Счет российского ООО за рубежом

В условиях продолжающихся сложностей с международными платежами у многих компаний возникла необходимость открытия счета в зарубежном банке.

Однако при этом важно не забывать, что открытие банковского счета в другой юрисдикции налагает ряд дополнительных обязанностей на компанию – в том числе по сдаче необходимых отчетов и уведомления.

В нашем обзоре разберем, как не нарушить закон в этой ситуации, и как избежать штрафов.

Пошагово рассмотрим, что должна сделать компания, чтобы корректно выполнить все требования.

1. Уведомить Федеральную налоговую службу России.

Уведомлять ФНС необходимо в следующих случаях:

- открытие счета в банке за пределами РФ;

- закрытие такого счета;

- изменение реквизитов счета.

Соответствующее уведомление обязаны подавать все российские организации (ч.2, ч.8 ст. 12 закона №173-ФЗ). Уведомление следует направить в налоговый орган по месту нахождения организации по форме, утвержденной Приказом ФНС России от 26.04.2024 N СД-7-14/349@, не позднее одного месяца со дня соответственно открытия (закрытия) счета или изменения реквизитов (ч. 2 ст. 12 Закона о валютном регулировании).

Утверждены две формы: одна – для открытия и закрытия счета (Приложение N1), другая – для изменения реквизитов этого счета (Приложение N2).

Передать уведомление в налоговый орган можно на бумаге (лично, через представителя, по почте заказным письмом) либо в электронной форме по телекоммуникационным каналам связи (ТКС) или через личный кабинет налогоплательщика (ЛК).

При первом переводе на свой банковский счет за рубежом организации нужно предъявить российскому банку уведомление об открытии этого счета с отметкой налоговой инспекции о его принятии (ч. 4 ст. 12 Закона о валютном регулировании).

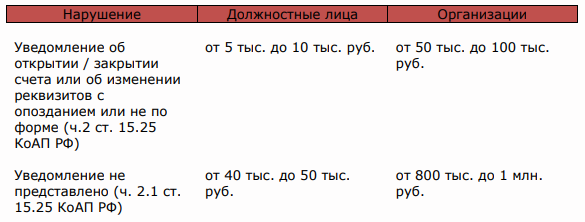

Если не подать уведомление о счете, или нарушить сроки либо порядок его представления, на организацию может быть наложен штраф.

Их размеры установлены в ст. 15.25 КоАП РФ.

2. Отчитаться перед ФНС обо всех движениях средств по счетам.

При наличии зарубежных счетов юридическое лицо (резидент РФ) ежеквартально в течение 30 дней по окончании отчетного квартала, предоставляет в налоговый орган отчет о движении денежных средств, прилагая подтверждающие документы: выписки или иные документы, выданные банком (Постановление Правительства РФ от 28.12.2005 N 819 (ред. от 22.05.2024)).

Если документы составлены на иностранном языке, организация должна приложить перевод на русский язык, надлежащим образом заверенный в соответствии с законодательством РФ (п.7 Правил представления отчетов резидентами — юрлицами).

Перевод может выполнить сотрудник организации либо организация, занимающаяся переводческой деятельностью, поскольку способы осуществления перевода законодательством не ограничены.

В случае необходимости по запросу налоговых органов представляется перевод на русский язык, нотариально заверенный в соответствии с требованиями законодательства Российской Федерации.

3. Соблюдать валютное законодательство, в частности совершать только законные валютные операции.

Контракты с нерезидентами, сумма обязательств по которым превышает установленное пороговое значение, а именно импортные контракты от 3 млн. руб. и экспортные контракты от 10 млн. руб., необходимо ставить на учет в уполномоченном банке РФ.

Банк присвоит контракту уникальный номер (п. п. 4.2, 5.5 Инструкции Банка России от 16.08.2017 N 181-И (ред. от 09.01.2024).

При зачислении на счет за рубежом экспортной выручки необходимо предоставить в уполномоченный банк справку о валютных операциях (СВО) по расчетам через счет за рубежом по учетным контрактам, а также предоставить банковскую выписку.

Срок предоставления СВО по расчетам через счет за рубежом – не позднее 30 рабочих дней после последнего дня месяца, в котором были осуществлены такие операции.

4. Нужно ли репатриировать валюту?

На сегодняшний день обязанность по репатриации валюты сохранена только для некоторых компаний.

С 16.10.2023 по 30.04.2025 включительно определенные российские экспортеры, указанные в Перечне, утвержденном Указом Президента РФ от 11.10.2023 г. №771, обязаны зачислять на свои счета в уполномоченных банках и продавать выручку в иностранной валюте на внутреннем валютном рынке РФ в установленный срок и в установленных размерах (п. п. 1, 5 Постановления Правительства РФ от 12.10.2023 г. №1681 «О мерах по реализации Указа Президента Российской Федерации от 11 октября 2023 г. №771»).

Закрытый перечень состоит из 43 групп компаний, относящихся к отраслям топливно-энергетического комплекса, черной и цветной металлургии, химической и лесной промышленности, зернового хозяйства. Экспортеров об их включении в перечень уведомляет в 3-дневный срок Минэкономразвития России.

Для компаний, которые не состоят в закрытом перечне, в настоящее время размер валютной выручки, подлежащей обязательной продаже, составляет 0%.

Таким образом, если на организацию распространяется отмена репатриации, сроки по переводу экспортной выручки со счета организации, открытого за рубежом в российский банк, нормативно не установлены, т.е. такие средства могут остаться на счете за рубежом и эти средства можно использовать, например для расчета по импортным или другим контрактам.

Ваши контактные лица:

Наталья Сафиулина

Надежда Коломникова

Другие новости

26.05.2025