Category: Past events

Online seminar 11/12/2024: Features of liquidation of companies with foreign participation: latest changes and practice

PROGRAM

1. Features of liquidation of foreign subsidiaries in 2024-2025.

Daria Pogodina, CEO of swilar

2. Liquidation audit – features of the procedure.

Olga Grigorieva, CEO of Shterngoff Audit

3. Closing representative offices and branches of foreign companies – what to consider?

Daria Pogodina, CEO of swilar

4. Features of termination of employment relations with employees during company liquidation.

Elena Balashova, Managing Partner of Balashova Legal Consultants

5. Planning the budget and financing of the company during the liquidation period.

Natalia Samonova, Head of Controlling Projects of swilar

6. Business valuation in Russia for the purpose of submission to the Government Commission.

Alexey Sitnikov, Director, Swiss Appraisal

Online seminar 13.12.2024: Doing Business in Russia – Practical Experience in New Circumstances

PROGRAM

Detailed reviews and Q&A session with experienced experts on the following topics

1. Doing business in Russia

legal, tax, HR and migration issues. Basics.

2. Overview on bank transaction with Russia

SWIFT, currency exchange and other.

3. Practical experience of foreign companies in Russia

FAQ in the regular business processes.

Topics 2025: Practical Experience and Recommendations for Business Operations in Changing Conditions

PROGRAM

1. Current situation with international payments — overview and practical recommendations. Cryptocurrency payments — new opportunities for business?

Daria Pogodina — Managing Partner, swilar

2. Possibilities of transfers within the framework of foreign economic activity in rubles and yuan

Vasily Lukyanenko — Head of Department, JSC OTP Bank, Corporate Business Directorate

3. What to consider when working with personnel

Elena Balashova — Managing Partner, Balashova Legal Consultants

4. Liability insurance as an important element of risk management. Risks of directors and managers

Nikolay Artamonov — Underwriter for financial risks, JSC IC Turikum

5. Audit checklist — main errors identified by auditors in accounting and tax accounting based on the results of 2024 in the context of constant changes. Preparation for the annual audit

Olga Grigorieva – CEO of Shterngoff Audit LLC

6. Logistics and customs risks when importing to the Russian Federation. Latest practice: routes, customs control, inclusion of agent fees, dividends

Anna Dashicheva. Commercial Director of Polar Group LLC

FSBU 27/2021 and new sanctions restrictions in terms of impact on the IT sector: risks, deadlines, necessary actions

PROGRAM

1. FSBU 27/2021 and new sanctions restrictions in terms of their impact on the IT sector. Overview.

Daria Pogodina, CEO of SVILAR LLC

Olga Grigorieva, CEO of Shterngoff Audit LLC

2. Localization and support of ERP taking into account the 12th package of sanctions.

Stanislav Malyshev, CEO of ALPE Consulting LLC

3. The 12th package of sanctions and other restrictions in the IT sector.

(How to prepare a company’s infrastructure for changes)

Sergey Idiyatov, Head of Corporate Client Support, ALP ITSM

Online seminar 02.03.23: “Situation of foreign SMEs in Russia — Practical experience and reorientation under new conditions: Update”

On 2 March, an online seminar on “Situation of foreign SMEs in Russia — Practical experience and reorientation under new conditions: Update” was held.

The meeting started with a welcome speech by Artur Czerniejewski, Head of Swiss Business Hub Russia, and continued with a discussion of the most relevant topics for foreign SMEs in Russia.

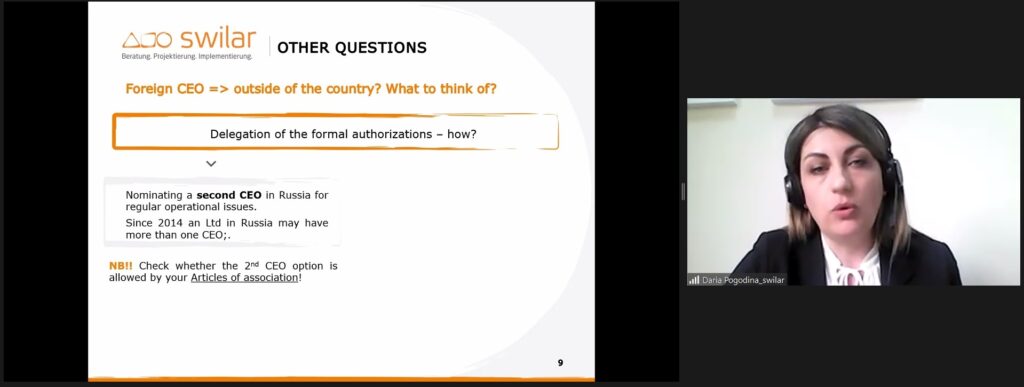

Daria Pogodina, General Manager swilar OOO, talked about the peculiarities of business restructuring in the current situation and discussed options such as management buyout, liquidation, “sleep mode”.

Ivan Ashaulov, Director, Key Accounts&Partners, gave advice on preparing the business before submitting it to the Government Commission.

Evgenia Chernova, Project leader controlling swilar OOO, reminded of recent changes related to the payment of dividends from a Russian subsidiary to a foreign parent company.

At the end of the meeting, the speakers answered questions from the audience. Keep an eye on our events programme in the future and join us if the topic is relevant to you.

Organised by Switzerland Global Enterprise, swilar and Swiss Appraisal.

Online seminar “Overview of FSBU changes, unified tax account, military records, work with founders

(dividends, management responsibility), employees abroad, customs value”

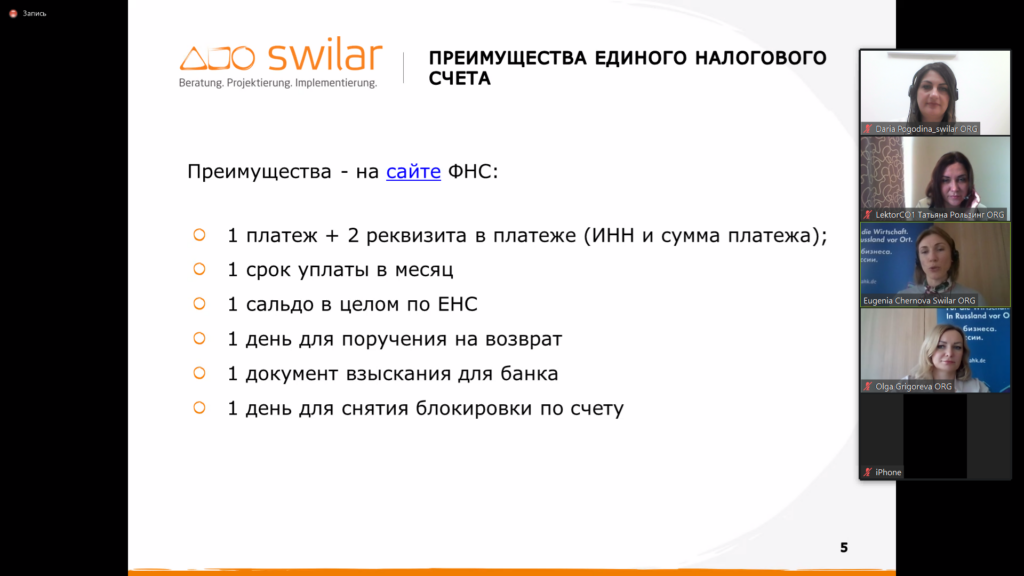

On 21 December, an online seminar on “Overview of FSBU changes, unified tax account, military records, work with founders (dividends, management responsibility), employees abroad, customs value” was held.

Daria Pogodina, General Director at SWILAR, spoke about the peculiarities of dividend payments to foreign participants and transactions with LLC shares under the new conditions, and Evgenia Chernova, Head of Controlling Projects at SWILAR, spoke about the new rules for settlements with the state from 01.01.2023. The issues of a unified tax account and a unified tax payment were covered.

Olga Grigorieva, General Director, Auditor at Sternhoff Audit, gave an overview of the new FSBU.

Elena Balashova and Anastasia Zaitseva, partners of Balashova Legal Consultants, highlighted practical aspects of the organisation of military records and employer responsibility of international business in the Russian Federation.

Erich Rath, managing partner of the law firm RECHTSANWALT ERICH RATH, spoke about how to minimise risks in the context of subsidiary liability of a company executive.

Albina Ostrovskaya, tax consultant at Sternhoff Audit, explained the specifics of personal income tax when an employee performs his or her employment duties abroad and the main mistakes accountants make in paying remuneration.

Alexander Revtyuk, customs law expert at Sternhoff Audit, parsed a new clarification of the Supreme Arbitration Court regarding inclusion of dividends to customs value.

The meeting ended with answering questions from the seminar participants.

Follow the programme of future events on the website or in our Telegram-channel and join us.

Organised by SWILAR company in cooperation with audit company Sterngoff Audit, legal company Balashova Legal Consultants and law office RECHTSANWALT ERICH RATH.

Online seminar on 28.10.22: FAS 6, FAS 26, Single Tax Account

On October 28, the online seminar “FAS 6, FAS 26, single tax account” was held by SWILAR experts together with their colleagues from Sterngoff Audit. They gave an overview of the current changes in legislation and answered the main questions regarding the accounting of fixed assets and capital expenditure under the new FAS, as well as regarding the single tax account.

Eugenia Chernova, Project Manager at SWILAR, thoroughly explained the changes in the rules for tax settlements with the Russian Federation, the new payment schedule, the nuances of individual taxes and contributions and gave practical advice to accountants during the transition period.

At any time, and especially now, it is important to feel supported. Keep an eye on our events, and be sure to join us in discussing topics that are relevant to you in the future. Announcements and news are published regularly on the SWILAR Telegram channel.

Online Seminar 19.05.22: “Situation of Swiss and foreign SME in Russia – practical experience in new circumstances: update”

On 19 May, together with Switzerland Global Enterprise, Swiss Business Hub Russia, AsstrA Forwarding AG, VIK LEGAL and JFL Consulting, swilar experts held an online seminar on the topic “Situation of Swiss and foreign SME in Russia – practical experience in new circumstances: update”.

Together with Torsten Erdmann (DZ BANK AG), the participants discussed the prospects of the banking sector in and with Russia.

Daria Pogodina (swilar) shared her practical experience in dealing with current business process issues faced by foreign SMEs in Russia in the present global situation, including an overview of the options currently available for transactions with foreign participants’ interests in Russian companies.

Tatiana Gaevskaya (AsstrA Forwarding AG) addressed the EU-Russia logistical challenges, and Denis Guzilov (VIK LEGAL) looked at the legal aspects of the sanctions.

How to manage human resources in the Russian market in the changing environment was revealed by Jeremy Florat (JFL CONSULTING).

The event took place online in English.

Stay tuned for more news and join us for future online seminar.

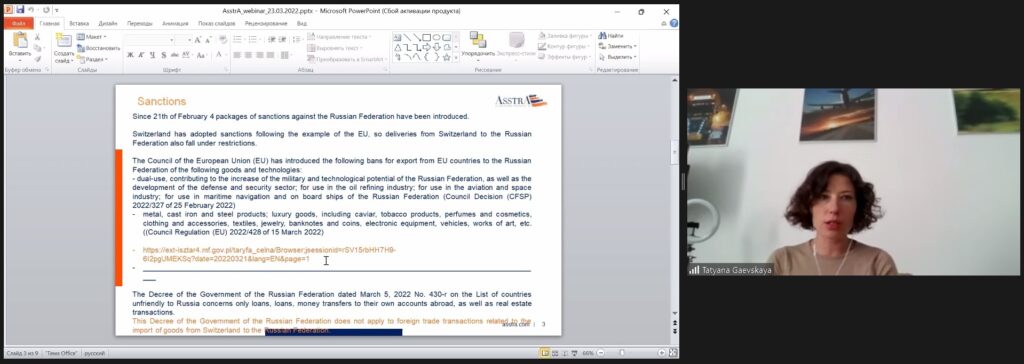

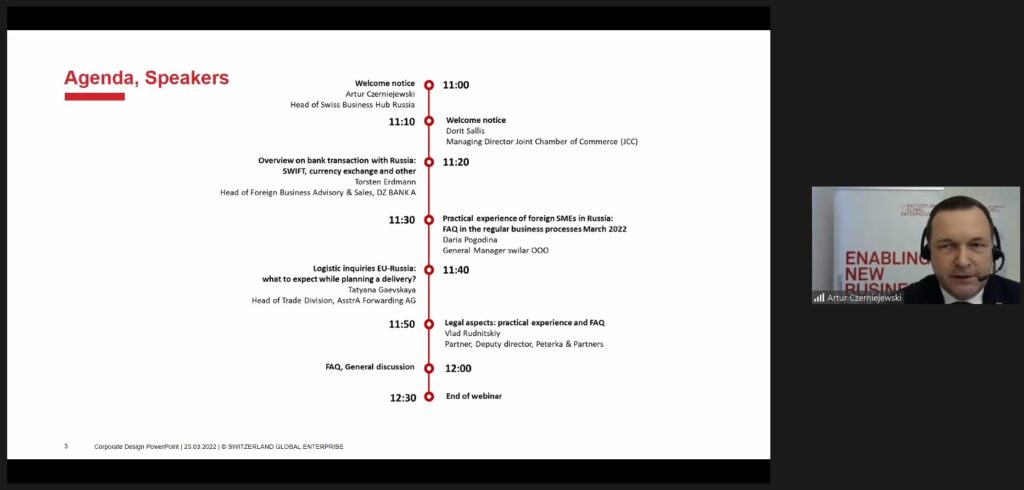

Situation of Swiss and foreign SME in Russia – practical experience in new circumstances

We thank the 155 participants and experts who attended the online seminar “The Situation of Swiss and Foreign SMEs in Russia – Practical Experience in the New Environment”, held on March 23.

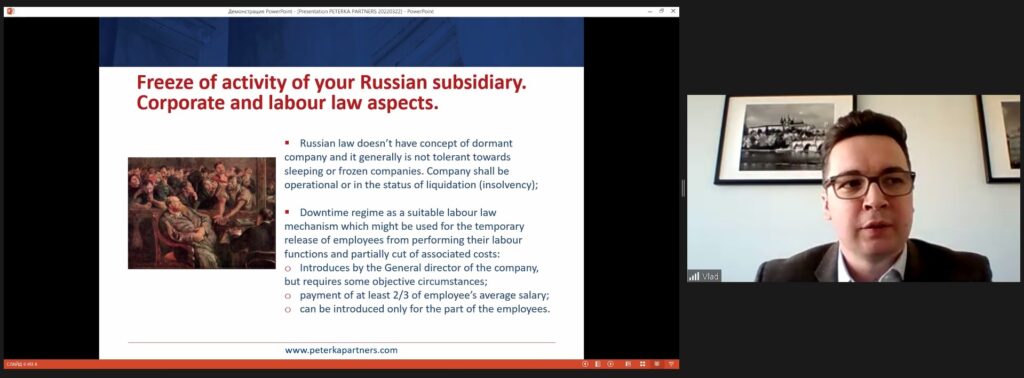

As a reminder, the event was organized by Switzerland Global Enterprise, Swiss Business Hub Russia, Joint Chamber of Commerce (JCC), SWILAR, AsstrA Forwarding AG and Peterka & Partners.

Thorsten Erdmann, Head of Group for Consulting and Foreign Business Sales Bavaria and Baden-Wuerttemberg in DZ BANK AG, gave an overview of the prospects of banking in Russia and with Russia.

Daria Pogodina, General Director of swilar OOO, summarized the practical experience of foreign small and medium-sized enterprises in Russia.

Tatiana Gaevskaya, Head of Trade Department, AsstrA Forwarding AG, answered the questions connected with EU-Russia logistics and told what to expect while planning delivery.

Vlad Rudnitsky, partner and deputy director, PETERKA & PARTNERS LLC, shared his practical experience in solving the legal aspects relevant for March 2022.

It is especially important to stay in touch and have the opportunity to share experiences with other representatives of foreign businesses in a situation of high uncertainty.

All registered participants have already received presentations and a recording of the webcast.

We will be holding this type of meetings in the future as well, stay tuned.

March 3 – “Live” seminar for financial departments of foreign companies

“Live” seminar for financial departments of foreign companies:

expert reviews and networking

In the current turbulent times it is more important than ever to stay in touch, be in touch, and follow the events and developments.

Therefore, despite the current acute situation, we are not cancelling the previously planned offline event on 03.03.2022, and offer you to meet offline in order to obtain useful information in your work and share experiences with other foreign companies.

We have invited leading experts who will talk about the latest changes in FSBU standards, specifics of interaction with foreign employees under the new rules and current tax issues.

Head of German luxury brand of organic cosmetics “Dr.Hauschka” Mr. Artem Boyko will share his experience and talk about brand products and care.

The seminar will take place on March, 3 in the German Center of Industry and Trade – we would like to thank for the cooperation the head of the center Dr.Hauschka Kristina Frank.

At the event you can get useful information from experts not only on the new accounting standards and auditors’ comments, but also learn about the latest tax changes and migration issues.

After the substantial part of the program, participants will be able to share their experience in current planning processes with other representatives of foreign businesses in Russia.

Snacks and drinks will be offered to participants.

MARCH 3 FROM 10:00 TO 17:30

LOCATION: The German center of industry and trade

Moscow, Andropov Ave, 18, 5-minutes-walk from Technopark metro station

PARTICIPATION IS FOR A FEE.

INFORMATION ABOUT THE CONDITIONS OF PARTICIPATION IS AVAILABLE AT THE REGISTRATION LINK.

We look forward to your participation!