Business Abroad: What Notifications Need to Be Filed?

In this review, we have summarized the rules governing the required notifications and reports that must be filed in the Russian Federation if you have (or are acquiring) a share in a foreign organization.

When creating/acquiring a share in a foreign organization: notification

When a share in a foreign organization arises (or changes), regardless of the size of the share, an individual who is a tax resident of the Russian Federation must file a notification of participation in foreign organizations (on the establishment of foreign structures without forming a legal entity).

This notification must be filed no later than three months from the date of the emergence (change in share) of participation in a foreign organization.

Failure by a taxpayer to submit a notification of participation in foreign organizations to the tax authority within the prescribed period or submission of a notification of participation in foreign organizations containing inaccurate information entails a fine of 50,000 rubles for each foreign organization.

What is considered a controlled foreign organization (CFO)?

A controlled foreign company is a legal entity or a structure without the formation of a legal entity, the place of tax residence of which is a jurisdiction other than the Russian Federation, controlled by a legal entity or an individual who is a tax resident of the Russian Federation.

When creating / acquiring a share in a CFC (controlled foreign organization)

When a share in the CFC arises (changes) the individual must submit a notification of controlled foreign companies to the tax authority at the place of registration during the reporting year, but no later than April 30 of the year following the reporting year. The deadlines for sending an annual notification of a CFC to the Federal Tax Service for individuals are set out in Article 25.14 of the Tax Code of the Russian Federation.

The notification form is set out in legislation.

In addition to the notification form itself, it is necessary to collect a package of documents on the controlled foreign company and its participant. Typically, this list includes:

1. Certificate of registration of the organization and an extract from the trade register;

2. Certificate of the state – tax registrar;

3. Financial statements of the CFC, prepared in accordance with the personal law of such a company for the financial year. In case of its absence, it is necessary to submit other documents that confirm the profit or loss of the company;

4. Auditor’s report on the financial statements of the CFC, if the audit is mandatory or the company voluntarily conducted an audit;

5. Copy of the passport of the CFC participant;

6. Notarized power of attorney in case of notification by a third party.

If the original documents are attached not in Russian, a notarized translation is required.

Calculation of the tax base for the CFC

The minimum amount of CFC profit that can be used as a taxable base is 10 million rubles, CFC profit below this amount is not taxed in the Russian Federation and is not subject to declaration.

If the profit of a controlled foreign company exceeds 10 million rubles, it is used as a tax base for calculating income tax and is filled in the 3-NDFL declaration (Sheet B) for individuals. Information on each CFC is submitted separately, the data is not summarized. Declarations must be submitted to the Federal Tax Service as part of the normal procedure for filing declarations along with other sheets of the document.

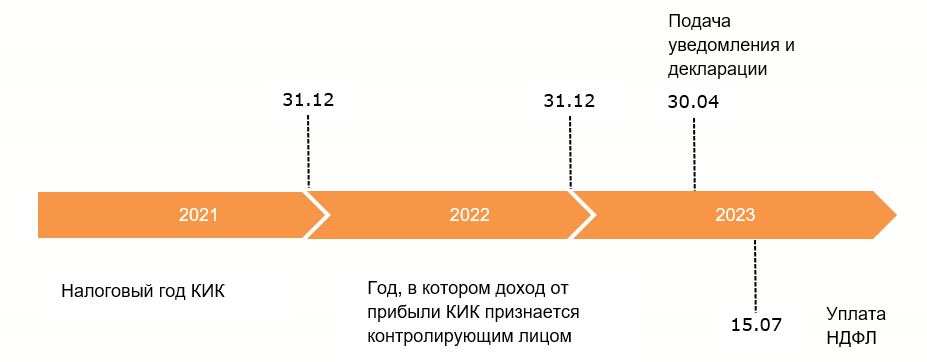

Particular attention should be paid to determining the date of receipt of profit from the CFC by the controlling person – December 31 of the year following the tax year of the foreign organization. The dates of receipt of profit and reporting on it are clearly presented in the diagram:

The profit (loss) of a CFC is the amount of profit (loss) of this company, determined in one of the following ways:

1. According to its financial statements prepared in accordance with the laws of the jurisdiction in which the company is registered, for the financial year;

2. According to the rules established by Chapter 25 of the Tax Code of the Russian Federation (in the event of failure to meet the conditions for determining the profit (loss) of a CFC based on its financial statements, as well as at the choice of the taxpayer – the controlling person).

In order to determine the profit (loss) of a CFC, the unconsolidated financial statements of such a company, prepared in accordance with the standard established by the personal law of such a company, are used. If the personal law of a CFC does not establish a standard for preparing financial statements, the profit (loss) of such a CFC is determined based on the financial statements prepared in accordance with International Financial Reporting Standards or other internationally recognized standards for preparing financial statements.

For tax purposes, the following are deducted from the profit of a CFC:

Distributed dividends (have already been taxed at source);

Dividends paid from Russian organizations (have already been taxed at the time of payment in the Russian Federation);

Losses from previous years (which can be offset against taxable profit regardless of the position of the CFC jurisdiction on this matter);

Distributed profit of a foreign person without forming a legal entity.

Exemption from taxation of profit of a controlled foreign company

The profit of a CFC is exempt from taxation in the Russian Federation if at least one of the following conditions is met with respect to such a CFC:

1. A CFC is a non-profit organization that, in accordance with its own law, does not distribute the profit (income) received between shareholders (participants, founders) or other persons;

2. A CFC is formed in accordance with the legislation of a member state of the Eurasian Economic Union and has a permanent location in this state;

3. The effective tax rate on income (profit) for this CFC based on the results of the period for which, in accordance with the personal law of such an organization, financial statements for the financial year are prepared, is at least 75% of the weighted average tax rate for corporate income tax;

4. The CFC is one of the following companies:

an active foreign company;

an active foreign holding company;

an active foreign subholding company;

and others that are less commonly applicable.

Carry-forward of a CFC loss

If, according to the financial statements of the CFC prepared in accordance with its personal law for the financial year, a loss is determined, the said loss may be carried forward to future periods without restrictions and taken into account when determining the CFC profit.

A CFC loss may not be carried forward to future periods if the taxpayer – the controlling person has not submitted a notification of the CFC for the period for which the said loss was incurred.

Fines for failure to provide notification of CFC

More information on the FTS website.