Author: Анна Сильнова

General introduction to local specifics: taxes, visa regulations, legal aspects

Daria Pogodina spoke at an online seminar on the specifics of doing business in Kazakhstan. As part of the topic “General introduction to local specifics: taxes, visa rules, legal aspects”, the speaker gave an overview of the key requirements and regulatory conditions that foreign companies face. Participants received a basic understanding of the tax system, visa registration and legal environment of the country.

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025

Dear colleagues, Please accept our sincere congratulations on the upcoming New Year and Christmas!

Online seminar 09.08.2023 — FAQ OF FOREIGN SUBSIDIARIES IN RUSSIA

Daria Pogodina participated in an online seminar and spoke in detail about the possibilities of transferring Russian subsidiaries with foreign participation to the so-called “sleep mode”, as well as about liquidation procedures in the current legal environment. Restrictions, approvals with the government commission and practical steps that are be considered when making corporate decisions were reviewed. The seminar aroused keen interest among companies considering restructuring or curtailing operations in Russia.

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025

Dear colleagues, Please accept our sincere congratulations on the upcoming New Year and Christmas!

New in migration legislation: changes for highly qualified specialists

On July 10, 2023, Federal Law No. 316-FZ was adopted, introducing a number of significant changes regarding the legal status of foreign citizens in the Russian Federation (hereinafter referred to as “Law No. 316-FZ”).

This law entered into force on July 10, 2023, but provides for separate, later deadlines for the entry into force of a number of provisions (more details below).

According to the new rules, family members of highly qualified specialists (hereinafter referred to as “HQS”) will be required to undergo a medical examination again within 30 calendar days from the date of the decision to extend the validity of the HQS work permit or from the date of entry into the Russian Federation (if they were outside the Russian Federation on the day of such a decision). Previously, family members of HQS were required to undergo a medical examination annually.

In addition, after 180 days from the official publication of Law No. 316-FZ, the following changes will come into force:

The obligation to obtain a work permit within 30 calendar days from the date of the decision to issue (extend) it is introduced.

In the presence of documented valid reasons and a written application from the employer, a work permit may be obtained at a later date, but not exceeding 30 calendar days. After the expiration of the established period, a work permit is not issued, and the decision to issue (extend) it is canceled.

In the event of early termination of an employment or civil law contract, the HQS, as before, has the right to search for another employer or customer of work within 30 working days.

If a new contract has not been concluded upon expiration of this period, the HQS and his family members will be required to leave the Russian Federation within 30 calendar days, and their visas and residence permits (if any) will be considered cancelled.

Before the said changes come into force, HQS and their family members will be given 30 working days to leave.

A HQS who has worked in this capacity in the Russian Federation for at least two years and his family members who have a residence permit will be issued an indefinite residence permit if the following conditions are met:

The HQS and family members reside in the Russian Federation with a residence permit;

during the period of the HQS’s employment, the employer calculated, withheld and transferred taxes to the budget system of the Russian Federation.

It is envisaged to issue a work permit for highly qualified specialists to carry out labor activities in two or more constituent entities of the Russian Federation if the following conditions are met:

work in other constituent entities is provided for by the provisions of an employment or civil law contract for the performance of work (provision of services);

a foreign citizen carries out labor activities in separate divisions of an organization, branches or representative offices of a legal entity or with related parties located in these constituent entities.

A ban on the employer to attract foreign highly qualified specialists to labor activities in the Russian Federation for two years in the event of failure to provide the tax authorities with information on the amounts of personal income tax calculated and withheld by the tax agent in relation to highly qualified specialists after 6 months, as well as if the information provided turned out to be fake or counterfeit.

In addition, from 01.03.2024, the level of wages (remuneration) of highly qualified specialists will increase to 750 thousand rubles per quarter. Before the changes were introduced, the threshold was 2 million rubles/year.

At the same time, Law No. 316-FZ does not cancel the previous reduced wages required to attract highly qualified specialists who are medical, teaching staff, participants in the implementation of the Skolkovo project, and employees of resident companies of special economic zones.

We are closely monitoring the development of the situation and innovations in legislation and will be happy to answer any questions you may have!

Your contacts on this topic:

Maria Matrosova

Yulia Belokon

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025

Dear colleagues, Please accept our sincere congratulations on the upcoming New Year and Christmas!

Online seminar 04/26/23: “Tax changes, FSBU, ETS, tax risks, dividend payments and other issues”

Online seminar 04/24/2023 – FAQ OF FOREIGN SUBSIDIARIES IN RUSSIA

Daria Pogodina participated in an online seminar on the topic “FAQ of Foreign Subsidiaries in Russia. Overview on Current Regulations for Transactions with LLC shares, “sleep” mode or LLC liquidation”. The speaker covered current legal aspects related to the management of foreign subsidiaries in Russia: the procedure for transactions with shares in LLCs, the features of the “sleep” mode and liquidation options. The report was accompanied by practical examples and explanations of current restrictions, which aroused keen interest among representatives of foreign structures.

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025

Dear colleagues, Please accept our sincere congratulations on the upcoming New Year and Christmas!

Online Seminar Sterngoff Audit

PROGRAM

FAQ FOREIGN SUBSIDIARIES

Daria Pogodina

Distribution and payment of dividends. Solution in the current conditions

Eugenia Chernova

SINGLE TAX PAYMENT from 01.01.2023 Practical advice for an accountant

Eugenia Chernova

ABOUT THE SEMINAR

Daria Pogodina spoke at the online seminar “FAQ of Foreign Subsidiaries” organized by the company “Sterngoff Audit”. She analyzed in detail the typical issues faced by subsidiaries of foreign organizations in Russia: from accounting and taxation to compliance with legal requirements. The seminar became a useful platform for sharing experiences and discussing current practical cases.

Eugenia Chernova, as part of her speech, considered current restrictions affecting cross-border distribution of profits, and also gave recommendations for developing solutions considering the current regulations. The report aroused great interest among participants working in international companies.

One of the topics of the seminar was “Single tax payment from 01.01.2023. Practical advice for an accountant.” During her speech, Eugenia covered the procedure for applying the new mechanism of the Unified Tax Payment, spoke about the rules for distributing payments, common mistakes and ways to prevent them. Particular attention was paid to real cases and recommendations for accountants working in companies with different forms of ownership. Participants noted the practical benefit and relevance of the report.

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025

Dear colleagues, Please accept our sincere congratulations on the upcoming New Year and Christmas!

SINGLE TAX PAYMENT from 01.01.2023. Practical advice for an accountant

Daria Pogodina spoke at the online seminar “FAQ of Foreign Subsidiaries” organized by the company “Sterngoff Audit”. The speaker analyzed in detail the typical issues faced by subsidiaries of foreign organizations in Russia: from accounting and taxation to compliance with legal requirements. The seminar was a useful platform for sharing experience and discussing current practical cases.

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025

Dear colleagues, Please accept our sincere congratulations on the upcoming New Year and Christmas!

Business Abroad: What Notifications Need to Be Filed?

In this review, we have summarized the rules governing the required notifications and reports that must be filed in the Russian Federation if you have (or are acquiring) a share in a foreign organization.

When creating/acquiring a share in a foreign organization: notification

When a share in a foreign organization arises (or changes), regardless of the size of the share, an individual who is a tax resident of the Russian Federation must file a notification of participation in foreign organizations (on the establishment of foreign structures without forming a legal entity).

This notification must be filed no later than three months from the date of the emergence (change in share) of participation in a foreign organization.

Failure by a taxpayer to submit a notification of participation in foreign organizations to the tax authority within the prescribed period or submission of a notification of participation in foreign organizations containing inaccurate information entails a fine of 50,000 rubles for each foreign organization.

What is considered a controlled foreign organization (CFO)?

A controlled foreign company is a legal entity or a structure without the formation of a legal entity, the place of tax residence of which is a jurisdiction other than the Russian Federation, controlled by a legal entity or an individual who is a tax resident of the Russian Federation.

When creating / acquiring a share in a CFC (controlled foreign organization)

When a share in the CFC arises (changes) the individual must submit a notification of controlled foreign companies to the tax authority at the place of registration during the reporting year, but no later than April 30 of the year following the reporting year. The deadlines for sending an annual notification of a CFC to the Federal Tax Service for individuals are set out in Article 25.14 of the Tax Code of the Russian Federation.

The notification form is set out in legislation.

In addition to the notification form itself, it is necessary to collect a package of documents on the controlled foreign company and its participant. Typically, this list includes:

1. Certificate of registration of the organization and an extract from the trade register;

2. Certificate of the state – tax registrar;

3. Financial statements of the CFC, prepared in accordance with the personal law of such a company for the financial year. In case of its absence, it is necessary to submit other documents that confirm the profit or loss of the company;

4. Auditor’s report on the financial statements of the CFC, if the audit is mandatory or the company voluntarily conducted an audit;

5. Copy of the passport of the CFC participant;

6. Notarized power of attorney in case of notification by a third party.

If the original documents are attached not in Russian, a notarized translation is required.

Calculation of the tax base for the CFC

The minimum amount of CFC profit that can be used as a taxable base is 10 million rubles, CFC profit below this amount is not taxed in the Russian Federation and is not subject to declaration.

If the profit of a controlled foreign company exceeds 10 million rubles, it is used as a tax base for calculating income tax and is filled in the 3-NDFL declaration (Sheet B) for individuals. Information on each CFC is submitted separately, the data is not summarized. Declarations must be submitted to the Federal Tax Service as part of the normal procedure for filing declarations along with other sheets of the document.

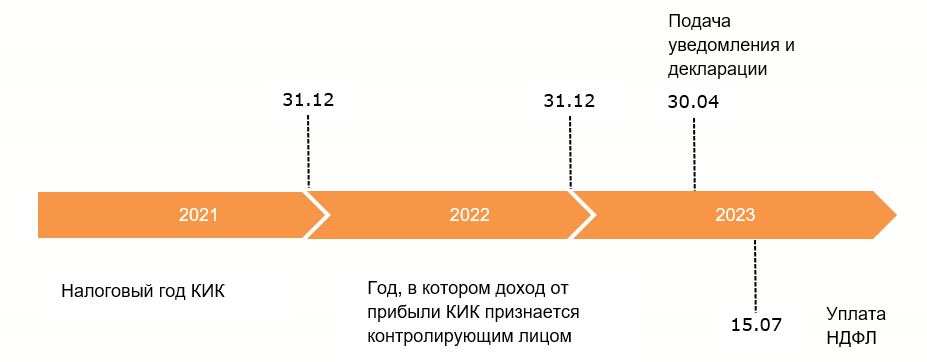

Particular attention should be paid to determining the date of receipt of profit from the CFC by the controlling person – December 31 of the year following the tax year of the foreign organization. The dates of receipt of profit and reporting on it are clearly presented in the diagram:

The profit (loss) of a CFC is the amount of profit (loss) of this company, determined in one of the following ways:

1. According to its financial statements prepared in accordance with the laws of the jurisdiction in which the company is registered, for the financial year;

2. According to the rules established by Chapter 25 of the Tax Code of the Russian Federation (in the event of failure to meet the conditions for determining the profit (loss) of a CFC based on its financial statements, as well as at the choice of the taxpayer – the controlling person).

In order to determine the profit (loss) of a CFC, the unconsolidated financial statements of such a company, prepared in accordance with the standard established by the personal law of such a company, are used. If the personal law of a CFC does not establish a standard for preparing financial statements, the profit (loss) of such a CFC is determined based on the financial statements prepared in accordance with International Financial Reporting Standards or other internationally recognized standards for preparing financial statements.

For tax purposes, the following are deducted from the profit of a CFC:

Distributed dividends (have already been taxed at source);

Dividends paid from Russian organizations (have already been taxed at the time of payment in the Russian Federation);

Losses from previous years (which can be offset against taxable profit regardless of the position of the CFC jurisdiction on this matter);

Distributed profit of a foreign person without forming a legal entity.

Exemption from taxation of profit of a controlled foreign company

The profit of a CFC is exempt from taxation in the Russian Federation if at least one of the following conditions is met with respect to such a CFC:

1. A CFC is a non-profit organization that, in accordance with its own law, does not distribute the profit (income) received between shareholders (participants, founders) or other persons;

2. A CFC is formed in accordance with the legislation of a member state of the Eurasian Economic Union and has a permanent location in this state;

3. The effective tax rate on income (profit) for this CFC based on the results of the period for which, in accordance with the personal law of such an organization, financial statements for the financial year are prepared, is at least 75% of the weighted average tax rate for corporate income tax;

4. The CFC is one of the following companies:

an active foreign company;

an active foreign holding company;

an active foreign subholding company;

and others that are less commonly applicable.

Carry-forward of a CFC loss

If, according to the financial statements of the CFC prepared in accordance with its personal law for the financial year, a loss is determined, the said loss may be carried forward to future periods without restrictions and taken into account when determining the CFC profit.

A CFC loss may not be carried forward to future periods if the taxpayer – the controlling person has not submitted a notification of the CFC for the period for which the said loss was incurred.

Fines for failure to provide notification of CFC

More information on the FTS website.

Contacts

Evgeniya Chernova

Olga Kireeva

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025

Dear colleagues, Please accept our sincere congratulations on the upcoming New Year and Christmas!

Online seminar “Changes in the TCO from 01.01.24. Review for residents of the SEZ “LIPETSK”

During her speech, Evgeniya Chernova covered in detail the key changes in the transfer pricing rules that came into force at the beginning of 2024. Particular attention was paid to the practical aspects of applying the new rules for companies operating in the special economic zone. The report aroused great interest and became a reason for discussion among the participants.

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025

Dear colleagues, Please accept our sincere congratulations on the upcoming New Year and Christmas!

Obligation to enter information about corporate subscribers into the Unified Identification and Authentication System

From December 1, 2021, in accordance with amendments to the Federal Law “On Communications” No. 126-FZ dated July 7, 2003, corporate mobile communications will be provided to organizations and individual entrepreneurs only if there is data about the corporate communications user in the Unified Identification and Authentication System (ESIA).

If this requirement is not met, organizations will be disconnected from corporate communications services from December 1.

What is ESIA?

ESIA is a Russian information system used for authorization on the state portal “Gosuslugi”.

How is data entered into ESIA?

Data is entered into ESIA in three stages. The procedure is as follows:

The organization enters the following information about employees using corporate mobile communications in its personal account on the website of the operator providing corporate communications:

personal data of an individual (passport data);

subscriber number;

name of the organization / full name of the individual entrepreneur.

Employees who have access to the personal account of the corporate communications operator can also enter information about themselves.

The employee confirms the transfer of information through the personal account on the State Services portal, after which the information is sent to the mobile operator.

The mobile operator enters the data into the Unified Identification and Authentication System.

When should the information be provided?

Data on users of corporate mobile communications under contracts concluded before 01.06.2021 must be entered into the system no later than 30.11.2021. When starting to use corporate mobile communications from June 1, 2021, the information must be transferred to the operator before the start of services.

Corporate users using M2M (Machine to machine) SIM cards for ATMs, POS terminals, video surveillance systems, the deadline for submitting information, according to Government Resolution No. 844 of 05/31/2021, must provide information no later than September 1, 2021.

Your contacts on this topic:

Maria Matrosova

Tatyana Ushakova

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025