeds to an account abroad, it is necessary to provide to the authorized bank a certificate of currency transactions for settlements through an account abroad under accounting contracts, as well as provide a bank statement.

The term for providing a certificate of currency transactions for settlements through an account abroad is within 30 working days after the last day of the month in which such transactions were carried out.

4. Is it necessary to repatriate currency?

At present, the obligation to repatriate currency has only been retained for some companies.

From 16.10.2023 to 30.04.2025 inclusive, certain Russian exporters specified in the List approved by the Decree of the President of the Russian Federation dated 11.10.2023 No. 771, are required to credit to their accounts in authorized banks and sell proceeds in foreign currency on the domestic currency market of the Russian Federation within the established period and in the established amounts (cl. 1, 5 of the Decree of the Government of the Russian Federation dated 12.10.2023 No. 1681 “On measures for the implementation of the Decree of the President of the Russian Federation dated October 11, 2023 No. 771”).

The closed list consists of 43 groups of companies belonging to the sectors of the fuel and energy complex, ferrous and non-ferrous metallurgy, chemical and forestry industries, and grain farming. Exporters are notified of their inclusion in the list within 3 days by the Ministry of Economic Development of Russia.

For companies that are not on the closed list, the amount of foreign currency earnings subject to mandatory sale is currently 0%.

Therefore, if the organization is subject to the cancellation of repatriation, the terms for transferring export proceeds from the organization’s account opened abroad to a Russian bank are not established by regulation, i.e. such funds may remain on account abroad and these funds can be used, for example, for settlement of import or other contracts.

Contacts:

Natalia Safiulina

Nadezhda Kolomnikova

Other news

10.03.2026

Submission of information on participants of a foreign organization for 2025

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

Online seminar 11/12/2024: Features of liquidation of companies with foreign participation: latest changes and practice

PROGRAM

1. Features of liquidation of foreign subsidiaries in 2024-2025.

Daria Pogodina, Managing Partner of swilar

2. Liquidation audit – features of the procedure.

Olga Grigorieva, General Director of Sterngoff Audit

3. Closing representative offices and branches of foreign companies – what to consider?

Daria Pogodina, Managing Partner of swilar

4. Features of termination of employment relations with employees during company liquidation.

Elena Balashova, Managing Partner of Balashova Legal Consultants

5. Planning the budget and financing of the company during the liquidation period.

Natalia Samonova, Head of Controlling Projects of swilar

6. Business valuation in Russia for the purpose of submission to the Government Commission.

Alexey Sitnikov, Director, Swiss Appraisal