Month: May 2021

Transferpricing: penalties from tax authorities for non-submission of master file

Recently, there have been an increasing number of cases in which Russian companies that are part of an international group of companies have been asked to submit the global documentation (so-called master file) to the Russian tax authorities, especially in the context of the formation of the regular transfer price declaration and documentation.

As a reminder: the global documentation (master file) must be provided to the supervisory authority upon their request within 3 months fr om the date of having received an according notice. The file is to be provided in Russian language.

The master file may be requested not earlier than 12 months and no later than 36 months after the end of the reporting year, so e.g. starting from 01.01.2022 till 31.12.2024 for the year 2020. The documentation must comply with the requirements of Article 105 16-4 of the Russian Tax Code.

Please note that the violation of the rules of the Tax Code – failure of the taxpayer to submit global documentation in time (paragraph 2 of Article 129.11 of the Tax Code) may result in a fine in the amount of 100,000 rubles.

From 2020 onwards, the benefits of the so-called “Transitional period” (2017-2019), for which no fines were imposed, no longer apply. From 2020, failure to comply with the requirement to submit the master file to the authorities upon request can result in a maximum amount of fine.

In order to provide the required information to the tax authorities on time, if requested, we recommend the Russian member companies of international company groups to fulfill the following steps in advance:

- request the Global Documentation from the parent company,

- check it for compliance with the requirements of Article 105 16-4 of the Tax Code of the Russian Federation and, if necessary, supplement the File;

- translate the Global Documentation into the Russian language, if applicable.

Expert comment

Eugenia Chernova, Project Leader at swilar: “Not every taxpayer who is a member of an international group of companies may be required to provide global documentation. The existing limits are bound to the total revenue of the group. The lim it depends on the country of residence of the parent company.” If you have any questions about the necessity of global documentation for your company, swilar specialists will be happy to give you qualified advice.

Contacts:

Eugenia Chernova

Olga Kireyeva

Other news

10.02.2026

Environmental Fee: what changed since January 1, 2026 and what business should expect

23.12.2025

Dear colleagues, Please accept our sincere congratulations on the upcoming New Year and Christmas!

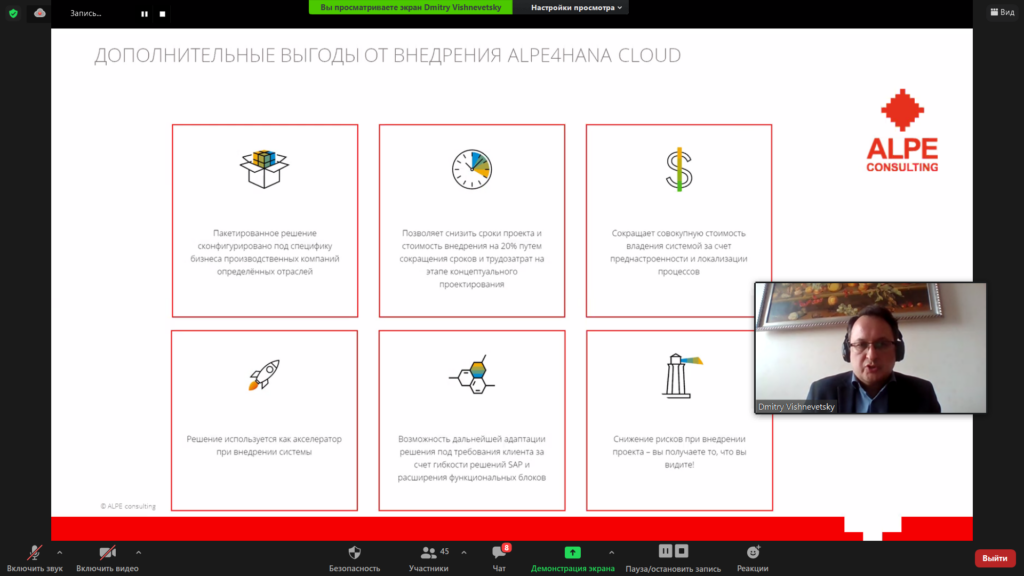

Online seminar 18.05.21: “Current issues of implementation and use of SAP in Russia”

On May 18, swilar specialists together with experts from ALPE Consulting discussed current issues of SAP implementation and use in Russia. The online meeting was held in Russian.

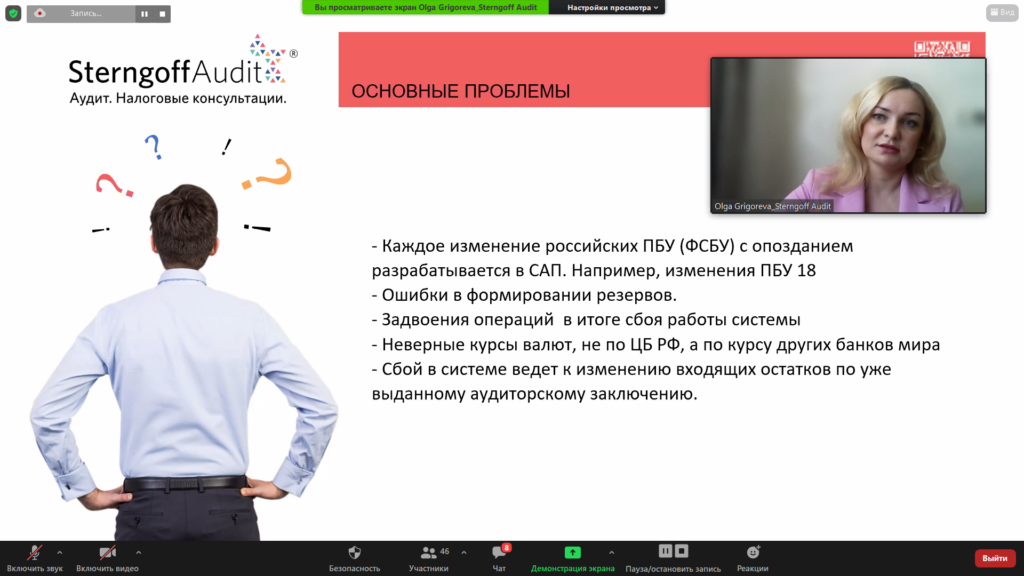

A team of experienced experts from different fields told about the nuances of the transition to SAP and its working in Russia, described the most common difficulties and issues, and disclosed ways to solve them.

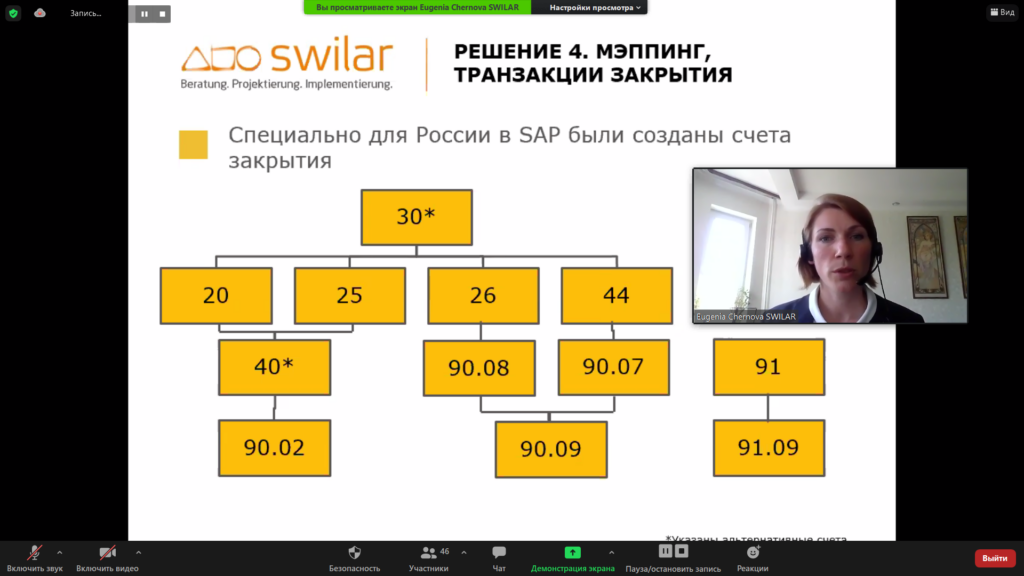

Eugenia Chernova, Project Manager of swilar OOO, gave an overview of frequently occurring issues during the migration to SAP, gave examples and solutions from practice.

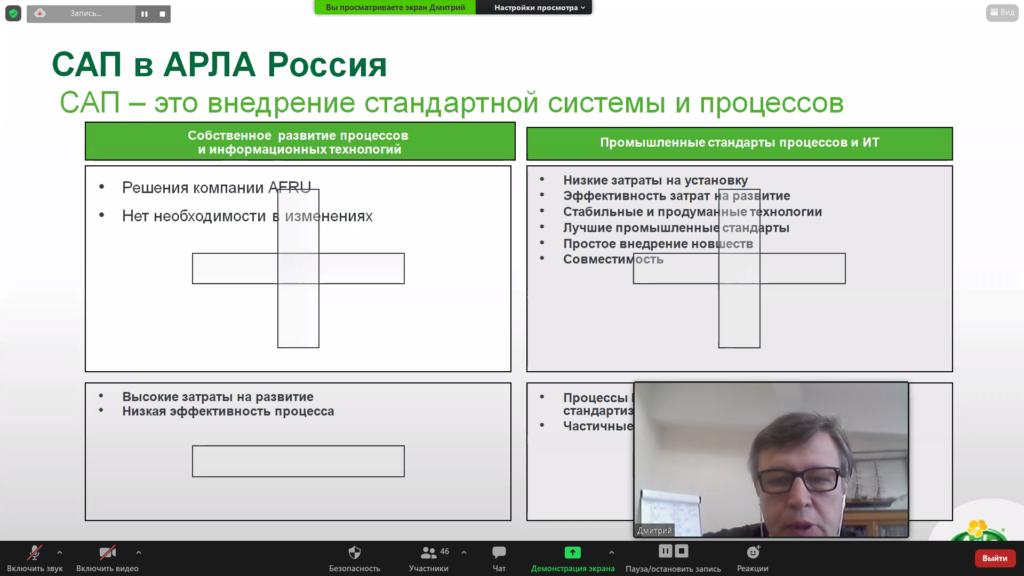

Conclusions were complemented by practical experience of ARLA Foods, implementing and successfully using SAP.

Organized by: swilar Group and ALPE consulting, together with the auditing company Sterngoff Audit, with the support of Arla Foods.