Month: October 2022

Online seminar on 28.10.22: “FAS 6, FAS 26, Single Tax Account”

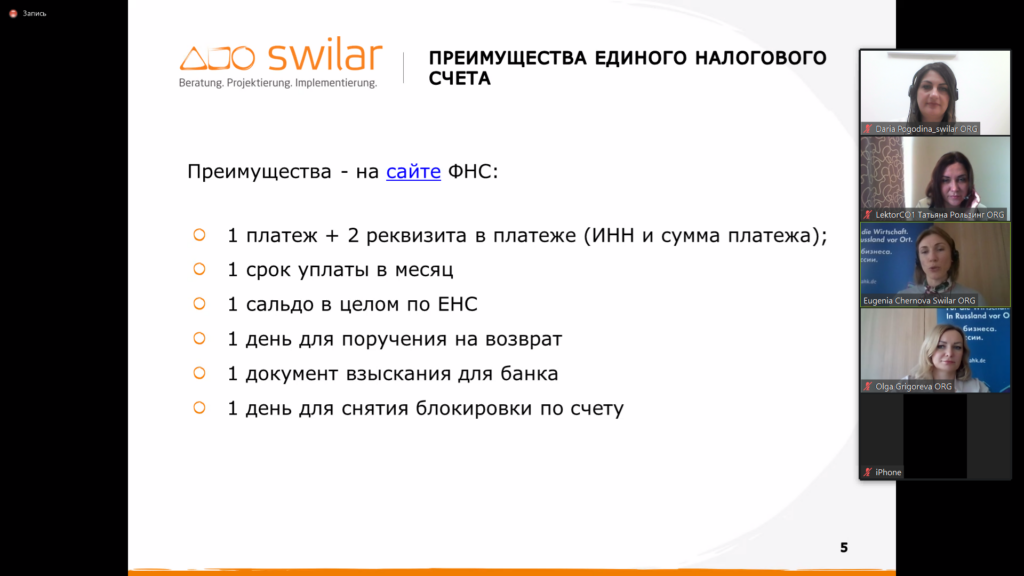

On October 28, the online seminar “FAS 6, FAS 26, single tax account” was held by swilar experts together with the colleagues from Sterngoff Audit. They gave an overview of the current changes in legislation and answered the main questions regarding the accounting of fixed assets and capital expenditure under the new FAS, as well as regarding the single tax account.

Eugenia Chernova, Project Manager of swilar, thoroughly explained the changes in the rules for tax settlements with the Russian Federation, the new payment schedule, the nuances of individual taxes and contributions and gave practical advice to accountants during the transition period.

At any time, and especially now, it is important to feel supported. Keep an eye on our events, and be sure to join us in discussing topics that are relevant to you in the future. Announcements and news are published regularly on the swilar Telegram channel.

Regulations on transactions with limited liability company shares and additional restrictions on payments

Earlier we brought to your attention the new requirement for mandatory approval by the Government Commission for transactions with shares in limited liability companies (OOO) (introduced by Presidential Decree No. 618 of 08.09.2022). We would like to remind you that this refers to transactions with OOO shares involving entities from foreign countries that commit unfriendly acts against the Russian Federation.

In the following overview, we have compiled for you information on the procedure for obtaining such a permit (approved by Government Resolution No. 1651 of 19.09.2022).

On 13.10.2022 the Ministry of Finance published official clarifications (letter No. 05-06-14RM/99138 of 13.10.2022) specifying types of transactions covered by the new regulations. According to these clarifications, the following types of transactions will require approval by the Government Commission:

- transfer of a part in the share capital of an OOO to one or more participants of the OOO or to a third party;

- acquisition by an OOO of a share in its share capital;

- withdrawal of a participant from an OOO by disposing of their share in the OOO or by claiming the acquisition of a share in the OOO;

- transfer of a share in an OOO to an investment fund;

- agreement with a commercial organization or individual entrepreneur on delegation of authority of the sole executive body of an OOO;

- agreement on exercising participants’ rights in an OOO;

- contract of convertible loan;

- OOO share pledge agreement;

- OOO share pledge management agreement;

- voluntary reorganization of an OOO in accordance with the legislation of the Russian Federation;

- an ordinary partnership agreement entered into by an OOO;

- agreement of trust management, agency and (or) other agreement on exercise of rights certified by OOO shares;

- other transactions.

We remind that the special procedure established by Presidential Decree No. 618 of 08.09.2022 does not apply to organisations in the financial and fuel and energy sectors.

The Russian Ministry of Finance also clarified that the approval of the Government Commission is not required for transactions executed against the will of an entity as part of the execution of a legally enforceable court decision.

At the same time we would like to draw your attention to the Presidential Decree No. 737 of 15.10.2022 which imposes additional restrictions on residents making payments in cases (1) of reduction of share capital of an OOO, (2) liquidation of an OOO and (3) bankruptcy procedures applied to an OOO.

Under the new regulations, making payments in these cases to entities from foreign countries committing unfriendly acts against the Russian Federation in an amount exceeding RUB 10 million per calendar month will require the use of a C-type special account (for a detailed overview of the use of C-type special accounts, see link) or obtain authorisation from the Russian Ministry of Finance.

Contacts:

Maria Matrossowa

Yulia Belokon

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025

Dear colleagues, Please accept our sincere congratulations on the upcoming New Year and Christmas!

FAQ – peculiarities of work with special C-type accounts

We would like to draw your attention to the recent clarifications issued by the Central Bank of Russia (hereinafter referred to as the “Central Bank”) regarding the relevant changes in legislation in accordance with the Presidential Decrees.

On 05.03.2022, Presidential Decree No. 95 “On the temporary procedure for meeting obligations to certain foreign creditors” (hereinafter referred to as Decree No. 95) was issued. Decree No. 737 of 15.09.2022 also introduces additional restrictions on payments to foreign residents – in particular, it concerns the implementation of payments to the participant in case of liquidation or reduction of shared capital (entered into force on 15.10.2022).

For which purposes it is compulsory to open a type C special account:

For payments in excess of 10 million rubles (or the equivalent in a foreign currency) per calendar month to “unfriendly” foreign counterparties, as well as to “friendly” foreign creditors, if the rights of claim on obligations passed to them fr om unfriendly foreign creditors after March 1, 2022 (Item 8 of Decree № 95) for:

- total liabilities of the debtor (including loan repayment and interest on it) on loans and borrowings, as well as payment of dividends/distribution of profits of Limited Liability Companies

- loans, borrowings, and financial instruments (including securities) of Joint Stock Companies

- fulfillment of obligations under concluded agreements which are derivative financial instruments

- purchase of real estate fr om “unfriendly” individuals

- Disbursement of funds by residents due to reduction of shared capital, liquidation or bankruptcy proceedings of resident legal entities (or permission obtained – Decree № 737 of 15.09.2022).

Who, where and in what currency should a type C account be opened:

- A resident sends an application to a credit institution in the name of a foreign creditor for a C-type account, whereby a bank account agreement does not need to be concluded.

A foreign creditor cannot open a C-type account on its own initiative (Letter of the Bank of Russia No. 019-12-4/2759 dated 06.04.2022).

- The C-type account is kept in rubles, is not opened in a foreign currency and cannot be opened in a foreign credit institution (clauses 3,5 of Decree No. 95).

- A bank account previously opened in the ordinary course of business will not be suitable for use as a C-type account, but depo accounts opened in the name of a foreign creditor before 24.03.2022 can be used.

When is a special account NOT needed?

- C-type accounts are not used if the aggregate amount of all debtor’s liabilities to all foreign creditors mentioned in Clause 1 of Decree No. 95 in a calendar month does not exceed 10 million rubles or its equivalent in foreign currency (at the official exchange rate of the Bank of Russia set as of the first day of the respective calendar month) or there is a permit from the Government Commission.

- If the obligation stipulated by Decree No. 95 is performed to a person who is not “unfriendly” (at the same time meeting the requirements set out in clause 12 of Decree No. 95 that the ultimate beneficiaries are the Russian Federation, its legal entities or individuals, and this information is disclosed to the tax authorities in an appropriate manner)

What is allowed when using a Type C account:

- It is possible to use a C-type account opened to a non-resident upon application of one resident for performance of obligations by other residents to the same non-resident and not to open a new C-type account.

- Transfer of funds to a non-resident to a C-type account opened with a bank different from the bank wh ere the resident is serviced.

- Transfer of rubles from a C-type account opened in favour of a non-resident legal entity of an “unfriendly” state in one credit institution to a C-type account of the same legal entity opened in another credit institution.

- There are no restrictions on residents using several C-type bank accounts for different obligations (contracts, products) in favour of one non-resident or applying one C-type account.

Limitations and specifics of the Type C account:

- Funds in the C-type account opened in the name of a foreign creditor belong to the foreign creditor from the moment the account is credited and until an agreement is concluded with the foreign creditor.

- The bank wh ere the C-type account was opened may not unilaterally close such account due to the absence of the foreign creditor’s application.

- A resident is not entitled to dispose of or request refund from a C-type bank account, except in case the funds were mistakenly credited to a C-type account.

- Transfer by the client from a C-type bank account to another non-resident bank account (opened both in the Russian Federation and abroad) is currently not possible (without authorisation).

For which purposes money can be written off:

- payment of taxes, duties, fees and other mandatory payments payable to the budget

- transfers for the purchase of federal loan bonds

- transfers to current accounts of non-residents in the currency of the Russian Federation, as stipulated by the permit

- transfers for other transactions provided for by the permit

- payment of commissions to the authorised bank servicing the account.

Contacts:

Eugenia Chernova

Olga Kireyeva

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025