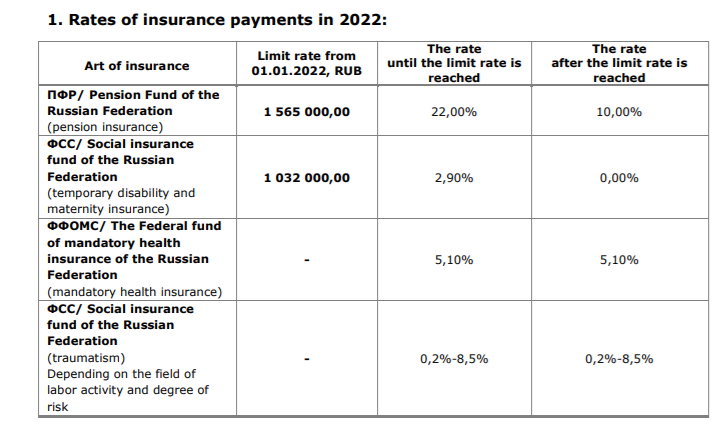

Оn January 1, 2022, the Resolution of the Government of the Russian Federation №1951 dd. 16.11.2021 comes into force. It concerns increasing the rate limit for insurance payments in cases of temporary disability and maternity, and also mandatory pension insurance:

- The rate limit for social insurance, in cases of temporary disability and maternity, for each individual does not exceed 1,032,000 rubles on a cumulative basis starting fr om the 1 January 2022;

- The rate limit for mandatory pension insurance does not exceed 1,565,000 rubles on a cumulative basis starting from the 1 January 2022 for each individual.

The payments for health care insurance and social payments in case of injuries will have to be made on the basis of all the taxable incomes irrespective of their amount. There will be no lim it for them, as before.

The limits and regulations for calculating insurance payments given above will be valid in 2022 for all companies, except for those with the status of SMEs.

2. Social contributions for SMEs in 2022:

We remind you that in accordance with the Federal Law of 01.04.2020 № 102-FZ dated April 1, 2020, the total amount of insurance payments for SME to state extrabudgetary funds in respect of payments to individuals, in excess of the minimum monthly wage, is reduced to 15%.

This reduced rate for SME applies irrespective of the maximum amount of payments to an individual (see above). At the same time, a part of payments less than or equal to the minimum monthly wage (determined at the end of each calendar month) is taxable at the general insurance contribution rate of 30%.

The value of the minimum monthly wage is set simultaneously on the entire territory of the Russian Federation by the federal law and is subject to annual indexation.

The minimum wage is established at the rate of 13 890 rubles for 2022 (Federal law N 406-FZ dated 06.12.2021).

Please note! Reduced tariff of insurance payments for SME from 01.01.2021 is determined for unlimited term (Item 17, clause 1, Art. 427 of the Tax Code, as amended from 01.01.2021).

We will be happy to answer your questions!

Contacts:

Natalia Safiulina, Chief accountant swilar OOO

M:

natalia.safiulina@swilar.ru, T: +7 495 648 69 44 (ext. 304)

Ekaterina Babenko, Deputy Chief accountant swilar OOO

M:

ekaterina.babenko@swilar.ru, T: +7 495 648 69 44 (ext. 305)